Highlights

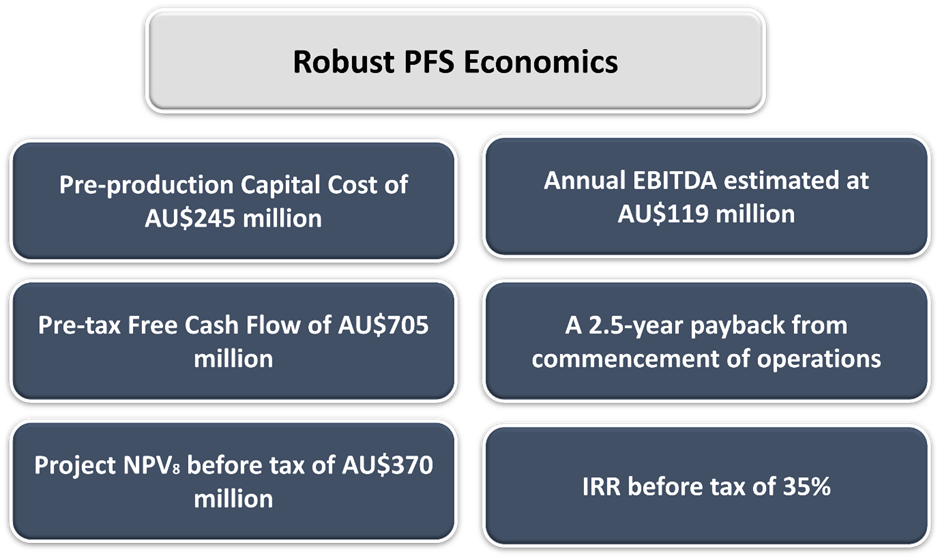

- Boab Metals’ Sorby Hills DFS has an estimated pre-tax NPV8 of AU$370 million, net cash flow of AU$705 million, and an IRR of 35%

- The average annualised EBITDA is expected to be AU$119 million

- As per the DFS, the project will require a pre-production CAPEX of AU$245 million

- The updated MRE by CSA Global has delivered a 78% increase in measured resources, and the project’s ore reserves saw a 12% jump to 15.2Mt

- The open-pit production target stands at 18.3 million tonnes at an average grade of 3.4% lead and 39g/t silver

- The Company will focus on concluding project financing activities before making a final investment decision

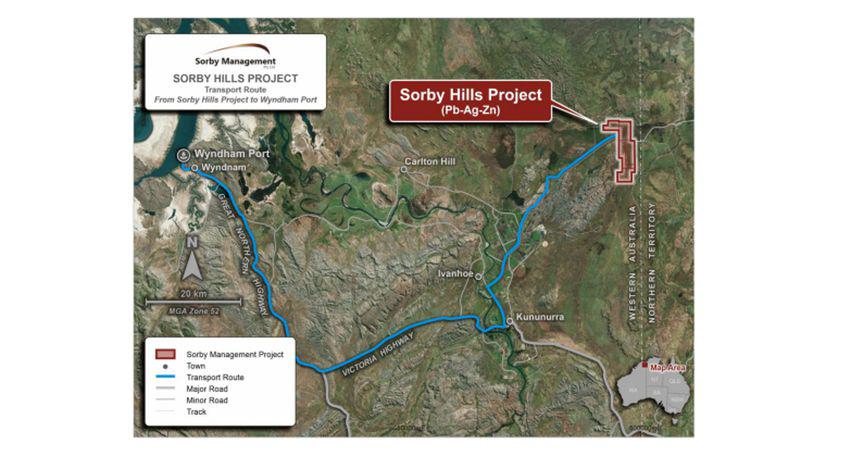

ASX-listed Western Australian-based exploration and development player Boab Metals Limited (ASX:BML) has hit a major milestone concerning its flagship Western Australian asset, the Sorby Hills lead-silver-zinc project. Boab has completed a crucial Definitive Feasibility Study (DFS) for the project with encouraging financial numbers.

The open-pit production target stands at 18.3 million tonnes at an average grade of 3.4% lead and 39g/t silver.

Data source: BML update, dated 19 January 2023

The Company intends to step up well-advanced discussions with off-takers and typical project finance due diligence workstreams. These steps will aid in securing financing for the project.

© 2023 Krish Capital Pty. Ltd., Data and image source: Company update

DFS indicates impressive project economics

The DFS study proposes open-pit mining and processing 18.3Mt of ore through the Sorby Hills processing plant over an initial 8.5-year processing period. On an annual basis, this will deliver an average of 103kt of concentrate containing 2Moz of payable silver and 64kt of payable lead.

The DFS churned out impressive project financials, highlighting strong pre-tax economics, including a net cash flow of AU$705 million and an NPV8 of AU$370 million.

The study indicated an average annualised EBITDA of AU$119 million with an internal rate of return (IRR) of 35%.

In terms of costs, the study has estimated a pre-production CAPEX of AU$245 million to put Sorby Hills into production. More than 50% of CAPEX will go into the processing plant’s engineering, procurement, and construction (EPC) while AU$40 million has been set aside for early works and related infrastructure. The CAPEX also includes a contingency of AU$21 million.

The study has estimated a C1 cash cost of US$0.39/lb of payable lead, including a net silver credit of US$0.38/lb payable lead, delivering an average operating margin of 41%.

The project is estimated to have a payback period of 2.5 years.

© 2023 Krish Capital Pty. Ltd., Data source: BML update, dated 19 January 2023

Boab Managing Director and CEO Simon Noon also highlighted confidence-boosting salient features of the project, including:

- A metallurgical campaign validating high metal recoveries and providing strong input for the design of the process plant

- The execution of a port access and services agreement, as well as a power purchase heads of agreement, supporting mining operations across the project

- A 50% increase in the process plant capacity to boost concentrate production and optimise unit operating costs

- Selection of GR Engineering Services (GRES) as the preferred tenderer to build the process plant

Updated Mineral Resource and Ore Reserve estimate for Sorby Hills

In addition, the Company has shared an updated mineral resource estimate (MRE) and ore reserve estimate for Sorby Hills.

The updated MRE stands at 47.3Mt and has achieved a 78% jump in measured resources, while the ore reserve estimate has increased by 12% to 15.2Mt with a 53% jump in proved ore reserves.

Decision to mine expected in mid-2023

Boab will proceed with project financing activities before making a final investment decision.

Boab and Henan Yuguang Gold and Lead Co Ltd (25% interest in Sorby Hills) will work with potential financiers, including the Northern Australia Infrastructure Facility (NAIF), Export Finance Australia (EFA), and other domestic and international commercial banks, toward a final investment decision. Yuguang is a major player in the Chinese lead smelting and silver production space.

The Company expects a decision to mine in mid-2023.