Highlights

- Allup Silica has lodged applications for two new silica exploration projects in WA and the NT.

- The company has also applied for an extension to the size of its Dune Buggy tenement holdings.

- APS is executing its commercial strategy to focus on multiple projects with logistics as well as port options.

Allup Silica Limited (ASX:APS) is committed to deepening its silica sand footprint in the prolific mining jurisdictions across Australia.

In line with its objective, the ASX-listed silica sand exploration firm has lodged new exploration licence applications (ELAs). Based in Western Australia and the Northern Territory, the projects are believed to be prospective for silica sand.

Allup is eyeing expansion of silica sand portfolio with

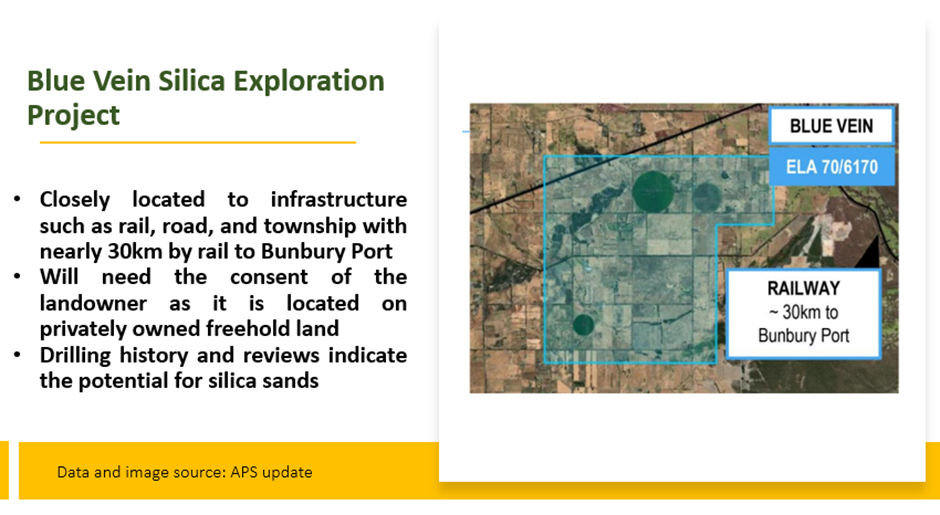

- ELA for Blue Vein (ELA 70/6170) in Western Australia

- ELA for Trigger Fish (ELA 33298) in the Northern Territory

- ELA for extending the size of its Dune Buggy tenement holdings

Meanwhile, the company's board has chosen to renounce its application for an exploration licence for the Antwalker project.

Previously allocated funds to the projects that are being withdrawn will be redirected. The funds will now go towards new exploration applications or other major projects of silica sands within the portfolio of Allup.

Overview of the Projects

The development represents the company's commercial strategy to focus on several projects with both port and logistic options.

According to the company, the alterations to its tenement portfolio will help in the optimisation of those projects which are early stage in nature.

© 2022 Kalkine Media®

Trigger Fish Silica Exploration Project

- Located about 4km to the east of the Adelaide-Darwin railway line, this project also lies near major infrastructure

- According to desktop reviews, the project has potential for silica sands

© 2022 Kalkine Media®

Stock information

Allup Silica has a market cap of about AU$6.59 million. APS shares were trading at AU$0.079 apiece midday on 12 September 2022.