Highlights

- The latest quarter saw Boab Metals making progress towards a decision to mine at its WA-based flagship project.

- Front End Engineering & Design is on track of completion during September 2023 quarter.

- The phase VII drilling campaign has commenced at Sorby Hills with assays expected during 3Q.

- The company continues to progress discussions concerning construction financing and offtake.

- As of June-end, the consolidated cash balance stood at ~AU$4.6 million.

Boab Metals Limited (ASX:BML) has reported another quarter of solid progress towards developing its Western Australia-based Sorby Hills JV project. The latest quarter ended 30 June 2023 saw continued progress toward reaching a decision to mine at the company’s flagship lead-silver-zinc project.

BML completed the project definitive feasibility study earlier in the year. The company has commenced the phase VII drill program, and Front End Engineering & Design (FEED) is on track for completion in the third quarter of 2023.

Image source: company update

Image source: company update

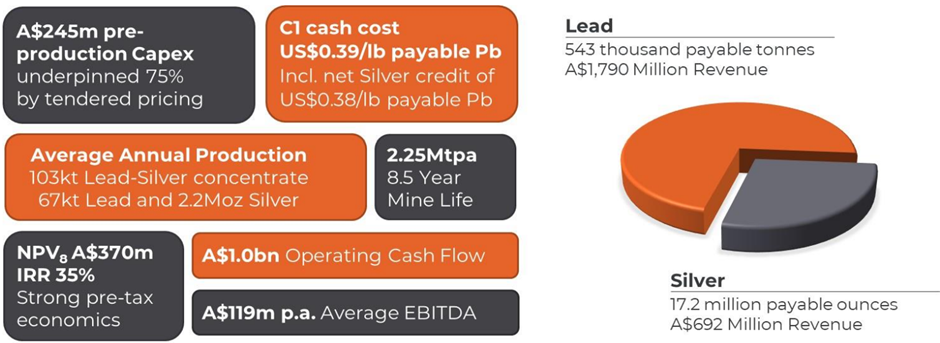

Sorby Hills DFS

Boab has a 75% ownership in the joint venture project - Sorby Hills and the remaining 25% interest is owned by Henan Yuguang Gold & Lead Co. Ltd. The DFS results were released in January 2023, supporting the progress towards a decision to mine at the project.

Here’s the summary of DFS -

Image source: company update

Developments across Sorby Hills

Boab has finalised the project design criteria and process flow diagrams with its EPC contractor – GR Engineering Services (GRES). Also, the company has reported the optimisation of plant layout. As stated, the FEED is expected to be finished by the third quarter (3Q) of 2023.

Boab has also progressed with the re-optimisation of the mining schedule and tailings strategy with the intent to grow project cash flows over the initial years of production. This updated strategy has also enabled an opportunity to explore a rationalisation of contract packages. It includes the bundling of bulk earthworks activities and mining contracts.

Boab is working with Horizon Power on concluding the power solution design while undertaking discussions towards finalising a power purchase agreement.

Also, approvals workstreams are progressing with positive determinations expected to be received by the third quarter, before a final investment decision.

The Phase VII drilling campaign is underway at Sorby Hills. The 19-diamond hole campaign is designed to target mine life extensions and enhanced metallurgical recoveries at the Norton Deposit. Assay results are expected by the mid of 3Q 2023.

The company reported a consolidated cash balance of ~AU$4.6 million as of 30 June 2032.

Meanwhile, Boab continues to progress constructive discussions with potential project financiers of the Sorby Hills Project. The company expects to see developments including receipt of EPA amendments approval, completion of FEED, and awarding of offtake in the third quarter of 2023.