Highlights

- Calculating tax liability on cryptocurrency transactions is easy given you are aware of basic rules

- The taxation office mandates that tax liability accrues at the time of a transaction, regardless of whether the crypto later loses value

- For the purposes of recording and reporting transactions and tax implications, NFTs are considered on a par with cryptos

It is time for Australians to calculate their recent earnings and report them to the Australian Taxation Office (ATO). Previous financial year has come to an end, and with a rise in Australians’ bet on a new category of investment assets -- cryptocurrencies -- complications might arise.

What are the guidelines prescribed by the ATO with respect to cryptocurrencies? Are they considered the digital form of money or are they assets that can attract capital gains tax (CGT)? Let us quickly explore basics of cryptocurrency taxation in Australia.

Treatment of cryptos

First, the taxation office requires Australians to maintain a record of “all” crypto transactions. The word ‘all’ is fully capitalised in the official documentation available on the ATO’s website. For the purpose of reference, all documents of the ATO mention cryptocurrencies as “crypto assets”. This essentially means that cryptos, including non-fungible tokens (NFTs), attract capital gain taxes.

Complications can arise when the ATO also suggests that the personal use of crypto assets with no regard for investment is exempt from CGT.

Here, the holder must note that this treatment requires holding the asset for only a “short period” over which, the holder uses the cryptocurrency to purchase any item for personal use. For example, if any merchant accepts cryptos as payment, the payer might opt to make such payment by briefly converting fiat currency into cryptos. No CGT is levied in such cases.

Cryptos held for investment purposes -- which is mainly decided by the duration for which, the asset is held -- necessarily attract the levy of CGT.

Also read: Top 3 meme coins by market cap

Cryptocurrency taxation in Australia

Tax implications on crypto assets in Australia are pretty simple thing to understand. When a holder disposes of any crypto asset (tens of thousands of cryptos exist today), any gain must be included in the tax return, the ATO mandates.

The math is pretty simple. You bought a crypto asset, say Ether using AU$100. Now, when you sell it off, in part or completely, and convert it into fiat currency or any other asset like Dogecoin and book any gains, the transaction attracts CGT. If the transaction is made in any other currency, say the USD, at the time of acquisition or disposal, it must be first converted into Australian dollars before arriving at any calculation.

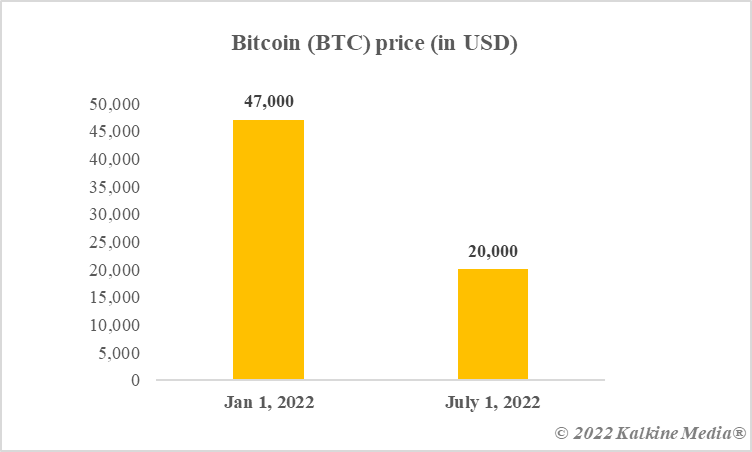

Tax liability arises as and when the transaction is made, no matter if the held crypto asset subsequently loses value. For example, if your Bitcoin (BTC) investment is presently losing its value, CGT will still be applicable if any gains were booked on any previous transaction. The ATO permits net capital losses to be deducted from capital gains accruing in a later year, however, such losses on cryptos cannot be adjusted against income and gains from non-crypto sources.

Data provided by CoinMarketCap.com

Bottom line

Understanding crypto taxation in Australia is not at all complicated, given you are aware of some fundamentals like NFTs are also treated as crypto assets, and the ATO closely inspects if someone reports a crypto transaction as ‘personal use’.

Also read: Cryptoqueen Ruja Ignatova on Most Wanted list: What it means for cryptos

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.