Highlights

- 88 Energy (ASX:88E) plans to spud the significantly derisked Hickory-1 exploration well in 2023 targeting net mean prospective resources of 647 million barrels of oil.

- Additional workovers are planned for Project Longhorn, targeting a production of ~600 BOE per day (~70% oil) by the end of this year.

88 Energy Limited (ASX:88E) is effectively steering the development of its quality portfolio of Alaskan exploration projects supported by conventional Texan production assets.

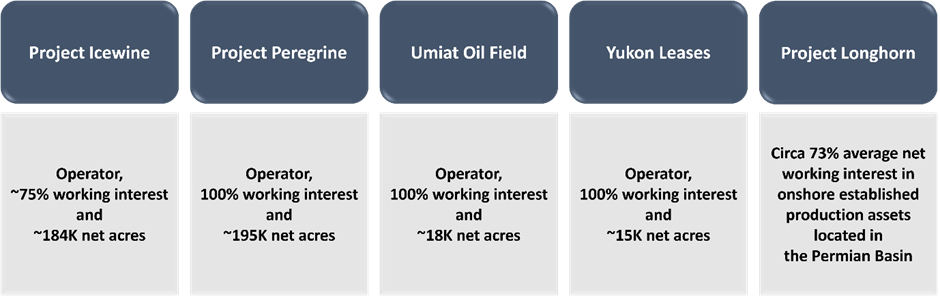

The company's key projects include the following:

Data source: 88E update

Below, we discuss the three domains that 88 Energy is focusing on.

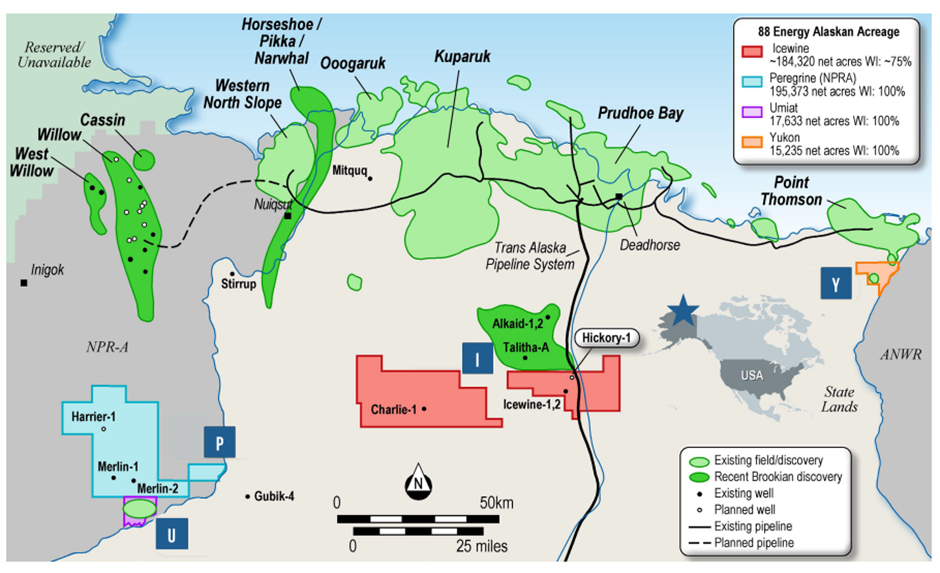

Extensive Alaskan Acreage Position

88E’s Alaskan acreage comprises four premium assets: Project Icewine, Project Peregrine, Umiat Oil Field, and Yukon leases (represented by I, P, U, and Y, respectively, on the map below).

Source: company’s update

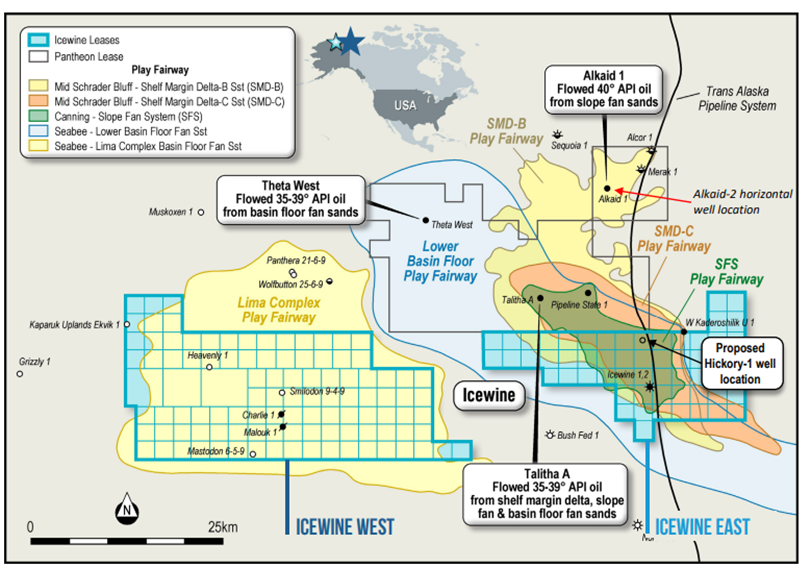

The Icewine project includes Icewine East, which holds the high-impact Hickory-1 exploration well, due for spudding in 2023, and Icewine West, where the company plans a follow-up appraisal well based on any successful flow test in Icewine East.

Source: company’s update

Project Peregrine covers multiple independent untested drill-ready targets, which, based on high-resolution gas chromatography data, are believed to host hydrocarbons.

The Umiat oil field, adjacent to Project Peregrine, shows upside potential and better apparent trap definition/resolution, based on recently completed amplitude variation with offset (AVO) work. The company is investigating the possibility of a new lightweight and low-cost drilling rig for a future appraisal well.

88E is in discussions with nearby lease owners for joint development of the Yukon leases.

High-impact drilling executing active, infrastructure-led exploration

88 Energy’s Icewine East acreage has excellent access to infrastructure and services, owing to its strategic location on the Dalton Highway and because the Trans-Alaska Pipeline System runs through the acreage.

The company has estimated significant prospective resources across all the mapped play fairways on the acreage. AVO analysis and interpretation of Franklin Bluffs 3D (FB3D) seismic data were used to delineate 'sweet spots' for each play.

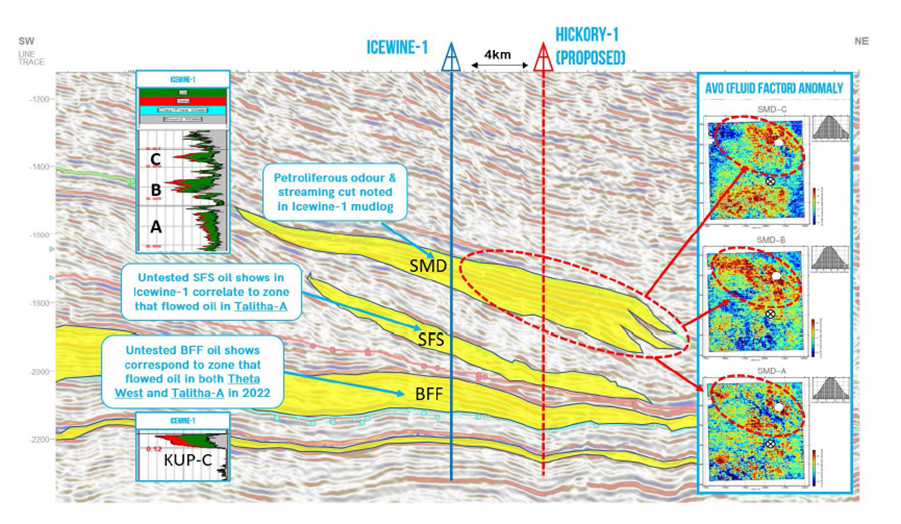

88E has commenced planning and permitting activities for the Hickory-1 exploration well, with the location of the vertical well selected to test all four key reservoirs.

The oil and gas exploration and production company is targeting the spud of the Hickory-1 exploration well in 2023 for 647 million barrels of oil (MMBO) unrisked net mean prospective resources.

The recent drilling and flow tests on the adjacent acreage by Pantheon Resources, Icewine-1 well logs, and the modern FB3D data sets have significantly derisked the Hickory-1 well.

Source: company’s update

Increasing direct production exposure

88 Energy has an ~73% average net working interest in Project Longhorn, which holds net 2.1 million barrels of oil equivalent 2P independently certified reserves.

The project has witnessed the successful completion of four workovers, with an increase of ~60% in production, since its acquisition in February 2022. Three more low-cost workovers are planned in the second half of 2022, to take the gross output to ~600 BOE per day (~70% oil) by the end of this year.

Planned activities (image source: © 2022 Kalkine Media®; data source: 88E update)

88E shares were trading at AU$0.010 midday on 9 November 2022.