Summary

- The Iron ore rally has supported the share price of many ASX-listed iron ore mining companies.

- The high prices have prompted many miners to focus on the production scenario to lock in a high price, Fortescue Metals Group Limited (ASX:FMG) previously upgraded its shipment guidance from 175 million tonnes to 177 million tonnes, and now, BHP Group Limited (ASX:BHP) follow suit.

- Furthermore, the Chinese steel industry, a primary catalyst behind the iron ore rally is anticipated by BHP to perform strongly ahead.

- BHP presents FY2020 operational review

Iron ore prices have shown an impeccable rally until now with prices of Iron Ore Futures reaching a new 52-week high of RMB 845.0 per dry metric tonne on 14 July 2020. Every uptick in iron ore prices is further contributing towards the momentum of ASX-listed iron ore stocks such as Fortescue Metals Group Limited (ASX:FMG), BHP Group Limited (ASX:BHP).

Also Read: Iron Ore- The Rally From 15-Week High to a 52-Week High

The high iron ore prices are prompting the domestic miners to boost the production, which could be inferred from the increasing guidance and high quarterly and yearly production. For example, in the recent past, FMG upgraded its shipment guidance from 175 million tonnes to 177 million tonnes, and the stock of the Company gained tremendous interest from the investing community over robust financial results.

To Know More, Do Read: Large Cap Blue Chip Iron Ore Company Basking under Mega Iron Ore Rally

After FMG, it is BHP Group, which is now breaking headlines over its recent rush in stock prices, which took it to a 20-week high of $38.830 (as on 21 July 2020) on the exchange. The Company released its operational review for the financial year ended 30 June 2020, which further reflected high iron ore production figures and BHP’s prudence in China.

- China is currently the main driver of both gold and iron ore, top-performing commodities of the year so far.

To Know How, Do Read: China- The Catalyst to Gold and Iron Ore Rally

BHP FY20 Operational Review

BHP produced 248 million tonnes of iron ore in FY2020, up by 4 per cent against the previous financial year.

- The June 2020 quarterly production rose by 7 per cent against the previous corresponding period and 11 per cent against the previous quarter to stand at 66 million tonnes.

- On a 100 per cent basis, the total iron ore production reached 281 million tonnes.

The WAIO operations of the Company achieved record production, with higher volumes reflecting record production at Jimblebar and Yandi.

- BHP also suggested that the weather impact of the Tropical Cyclone Blake and Damien was offset by strong performance across the supply chain.

- A strong performance along with reliability following a series of targeted maintenance programs over the past four years further enabled WAIO to produce a record annualised run rate of more than 300 million tonnes (100 per cent basis) during the June 2020 quarter.

- Furthermore, BHP improved the specification of Jimblebar fines to over 60 per cent Fe grade for the same period.

Apart from higher production, FY2020 also witnessed a high average realised price on sales with BHP recognising USD 77.36 on per wet metric tonne of iron ore on the Free-on-Board (or FOB) basis.

- The average realised price for FY2020 remained 16 per cent up against the previous financial year average realised price of USD 66.68 per wet metric tonne on FOB basis.

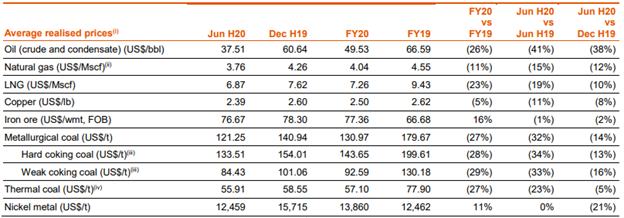

However, while the iron ore segment witnessed a higher selling price due to the rush in iron ore prices across the international front, other segments of the Company realised comparatively weak prices in FY2020 against FY2019.

A Snippet of Average Realised Price on Sales (Source: Company’s Report)

WAIO operations performed strongly during the June 2020 quarter and the resumption of WAIO to normal shift rosters along with the relocation of over 900 employees & contractors in business-critical roles to WA could further ensure smooth operations.

- While WAIO is poised to emerge from the impact of interstate travel ban and Tropical Cyclone Blake and Damien, the Company seems to be placing a strong bet on China, which is currently the largest buyer of the Australia iron ore supply.

BHP Optimistic on China

The Company maintained its view on the Chinese steel industry; however, anticipates that the steel production ex-China could contract by a double-digit percentage in the CY2020 and suggested that the capacity utilisation ex-China fell to between 50 and 60 per cent during the June 2020 quarter.

- Despite a decline in the global steel demand and production, China kept the steel furnaces hot to capture a large tranche of the global steel industry.

To Know More, Do Read: China Poised to Grab the Global Steel Trade as Economies Open up for Trade

- The blast furnace utilisation rates increased from around 80 per cent earlier in February 2020 to above 90 per cent in June 2020 across China, while the daily rebar transactions were above normal seasonal levels for much of the June 2020 quarter, enabling a crude steel run-rate of 1,117 million tonnes per annum in June 2020.

Over such a strong performance of the Chinese steel industry, the Company remains confident that the steel market across China would remain strong, which in turn, could provide a cushion to iron ore prices.

In a nutshell, the iron ore market remains strong so far, which in turn, is providing impetus to ASX-listed iron ore stocks, and after FMG, now BHP is catching the eye of the investing community over its high FY2020 production and higher realised price on sales, which could be inferred from the recent rush in the stock price.

Furthermore, the Chinese steel industry, which has primarily been the main driver behind the iron ore rally, is anticipated by BHP to perform strongly ahead, which could provide a cushion to iron ore demand and prices.