Summary

- Travel stocks are rebounding strongly from March 2020 crash, moving expeditiously on their path to recover from COVID-19 crisis.

- Webjet and FLT grabbed market attention for utilising capital raising method to strengthen balance sheets in order to sail through coronavirus storm.

- FLT continues to focus on cost reduction strategies and intends to reach $65million per month cost base by July 2020 end.

- Qantas is tapping burgeoning travel demand, planning to ramp up its flight capacity from 5 per cent to 40 per cent potentially by July 2020.

- The travel sector is likely to whip into shape as soon as situation returns to normalcy.

While COVID-19 emerged as a hard nut to crack leaving the entire globe in the abyss, relentless efforts of governments and policymakers enabled some countries to sweep through the sensitive juncture. A prime example being Australia, which cropped up as a role model in effectively containing COVID-19 spread via stringent lockdown measures.

However, these efforts to suppress the spread of virus delivered a heavy blow to Australia’s travel sector, which bore the brunt of government-led restrictions on non-essential activities and travel bans.

Fortunately, some glimmers of hope are shining in the gravely affected travel space amid sooner than expected lifting of restrictions in some states, government stimulus measures and potential commencement of international travel with trans-Tasman travel bubble. These signs of revival have worked in favour of ASX-listed travel stocks, that are moving expeditiously on their path to recover from COVID-19 induced losses.

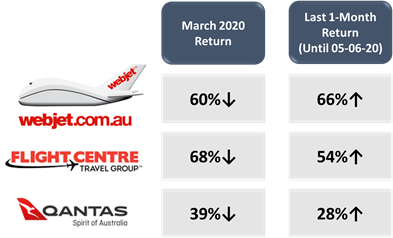

Travel stocks experienced a significant fall in their value during March 2020, when Australia implemented stringent social-distancing measures to control the sudden spike in coronavirus cases. However, these stocks are now covering some of their losses on hopes of sooner economic recovery, as reflected in their substantial 1-month return.

Below figure represents three such travel stocks that seem to be on their road to revival:

These companies undertook different strategic initiatives to mitigate or minimise the losses from coronavirus-induced travel restrictions. Such initiatives, along with burgeoning demand of domestic travel, seem to be providing cushion for the recovery of travel sector.

Webjet Utilised Capital Raising Tool to Strengthen Balance Sheet

Capital Raising has become toast of the town amid COVID-19 driven business challenges, with some companies bolstering capital buffers for balance sheets’ strength to sail through coronavirus storm. Travel agency Webjet Limited (ASX:WEB) is one such classic example.

In order to strengthen its balance sheet amid coronavirus crisis, the Company launched $275 million equity raising in April this year via fully underwritten institutional placement and partially underwritten one for accelerated non-renounceable, pro-rata entitlement offer.

The Placement was targeted at raising $101 million while the entitlement offer was aimed at raising around 174 million to $231 million.

The equity raising initiative was taken to deal with the continued impact of coronavirus and associated government constraints affecting travel sector globally. The Company notified that the proceeds from the capital raising would be sufficient to provide for capital expenditure and operating costs through to the end of 2020 despite continuation of severe travel restrictions.

Webjet’s management firmly believes that the Company is well positioned to perform well as soon as the market conditions normalise, backed by diversity of global source markets and product lines.

FLT Continues to Focus on Cost Reduction Strategies

Akin to Webjet, travel agency Flight Centre Travel Group Limited (ASX:FLT) has also recently raised funds worth $700 million to strengthen its balance sheet and liquidity position. The Company raised these proceeds under a Retail Entitlement Offer to gather support in the period of dislocation and uncertainty across the travel sector amid COVID-19.

Besides, the Company continues to progress towards its financial targets and cost reduction strategies. In May this year, the Company notified that its initial target is to reach $65million per month cost base by July 2020 end, with lower one-off implementation costs than originally envisaged.

What’s worth noting is that the Company generated some sales in April despite heavy travel restrictions in place, with TTV tracking at around 5 to 10 per cent of normal levels. Moreover, it continued to win and execute fresh corporate accounts that are likely to stimulate TTV growth when circumstances will normalise.

Lately, the Company also agreed to sell its Melbourne head office property to Shakespeare Property Group, which is likely to provide positive cash benefit worth $62.15 million. The Company also anticipates a net positive cash impact from government initiatives like Australia’s JobKeeper program and government-backed loan it has received in France.

Qantas Ramping Up Domestic Capacity to Tap Burgeoning Travel Demand

To serve growing demand for domestic travel as lockdown restrictions unwind, Australia’s top-notch carrier Qantas Airways Limited (ASX:QAN) is planning to ramp up its flight capacity from 5 per cent to 40 per cent potentially by July 2020.

Along with its budget subsidiary Jetstar, Qantas is planning to add as many as 300 flights per week by June end. The Company is already experiencing a surge in customers’ booking and inquiries for flights and expects an improvement in travel situation over the coming months.

Qantas has ensured to resume flight operations under appropriate safety precautions, with provisions of face masks and sanitizing wipes to passengers. The Company is more likely to commence flights intra-state as some inter-state travel restrictions are still in place for non-residents. On similar vein, tourism operators have recently pleaded the Queensland Premier to deliver a clear announcement over reopening of states borders.

Qantas is also hopeful of proposed trans-Tasman travel bubble, which is expected to encourage international travel between New Zealand and Australia without quarantine condition.

While COVID-driven restrictions brought blooming travel industry to a standstill, the sector is likely to whip into shape as soon as situation returns to normalcy. Moreover, government is doing its utmost to revitalise multi-billion-dollar travel industry via massive stimulus packages, steps towards resumption of international travel and re-opening of economies. But how soon would these efforts succeed in resurrecting distressed travel sector needs to be watched out for!