Summary

- Penny stocks have the potential to give gargantuan amount of return

- The small-cap low priced stocks can be bought in bulk quantities or with little money in the pocket

- During the unprecedented crisis, some of the penny stocks have yielded double-digit returns

In the equity investment arena, penny stocks are classified as companies with low market capitalisation, and low-priced, micro-cap stocks listed and traded on the recognised stock exchanges. The most crucial characteristics of penny stocks are that they have a low market-capitalization and they are mostly illiquid and have a large spread between the bid and ask quotes. We usually consider penny stocks to be any stock under 100 pence or GBX 100, though there are no fixed criteria.

Liquidity which is defined as the number of shares available for trading in the market daily is one of the most important factors in equity investment and many investors ignore it quite often when it is said that higher the liquidity there would be lower spread between the bid and ask quotes. On the other hand, lower the liquidity means the higher spread between the bid and ask quotes. Also, illiquid stocks can be manipulated easily by a bunch of traders through the placement of a large order, which is also known as market-making.

Penny stocks generally carry higher risks against large-cap and mid-cap stocks because there is a lack of liquidity, smaller number of shareholders, limited information availability and large spreads between bid and ask.

Also read: 5 Reasons to Look at FTSE AIM Stocks, If You Are Left with Little Money to Invest

However, many a time it has been experienced that penny stocks investing have turned investors fortune and handed the gargantuan amount of return in a very small-time span, which lures many investors and that's why investors keep hunting for penny stocks.

As mentioned, penny stocks are highly speculative in nature, but time and again, it has turned fortune for many investors. For instance, if an investor owns 50,000 shares of penny stocks priced GBX 10 or 10 pence, even a GBX 10 rise in share price could deliver him 100 per cent return in a single trading session, which is generally not possible in case of large-cap stocks because it larger company don’t have such type of daily movement and it needs large capital to buy such large quantum of shares.

However, there are also many downside risks involved in penny stocks investing, as market making can be relatively easy to play in case of penny stocks, one could move prices by placing a large volume orders and create a sudden spike into the stock price without leaving a clue to average investors to know whether the sudden spike is genuine or subject to market abuse.

Therefore, one should conduct a thorough analysis before adding penny stocks to their investment portfolio. Also, the portfolio weightage should be pre-defined before creating any position because a complete portfolio exposure to the penny could be extremely risky and in case bets turned out wrong it could destroy the investor's total wealth with negative potential to recover.

Also read: Some FTSE Traded Penny Stocks That Investors Need to Look Out For

In the UK, there is one specific sub-market of the London Stock Exchange that is designed to provide capital access to the smaller companies known as Alternative Investment Market, which allows small companies to raise capital by listing their shares on the London Stock Exchange with relatively higher regulatory flexibility against those listed and traded on the main market of London Stock Exchange (LSE). Due to the increased regulatory flexibility provided, these small-cap stocks are highly speculative in nature.

According to data available on the LSE website, at present, there are more than 800 companies listed on the AIM-segment of the London Stock Exchange, out of which more than 700 are UK-based companies, and rest are international companies listed and traded on the AIM segment of LSE.

At the London Stock Exchange, penny stocks are usually found on FTSE AIM All-Share index and the FTSE SmallCap index. Constituents of these two indices with very low market capitalisation, low price, and lesser availability of shares for trading are often considered as micro-cap or penny stocks.

In this article, we would discuss some penny stocks which have delivered great price returns during the unprecedented crisis. (All data figures are taken from Refinitiv, Thomson Reuters.)

- Premier Foods Plc: YTD Total Return-80 per cent

Food & Beverage company, Premier Foods Plc (LON:PFD) for FY20 recorded a growth of 3.9 per cent to £705.6 million in its Branded items segment by leveraging upon its strong brand equity and innovative products backed by strong advertising along with its strategic retail partnerships. The company’s revenue from UK operations was up by 4.3 per cent in the fiscal year 2020. During the unprecedented crisis, food has been a key industry, and the company witnessed a surge in demand for items such as cooking sauces and baking items during the outbreak of COVID-19. In the current scenario, the company expects stable demand across its product categories. On 16 July 2020, at the time of writing, GMT 11:20 AM+1, PFD shares were trading at GBX 90.50, up by 0.89 per cent against the previous day closing price.

- Aberdeen Standard European Logistics Income Plc: YTD Total Return-10 per cent

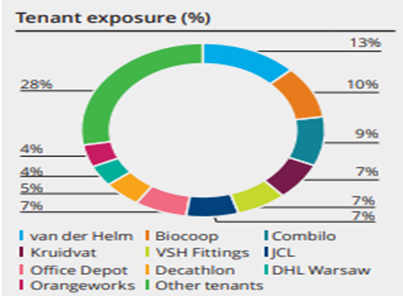

Aberdeen Standard European Logistics Income Group (LON:ASLI) is a real estate investment company which aims to generate returns from a diversified portfolio of properties such as warehouses and logistics facilities. According to its first-quarter report (2020), the company managed to recover 100 per cent rent from the tenants for the period. In addition, the company also managed to recover 67 per cent of rent due for the second quarter. On 16 July 2020, at the time of writing, GMT 11:22 AM+1, ASLI shares were trading at GBX 102.50, down by 1.44 per cent against the previous day closing price.

(Source: Factsheet, Company’s website)

- Triple Point Social Housing REIT Plc: YTD Total Return-19 per cent

Closed-ended real estate investment company, Triple Point Social Housing REIT (LON:SOHO), recently acquired seven housing properties and has entered new leases in respect of each of the properties acquired. As per the lease agreements, the rents received are subject to annual revisions in line with the CPI (Consumer Price Index). The company expects to receive rents on a timely basis and has done well during the unprecedented crisis. On 16 July 2020, at the time of writing, GMT 11:26 AM+1, SOHO shares were trading at GBX 104.50, down by 1.42 per cent against the previous day closing price.

- Galliford Try Holdings Plc: YTD Total Return-50 per cent

Leading UK construction group, Galliford Try Holdings Plc (LON:GFRD) witnessed a surge of 10 per cent in the order book, which is valued at £3.2 billion according to the trading update for the year ended 30 June 2020. Throughout the lockdown, the majority of the group's construction sites in England continued operations under strict safety guidelines. All the construction sites have now commenced operations across the UK and are performing well. In addition, the company has already secured 90 per cent of the planned revenue for the new financial year. The company’s order book comprises of projects related to public and regulated sectors, which enables it to contribute to the UK's economic recovery from the pandemic and capitalise on potential opportunities. On 16 July 2020, at the time of writing, GMT 11:30 AM+1, GFRD shares were trading at GBX 105.00, unchanged as of the previous day closing price.

- Vectura Group Plc: YTD Total Return-90 per cent

Vectura Group (LON:VEC) is a provider of differentiated proprietary technology and pharmaceutical development expertise in inhaled drug delivery solutions. The company has business continuity plans in place in the wake of the coronavirus crisis. The company has a strong balance sheet with an undrawn Revolving Credit Facility (RCF) of £50 million. The board of the company seems confident of delivering results in line with the expectations. On 16 July 2020, at the time of writing, GMT 11:31 AM+1, GFRD shares were trading at GBX 100.60, down by 0.20 per cent against the previous day closing price.

These stocks belong to sectors having resilient demand such as processed foods, REIT’s, Construction and Drug development. The performance of the stocks during the unprecedented crisis proves the resilience of their business models. In addition, these stocks provide an excellent opportunity for portfolio diversification.