Highlights

- Haranga has received strong support for its two-tranche placement raising AU$2.86 million.

- Proceeds will be used to advance the Saraya uranium project.

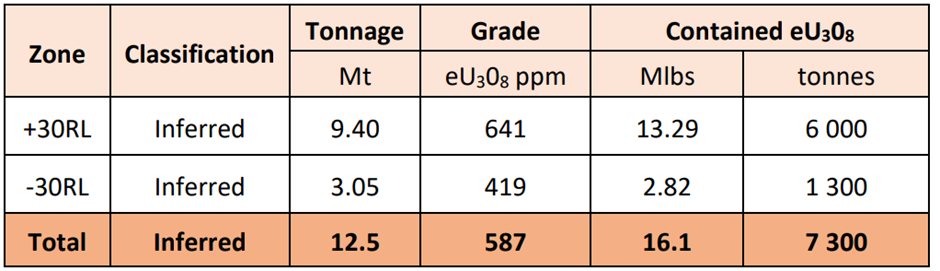

- The company is moving towards expanding its maiden JORC mineral resource (Inferred 12.5Mt @ 587ppm eU3O8 for 16.1 Mlbs) at the project.

- Existing shareholder Jason Peterson has committed ~AU$300,000 to the placement.

Share price of Haranga Resources Ltd (ASX: HAR, FRA: 65EO) shot up by 46.66% to AU$0.22 apiece during early morning trade on 27 September 2023. The share price surge followed a company update concerning heavily oversubscribed capital raising program and a maiden inferred mineral resource of 12.5Mt @ 587ppm eU3O8 for 16.1 Mlbs.

HAR has received strong support from sophisticated, professional, and institutional investors for a placement raising AU$2.86 million. The placement has also been supported by existing substantial shareholder Jason Peterson, who has committed to ~AU$300,000.

Proceeds from the capital raise are planned to be used for drilling at the Saraya uranium project in Senegal, as the company is advancing towards extending the maiden JORC mineral resource at the project.

CPS Capital Group Pty Ltd is the lead manager and broker of the capital raising program.

Data source: Company update

Details of the placement

Under the placement, HAR will issue 26 million shares at an issue price of AU$0.11 apiece. The issue price represents a discount of 26.6% to the company’s last closing price (AU$0.15 per share) and an 18% discount to the 15-day VWAP of AU$0.1342. The placement will settle in two tranches.

Tranche will raise around AU$1.65 million, while nearly AU$1.21 million will be raised under tranche 2, which is subject to shareholder’s approval.

HAR informed that tranche 1 is expected to be settled on or around 4 October 2023.

CPS will get 6% of the amount raised under the placement as the lead manager fee. The lead manager or its nominees will also receive 4 million unlisted options at AU$0.0001 per option issue price. The options with an exercise price of AU$0.18 is due to expire in three years from the issue date.

Saraya project

The maiden resource estimate (MRE) of Saraya is based on historical data and drilling conducted by Haranga. The MRE for the deposit is open along strike and at depth and can be extended by additional drilling.

Table source: Company update

Through gridded sampling at the deposit, along with randomly spaced historical drilling and radiometric data, the company has discovered anomalies extending from Saraya with a strike of more than 25km.

Termite mound sampling is progressing at the project. As of now, exploration has only covered 40% of the tenement.

Mineralisation orientation work at the Diobi, Mandankoli and Sanela anomalies is due to commence soon to define the next anomaly for drilling outside the Saraya deposit. Drilling is anticipated in late November or early December 2023.

_07_10_2025_00_42_28_863998.jpg)