Another start-up success story has been celebrated in the Silicon Valley, after 35-year old entrepreneur Stephen Dash, founder and CEO of ASX-listed entity Credible Labs Inc. (ASX:CRD) and the Board announced a merger with a subsidiary of American broadcasting company Fox Corporation. The San Francisco based financial technology start-up would be acquired by Foxâs subsidiary at a fully diluted equity value of approximately A$585 million. The update came in on 5 August 2019, following CRDâs Business and Quarterly report released for the quarter ending 30 June 2019 (as announced on 31 July 2019), where it had generated a gross profit of $6 million, up by ~230 per cent on pcp.

Before diving into the updates, let us get familiar with the two companies under discussion:

Credible Labs Inc.

A U.S. company based in San Francisco, founded by Stephan Dash, CRD operates a consumer finance marketplace, aiding consumers to save money and make better financial decisions. Its proprietary tech-savvy forum is unified with various credit bureaus and financial organisations. The company provides the option to compare rates from various financial organisations for student and personal loans along with mortgages.

Fox Corporation

A company started by Aussie expat Rupert Murdoch and is headquartered in NYC, Fox is a producer and distributer of compelling news, sports and entertainment content. A Few of its brands include- FOX Television Stations and FOX News.

With the two recent updates in its kitty, CRD is the hot stock amongst market enthusiasts given that its share price has tripled in the past six months.

Let us acquaint ourselves with these developments in CRD:

The Merger Agreement with Fox Corporation

The A$585 million mergerâs transaction is subject to customary closing conditions and CRD shareholdersâ approval. As per the agreement, shareholders would receive A$2.21 cash per CDI at a premium of 12.4% to the VWAP. Founder and CEO Stephen Dash would exchange stocks equivalent to 33.33% of the companyâs outstanding common stock in units of the newly created subsidiary of Fox. He would receive A$55.25 per share of common stock in the company for ~1 million shares, and this would be the maximum number of shares of common stock that he would be entitled to sell.

Also, Highbury Partnership is the financial adviser, and DLA Piper is the legal adviser, to the company.

What does the CRD Board say?

A special committee was formed exclusively to review, evaluate and negotiate any offer to acquire securities of CRD and make approval recommendations. The committee had financial and legal advisers, and the Fairness Opinion (obtained in accordance with U.S. practice) settled the consideration to be paid in connection with the transaction to shareholders was fair. PJT Partners is the financial adviser to the Special Committee and Akin Gump Strauss Hauer & Feld is CRDâs legal adviser.

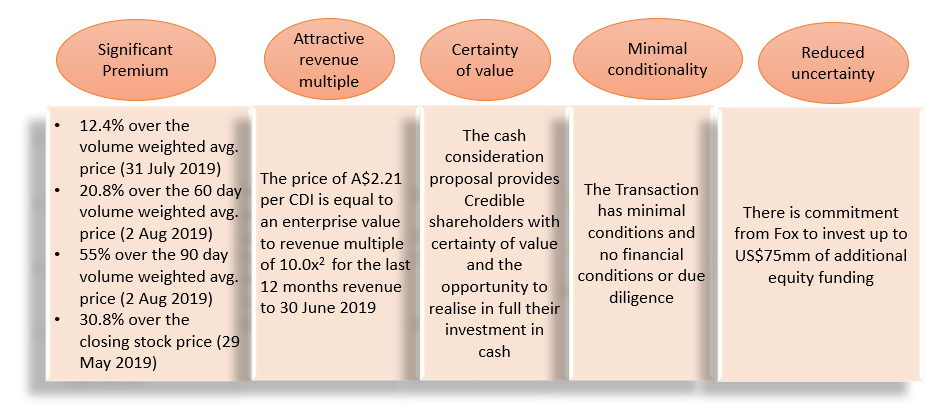

Concluding the fair and reasonable outcome from the special committee, CRDâs Board unanimously determined that the merger was in the best interests of the company, and suggested that shareholders vote in favour of the advisable transaction, citing the below significant positives of the deal:

Reasons to vote in favour of the Transaction (Source: CRDâs Report)

What do the experts say?

Market experts believe that the deal would enable the company to grow its distribution channels through Foxâs cable TV channels and the digital platforms. However, the huge premium amounts have left a few market enthusiasts perplexed, though majority believes that the company is following a growth trajectory.

The timeline of the Transaction

The Transaction would be implemented via voting of all the shareholders, and a vote of all shareholders excluding those interests controlled by Mr. Stephen Dash. The day for the shareholders meeting would be circulated in September 2019, along with a detailed insight of the transaction. The meeting of shareholders to consider and vote would likely be in October 2019, which is subject to change.

CRDâs Business and Quarterly Update

Reported on 31 July 2019 on ASX, as on 30 June 2019, the company held approximately USD24.3 million in cash and cash-like resources, slightly on the lower end of the 31 March 2019 figure of USD25.9 million. It achieved CLV of USD405 million in Q2 2019, up by 115 per cent on pcp (USD188 million). In 1H19, the company generated unaudited revenue of USD19.7 million and a gross profit and USD6 million, recording a booming growth of 124% and 231%, respectively. The gross margin for H1 2019 was 30.3%, up from the pcp figure of 20.6%. Moreover, it had maintained a strong cash and cash-like resources position of USD24.3 million as on 30 June 2019, down from USD25.9 million as on 31 March 2019.

Mr Stephen Dash informed that the Company had continued the development of its mortgage marketplace and was finally licensed to serve borrowers in 41 states, depicting almost 82% of the residential mortgage market. It had signed and launched a trial mortgage partnership with Realtor.com, which is the second largest digital real estate platform in the U.S. Besides this, CRD continued to scale up its partner channel radar and added 34 net new marketing partners in the quarter.

The companyâs team has been growing with the trend expected to continue in the coming days. It consisted of 134 people on 30 June 2019, up from 130 at 31 March 2019.

The Cash Flow Statement for the Quarter ended 30 June 2019 is highlighted below:

| Particulars | Amount ($USDâ000) |

| Net cash from operating activities | 27 |

| Net cash used in investing activities | 1,099 |

| Net cash used in financing activities | 523 |

| Cash and cash equivalents at end of quarter | 24,266 |

| Estimated cash outflows for next quarter | 16,100 |

CRDâs Stock Performance on ASX

On 6 August 2019, CRDâs stock last traded at A$2.18, with a market capitalisation of A$575.53 million and ~262.08 million outstanding shares. The YTD return of the stock is 188.16% and in the last three and six months, it is generated returns of 47.97% and 180.77%, respectively.

Foxâs Stock Performance on NASDAQ

After the close of trading hours on 5 August 2019, the FOXA stock was valued at $36.05, down by 1.58 per cent, relative to its last trade. Also, its market capitalisation is $22.35 billion.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.