Highlights

- 88 Energy (ASX:88E) has finalised the drilling location for the planned 1H 2023 exploration well at Project Icewine East leases.

- The recently completed interpretation of the available 3D seismic data set, along with Icewine-1 well logs, helped 88E identify the optimal drilling location.

- The well is planned to test all four key reservoirs noted in the recently announced prospective resource estimates for Icewine East.

- The Icewine East acreage has been significantly de-risked based on several data sets and test results.

- 88E share price spiked 12.5% after the update.

88 Energy Limited (ASX:88E, AIM:88E, OTC:EEENF) has marked an important milestone with the latest development at its Project Icewine East leases. The company has completed interpreting the recently licenced Franklin Bluffs 3D seismic survey data (FB3D), which sits over the Icewine East leases.

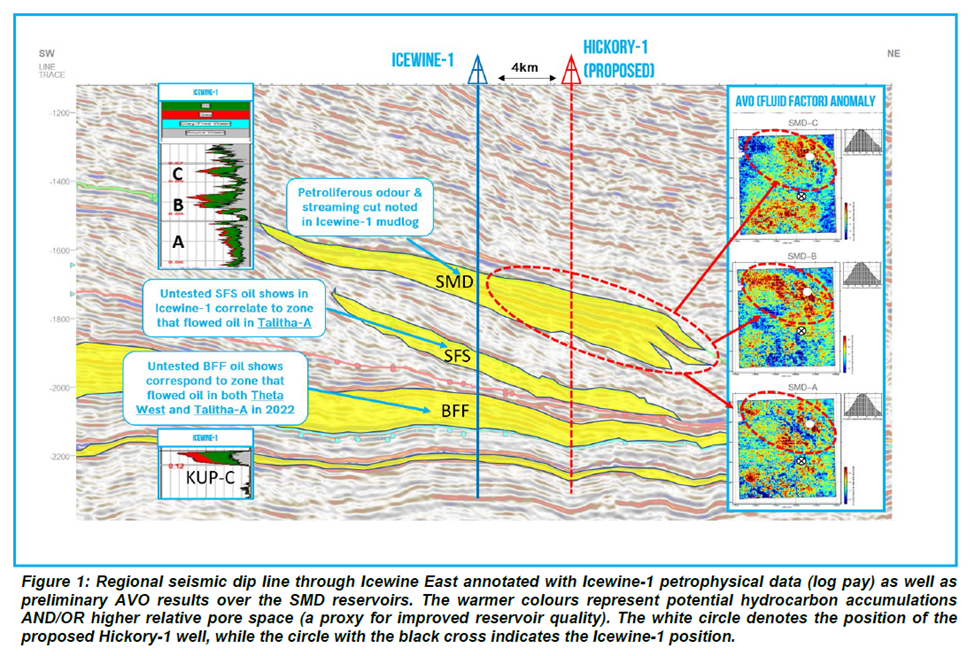

The data interpretation included Amplitude Variation with Offset (AVO) analysis, which helped the company to pinpoint a drilling location for its planned 2023 exploration well, Hickory-1 across the project area.

Triggered by the update, 88E shares gained 12.5% to trade at AU$0.009 on 5 September 2022.

Data interpretation boosts confidence in Icewine East potential

Interpretation of the FB3D data included AVO analysis, where a comprehensive study of the FB3D seismic gathers across all offsets, ultimately produced a series of AVO attributes (such as fluid factor). These attributes can be used to further enhance existing 2D and 3D interpretation and reservoir understanding, as well as improve the probability of geological success and refine selection of target drilling locations.

Significantly, it was observed that the Fluid Factor attribute has identified areas of anomalous AVO behaviour within the FB3D area, which could indicate hydrocarbon content and/or superior pore volume (reservoir quality). It was also observed that good correlation existed between AVO signatures, RMS amplitude and the geological model at Icewine East.

Source: Company’s announcement, 5 September 2022

The data interpretation, including the AVO analysis has helped the company define sweet spots for all four key plays - Shelf Margin Delta (SMD), Slope Fan System (SFS), Basin Floor Fan (BFF), and Kuparuk (KUP) play fairways.

These key play fairways are interpreted to extend from Pantheon Resources’ acreage onto Icewine East. Pantheon has multiple light crude wells, Alkaid-1, Talitha-A and Theta West-1, with American Petroleum Institute (API) gravity in the range of 35⁰ to 40⁰ from multiple Brookian reservoirs.

88E has also highlighted the status of a good correlation that existed between the AVO signatures, root mean square amplitude (RMS) amplitude, and the geological model at Icewine East.

Based on these successful results, the company has planned to drill an exploration well (Hickory-1 well) next year (H1 2023).

To know more about the company's recent financial performance, click here.

Hickory-1 well location and objective

88E has identified an optimum drilling location of the exploratory well based on the amalgamation of results from the initial analysis and interpretation of the FB3D along with Icewine-1 well logs. The well will be adjacent to the Trans Alaskan Oil Pipeline route and the Dalton Highway; the main north-south all-weather road highlights its strategically well-placed location.

Hickory-1 will be an exploratory vertical well, planned to be drilled to an approximate depth of 12,500 feet to intersect and test all the four key plays: SMD, SFS, BFF and KUP. It will also test the substantial potential oil volumes noted across all mapped play fairways, particularly the SMD and BFF reservoirs.

The well location is subject to permitting, Joint Venture (88E 75.2% WI) and government approvals. However, the company has commenced the planning and permitting part from its side.

About Icewine East Project

As per the independent assessment by Lee Keeling and Associates in Q3 2022, the project holds an estimated unrisked conventional total of 647 MMbbl of prospective oil resources (mean unrisked, net to 88E). The project has been significantly de-risked based on the recent Pantheon drilling and flow tests on their adjacent acreage and data from Icewine-1 well logs.