Highlights

- 88 Energy completed an in-depth petrophysical re-evaluation highlighting future exploration potential at Project Icewine.

- The company expects the completion of an independent resource report for Project Icewine in Q3.

- 88E is continuing Merlin-2 post well studies to determine exploration potential.

- Project Longhorn saw a significant boost in production levels.

- 88E remains in a strong financial position with AU$10.5 million in cash and zero debt at the quarter end.

88 Energy Limited (ASX:88E) advanced various works across its Alaskan project portfolio during the June quarter ended 30 June 2022.

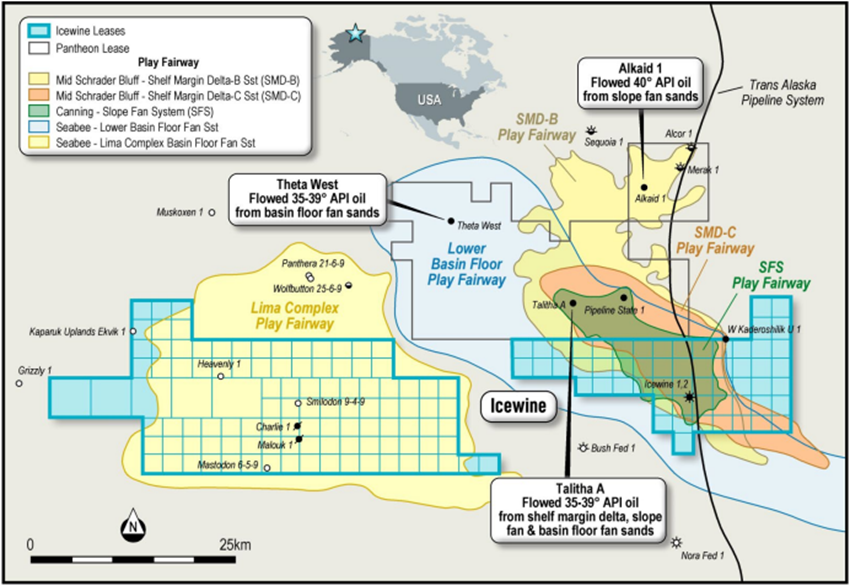

One of the key highlights during the quarter was the company’s advancement of the Project Icewine East acreage and prospectivity assessment which included completion of independent mapping of play fairways, petrophysical assessment and licensing of the Franklin Bluff’s 3D to identify a 2023 drilling location.

The Company also realised at its Longhorn Project asset, a significant production boost since acquisition in mid-February 2022.

What’s more, the company ended the period on a firm financial footing, with AU$10.5 million in cash and no debt.

Let us look at the company’s progress during the June quarter.

Project Icewine indicates significant opportunities

88E advanced additional studies and analysis across the Icewine East acreage, involving the finalisation of the mapping of the SMD, SFS and BFF play fairways onto the Project Icewine East acreage.

An independent evaluation has highlighted that all reservoir units (SMD, SFS, BFF) of the neighbour Pantheon Resources extended onto the Project Icewine acreage. It is to be noted that Pantheon’s wells – Alkaid-1, Talitha-A and Theta West-1 – all flowed 35 to 40⁰ API oil from multiple Brookian reservoirs.

Source: 88E Announcement 14/07/22

88E also inked a licensing agreement with SAExploration, Inc. (SAE) to use the latter’s Franklin Bluffs 3D seismic survey data, expected to help the company in undertaking its upcoming analysis. These studies would further support 88E in delineating sweet spots for each play and determining optimal drilling locations for future exploration and appraisal wells.

88E also progressed the initial Project Icewine East prospective resource estimate, which is expected to conclude in early Q3 2022. Planning is underway to spud a new exploration well in 2023.

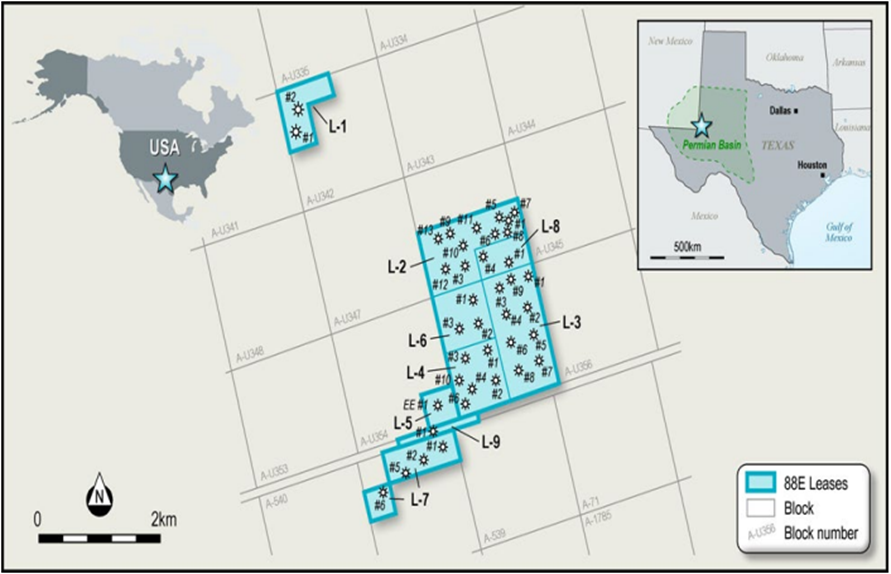

Project Longhorn sees substantial production boost

At Project Longhorn, the second and third of seven planned capital-efficient workovers scheduled in 2022 were successfully completed by Lonestar I, LLC, the operator and ~24% net working interest partner of 88E. The works delivered a substantial boost to the total oil & gas production rates of Project Longhorn.

With the third workover completion at May end, production from the Longhorn wells surpassed 650 BOE per day gross.

88E now expects daily production rates to settle at around ~500 BOE per day gross in Q3, indicating an increase of ~70% in the total output since the acquisition was completed in mid-February 2022.

The production boost offers further direct exposure to the higher WTI oil & gas price environment while expediting payback on the asset acquisition as well as capital investment in the workovers.

Project Longhorn acreage (Source: 88E Announcement 14/07/22)

It is expected that the targeted seven capital development activities would be completed ahead of schedule during Q4 2022.

Independent NPRA basin modelling study commenced at Project Peregrine

88E has initiated a detailed analysis of data gathered from the Merlin-2 drilling program to evaluate future exploration potential.

During the quarter, the company initiated an independent NPRA basin modelling study to enhance its understanding of the geological history and the way it relates to the Nanushuk reservoir quality across Project Peregrine. Multiple independent drill ready targets remain untested (Harrier-1 & Merlin-1A).

The study is anticipated to conclude by the third quarter of 2022.

Progress at Yukon Leases and Umiat Oil Field

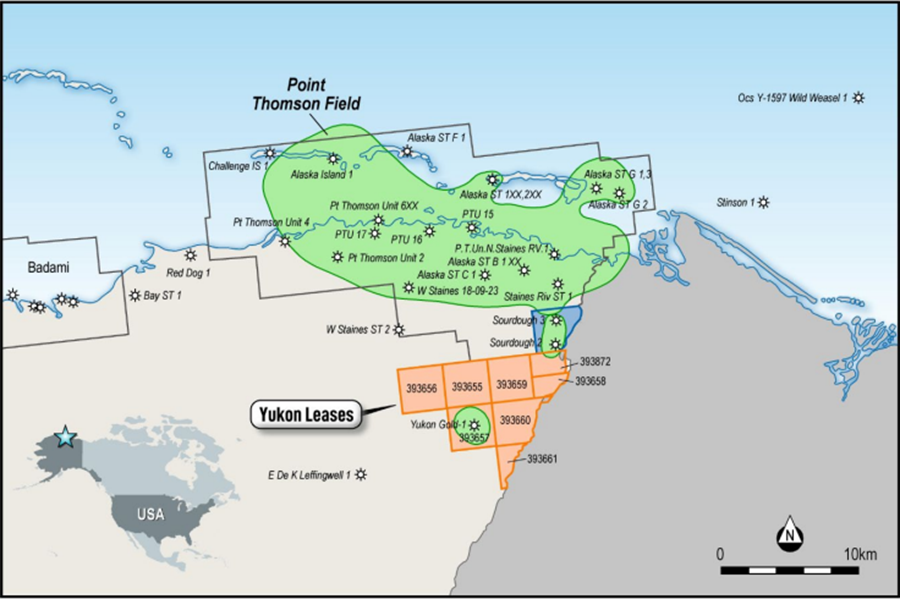

At its Yukon Leases, 88E looks to progress towards completion of due diligence and commercial assessment of joint development with nearby resource owners.

Yukon acreage (Source: 88E Announcement 14/07/22)

At the Umiat Oil Field, 88E initiated discussions with an Alaskan drilling operator in relation to the use of a new lightweight rig and optimised operations. This is intended to drill a cost-effective exploration well designed to unlock additional upside in Umiat.

88E shares were trading at AU$0.012 in the early hours of 15 July 2022.