Selection of stocks to buy and sell entails extensive research, vigilant analysis and consumes ample amount of time. Especially in the current times, an investor competes with better experienced professionals who have exposure to additional information. Australia, a developed market economy has always been a hot spot and safe bet for investors. Share market enthusiasts look for good Australian companies to invest in, and the listed investment companies in ASX make headlines across the globe.

In todayâs article, we would understand concepts that an investor (especially a first timer) should bear in mind, before deciding to break the investing ice. We would also screen through ASXâs performance and look at a few gainers and decliners for the day, to understand the way investor sentiment was built on the exchange during the trading session on 11 October 2019.

Let us begin by understanding few key concepts of investing in Australia:

Investing In Australia

Regarded as one of the most robust economies of the world presently, Australia has evolved well since the 1980s, with the government helping in constructive transformation of the economy to make it export-driven and tech savvy.

A sturdy stance proving Australiaâs resilience, in terms of business and economics, has been the global economic downturn of 2008 and beyond, which the Australian economy weathered in a much better way than other world economies. Consumer confidence, business confidence, crisis rebound strategy and capability are other factors that make Australia an attractive investment spot.

The above-mentioned reasons have gained positive investor traction in Australia over time. One of the highly promising developed market of the current times, Australia has a vastly competitive business space which provides an active investment environment. This is constantly catalysed by the secure politics prevailing in the country, consistent frameworks that are constantly regulated and the profitable positioning to growing countries.

Pros and Cons of Investing in Australia

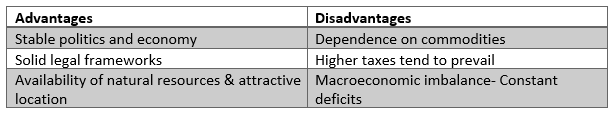

Before interpreting the advantages and disadvantages of investing in Australia, one should note that many market experts believe that Australia has rapidly expanded at a rate beyond that of most other developed countries, which keeps its leverage always high amid domestic and international investors.

Moreover, listings pace up on the ASX by the day, attracting investors, and companies do not hesitate from undertaking risks and are at par (and even above) the on-going advances made in the dynamic business world.

The table below highlights few pros and cons of investing in Australia:

ASX

Australian companies have a huge impact on the countryâs economy and the dynamism of the region and beyond. The Australian Securities Exchange (ASX) is Australiaâs primary securities exchange and is owned by ASX Limited. Australian companies, that wish to go public, list themselves on the ASX and are bound to comply with the regulations of the Australian Securities and Investments Commission (ASIC).

Furthermore, the stocks of the top 200 companies are aggregated in the S&P/ASX 200 Index, which is the benchmark index of Australia, representing approximately 82% of the total market capitalization on the ASX.

By listing themselves, companies gain access to capital from investors in exchange of a stake in the companyâs stock.

Ways to Invest In Australia

Amongst the various options available to investors in Australia, exchange-traded funds (ETFs), American Depository Receipts (ADRs), savings accounts and term deposits, Fixed interest investments, equities, managed funds, investment or growth bonds, annuities, Listed investment companies (LICs), real estate investment trusts (REIT).

Even though the conventional thought process states that property gets the lionâs share of attention when it comes to investing money in Australia, the emerging trends on the technological front is boosting the investing traction in P2P lending and cryptocurrencies as well.

Moreover, investors have been noticeably, effectively and efficiently managing their investment risks by spreading their investments across different asset classes (diversification), which reduces their overall investment risk and makes the investor less exposed to a single economic event.

An Investorâs Checklist

Breaking down oneâs dilemma on which factor to look at and which to ignore, the Australian Securities & Investment Commission has simple, yet robust 5 tips that would get one started on the investing journey. Let us decode them:

- Understand the economy and financial environment- It is of utmost importance to be wary of ways in which the economic and market changes impact a companyâs earnings. Australiaâs central bank, Reserve Bank of Australia (RBA) is perhaps the best trusted source to acquaint oneself on the countryâs economic and regulatory forum.

Key Update: The RBA has recently exercised the third interest rate cut for 2019, by 0.25% to a new record low of 0.75%. To know more about this significant event, we encourage you to READ HERE.

- Tapping Shares to Buy- Pro advice from the Oracle Warren Buffett is to always start with an industry or business that one understands. This gives an ease to decode if a company is weak or strong. The ASX would aid the investor to breakdown industry sectors and get a list of companies, to examine it individually or on a comparative basis. It should be noted that each sector of the market has its own benefits and risks:

Decoding some for ease- In Australia, the financial sector is known to offer steady income through high dividends, while the resources sector offers potential for high capital growth (though it is exposed to market dynamics). The consumer sector offers medium-sized dividends and tends to fluctuate.

Moreover, an investor should be aware of his expectation from investing- and ask himself- Do I want a regular income or just capital growth?

- Research- Research and compare is a powerful tool that an investor must use. Annual reports, earning and press releases, its prospectus and associated risks, the outlook provided, is the company in the red zone or green and what strategy would it follow- all these aspects should be thoroughly checked to keep one well informed about the players of the investing game.

- Comparison within the industry â Knowing the competitors worth is an efficient way to decode the companyâs value. This can be done by studying the parameters like the earnings per share (EPS), price earnings ratio (P/E), annual dividend yield, to name a few. This would help the investor to conclude (to some extent) if the share price one is looking at, is under or overvalued.

- Portfolio Diversification- Last but not the least, a way to protect oneâs investing portfolio is to diversify, which is rewarding when the investor spreads the investment between different industries to identify and mitigate risk and gain more exposure.

ASX Performance, Gainers and Decliners

The benchmark S&P/ASX 200 settled the dayâs trade in green after the close of the market on 11 October 2019, up by 0.9% or 59.7 basis points at 6,606.8.

The top three gainers of the day, where the investor sentiment built positive and possibly propelled the indexâs performance were:

- Silver Lake Resources Limited (ASX:SLR), a metals and mining player which quoted $1.035, up 12.5%.

- CYBG PLC (ASX:CYB) from the financial sector, which quoted $2.150, up 9.41%.

- Iluka Resources Limited (ASX:ILU), another metals and mining company which last quoted $8.020, up 5.8%.

The top three decliners included:

- Financial player Netwealth Group Limited (ASX:NWL), down 5.54% at $8.69.

- Materials company Nufarm Limited (ASX:NUF), down 4.14% at $6.48.

- Healthcare sector firm Clinuvel Pharmaceuticals Limited (ASX:CUV), down 4.06% at $36.800.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.