Highlights

- Boab Metals (ASX:BML) is advancing with full gusto to develop its flagship Western Australian asset, Sorby Hills Lead-Silver Project.

- The company completed its Sorby Hills DFS in January 2023, which confirmed a 78% surge in measured resources.

- BML is in talks with multiple lenders, including Export Finance Australia (EFA), Northern Australian Infrastructure Facility (NAIF) and other national and international banks.

- The company has joined hands with GR Engineering Services for the construction of the process plant.

- BML recently announced positive results from its Phase VI drilling program at the Sorby Hills Project.

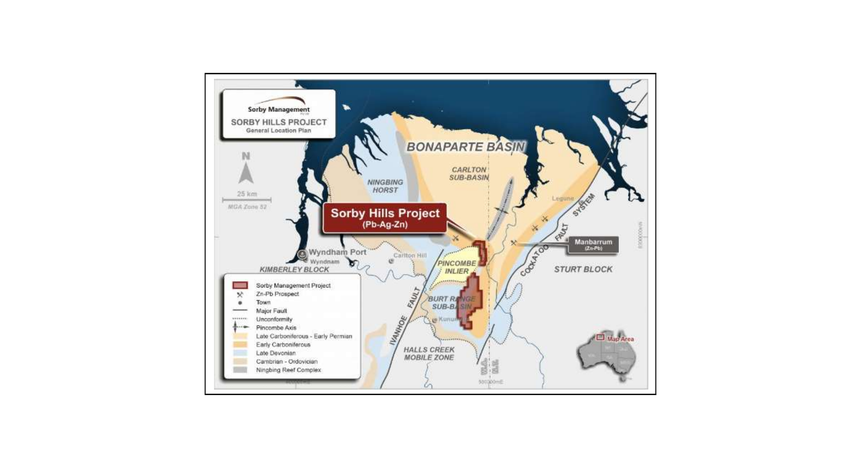

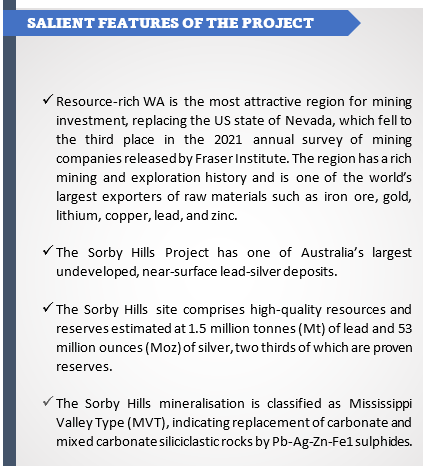

Perth-based resources company Boab Metals Limited (ASX:BML) has directed its absolute focus on developing its flagship asset, Sorby Hills Lead-Silver Project located in the tier-1 mining jurisdiction of Western Australia (WA).

Read further to learn more about some impressive advancements undertaken by the company recently towards project finance as well as the offtake front.

Sorby Hills - BML’s flagship lead-silver asset

Data source: company update

DFS highlights compelling project economics

The Sorby Hills Definitive Feasibility Study (DFS) was completed in January 2023, highlighting a 78% surge in measured resources. Additionally, there has been a 12% surge in the ore reserves post the study. The approximate C1 cash cost of US$0.39 per pound of lead has been one of the lowest in the present environment, says the company, which expects operating profitability of more than 40%.

FEED work and Project Finance

BML is all geared up to accelerate the mining operations with FEED work. The ASX-listed exploration and development player has joined hands with GR Engineering Services (GRES) for the construction of the Process Plant. GRES is one of the leading engineering consulting and contracting companies of Australia. The front-end engineering & design work is in progress.

The company has also begun the logical process of the assessment of financing options. It is in talks with numerous lenders, such as Export Finance Australia (EFA), the Northern Australian Infrastructure Facility (NAIF), and several national and international banks.

Encouraging Phase VI drilling program results

BML recently announced positive drilling results from its Phase VI drilling program undertaken over 3,020m across 28 Reverse Circulation (RC) drill holes at the Sorby Hills Project. Additional results from the Beta deposit confirmed the current mineralisation model and opened the prospect for mineralisation extensions.

A total of 1,700 drill samples have been sent to Intertek Laboratories in Darwin for a broad spectrum of element analysis, including lead, silver, and zinc.

Decision-to-mine likely in Q3 2023

BML says that Sorby Hills lead-silver concentrate has received strong offtake proposals from a host of international and domestic lead concentrate smelters and traders.

BML is working closely with its JV partner, Yuguang, towards a decision-to-mine to bring Sorby Hills into production. The company plans to begin with procurement and offsite fabrication process immediately after closing the FID by the end of Q3 2023.

The process plant construction team will be mobilised to the project site in April 2024 and BML intends to produce its first concentrate by early 2025.

BML stock traded at AU$0.205 on 12 May 2023, with market capitalisation of over AU$35 million.