Highlights

- Invictus has announced an entitlement issue for ordinary shares and IVZOA listed options for its shareholders.

- The offer is targeting to raise AU$15,236,541.

- The funds raised via the offer will be directed towards multiple activities at its Cabora Bassa Project.

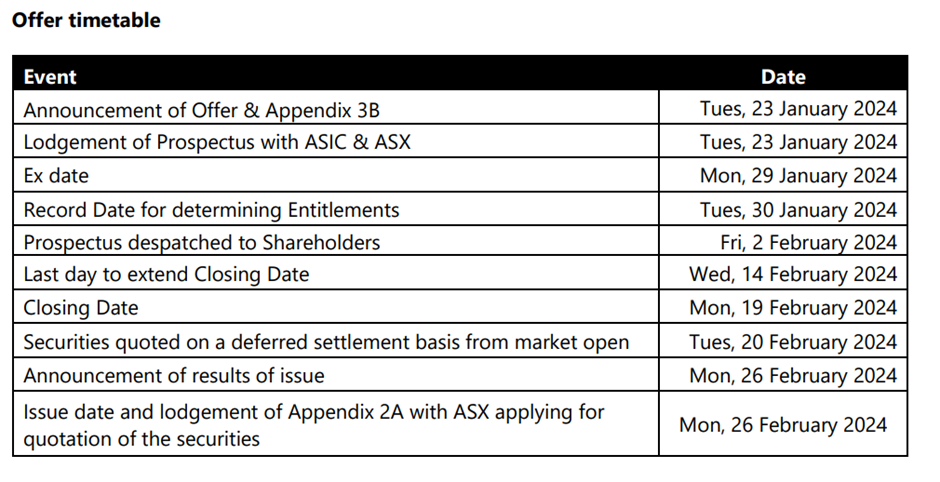

Invictus Energy Limited (ASX:IVZ) has announced an entitlement issue for ordinary shares and IVZOA listed options s for all eligible shareholders, as on 30 January 2024. The company has issued the offer post raising over AU$15 million of capital via a private placement.

The proceeds are being directed towards advancing exploration and development work at the company’s 80% owned Zimbabwean project. The company is also the operator of the Cabora Bassa Project.

More about the offer

Invictus is making the offer as a pro-rata non-renounceable entitlement issue of one share for every 12 shares owned by shareholders at an issue price of AU$0.13 per share along with one listed option (Option ASX:IVZOA) for every two shares subscribed for and issued.

In total, around 117,204,164 shares and 58,602,082 IVZOA options will be offered under the issue for a capital of up to AU$15,236,541.

Upon exercise of the option, the shareholders will be eligible for subscribing for one share at an exercise price of AU$0.20. IVZ has set 7 June 2026 as the expiry date.

Funds to fuel Cabora Bassa Project

The funds raised via the offer will be utilised for multiple activities at its Cabora Bassa Project, such as preparation for 3D seismic over Mukuyu gas field, Mukuyu-2 well test, long lead items as well as preparation for a new high impact exploration well post completion of interpretation of recently acquired CB23 infill seismic survey.

Image source: IVZ update

IVZ shares traded at AU$0.110 midday on 23 January 2024, up over 4.7% from the last close.