Highlights

- 88 Energy (ASX:88E) reported a maiden prospective resource estimate of 1.03 billion barrels of oil for the Icewine East project.

- Planning and permitting for drilling the Hickory-1 well site in 1H 2023 is underway.

- Chromatography results for Merlin-2 side wall cores across the Peregrine Project indicated definitive evidence of hydrocarbons.

- 88E received a quarterly cash flow distribution of AU$0.9 million from the Project Longhorn.

Oil & gas player 88 Energy Limited (ASX:88E) progressed with top-notch development activities across its project portfolio during the September 2022 quarter. The company made major strides across the Project Icewine, Project Peregrine and Project Longhorn.

The period saw 88E bolstering its financial footing with the completion of a share placement raising AU$14.9 million in gross proceeds. The company ended the quarter with cash of AU$17.5 million and no debt.

88E gears up for drilling at Project Icewine in 1H 2023

88 Energy holds a working interest of approximately 75% in the project. The company reported a maiden independent prospective resource estimate for the Icewine East project of 1.03 billion barrels (gross) of oil recoverable from multiple reservoir zones. The company also noted substantial oil volumes across all mapped play fairways.

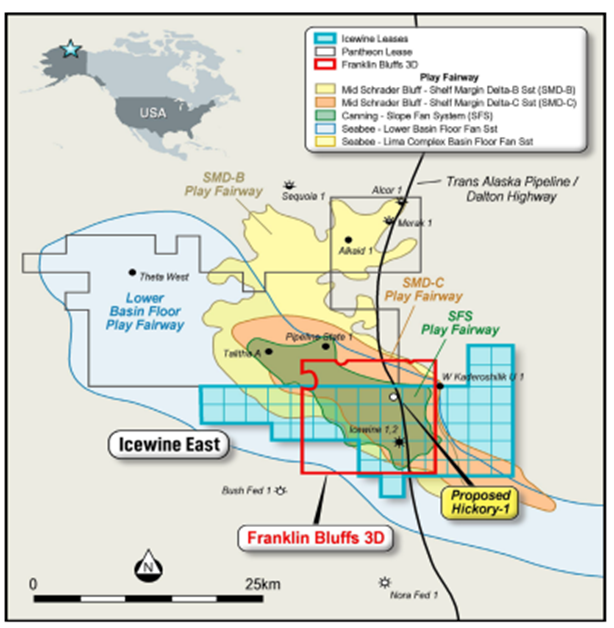

Icewine East lease area, including mapped play fairways and planned Hickory-1 well location

Image source: 88E update

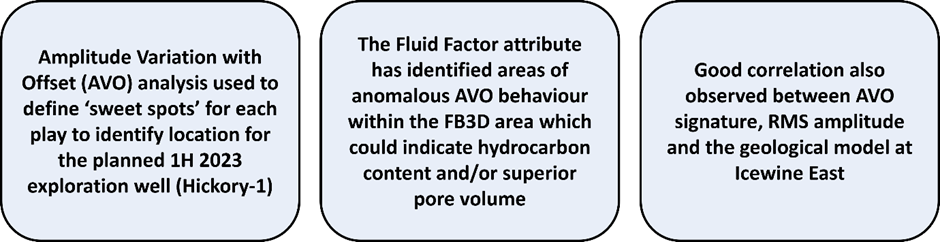

The period also witnessed the interpretation of the newly licenced Franklin Bluffs 3D seismic survey data (FB3D), which covers a substantial part of the Icewine East leases. The interpretation led to:

(Source: © 2022 Kalkine Media®, data source: Company’s update)

In September, 88 Energy selected drilling location for Hickory-1 exploration well in Icewine East. The company plans to drill Hickory-1 as a vertical well to ~12,500 feet in 1H 2023. The well is planned to intersect and test all four key reservoirs, Shelf Margin Delta (SMD), Slope Fan System (SFS), Basin Floor Fan (BFF) and Kuparuk (KUP) play fairways on the Icewine East acreage.

The company is currently engaged in planning and permitting activities required for the drilling campaign.

Basin modeling study on Project Peregrine delivers encouraging results

88E holds a 100% working interest in the project, which saw completion of a basin modelling study during the quarter. The study was designed to improve the company’s understanding of the geological history and how it pertains to the Nanushuk reservoir quality across the Project Peregrine.

The study results, along with abundant oil shows across Merlin-1 and Merlin-2, are encouraging for the untested Harrier and Harrier Deep prospects to the north.

The high-resolution gas chromatography performed on Merlin-2 side wall cores indicated definitive evidence of hydrocarbons.

Planned workover delivers immediate production from Project Longhorn

88 Energy holds a 73% working interest in the project, wherein Lonestar I, LLC, the project operator, is currently pursuing planned capital-efficient workovers. Of the seven workovers scheduled for 2022, the quarter saw the successful completion of the fourth workover. The development delivered immediate production with an average of ~85 BOE (gross) per day in September.

Longhorn wells produced at a rate of ~450 BOE (gross) per day (~70% oil) at the end of September 2022. It represents a nearly 60% increase in overall output since the completion of the project acquisition in mid-February 2022.

The investment has resulted in net cash flow returns of AU$2.8 million since the acquisition, while for the September quarter, the value stood at AU$0.9 million, received in September 2022.

88E shares were trading at AU$0.010 midday on 11 November 2022.

_09_03_2024_01_03_36_873870.jpg)