The Infrastructure of a country is referred to as the cornerstone of the quality of life of its people. The infrastructure lays the foundation for other economic aspects like employment, healthcare, education, insurance, etc. Access to the facilities, quality and cost of the facilities in an economic infrastructure are the aspects that matter the most to the people. More prominently, any infrastructure fails to instil all the above-mentioned aspects.

After zooming into the Australian infrastructural developments, the indicators reflecting the need for infrastructural development in Australia are apparent.

Australia is ranked third in the world on the UNâs Human Development Index. Australiaâs infrastructural needs across sectors and jurisdictions involve developing a national evidence base to guide infrastructure decision-making, and focus attention on the investments and reforms that will improve the standard of living as well as national productivity.

Challenges to Australian Infrastructure

Currently, Australia faces a diverse range of challenges to its infrastructural efficiency, such as vast distances, extreme weather, increasing maintenance backlogs, and rapidly growing cities.

With persistent challenges and substantial progress in the infrastructural investment from the public as well as private players, Australia ranks below the OECD average for infrastructure investment. However, the current infrastructural progress made in the various sectors demands further efforts to develop and augment the quality of life and economic efficiency.

According to Infrastructure Australia, an independent statutory body providing research and advice for infrastructure needs, new issues have emerged with time along with the ongoing challenges like,

- Population growth has furthered the road congestion, crowding on public transport and growing demands on social infrastructure, such as health, education and green space

- Energy affordability has also deteriorated with a steep rise in network costs has driven energy bills 35% higher over the past decade, and up by 56% per unit of electricity consumed in real terms

- In telecommunications, the NBN rollout continues to face challenges, with 4.8 million households activated but services have not met the expectations of many users

- In the water sector, many regional areas are suffering from growing water security fears as large parts of the country are in drought. However, many metropolitan utilities are increasing the sustainability and quality of their services through innovation, supporting the liveability of our cities

Infrastructure Australia Chair, Julieanne Alroe commented:

âProjects across Australia are getting larger and increasingly complex and will require new approaches if they are to be effectively deliveredâ

âSo-called mega projects â projects larger than $1 billion in value- are becoming the default, increasing the burden on the sector, and in some cases exceeding industry capacityâ

In addition to the above, Infrastructure Australia believes that the current inappropriate placement of the tools is coupled with the new infrastructure-related challenges in todayâs rapidly changing environment.

The changes taking place in the environment comprise of increasing interdependencies in social, economic and environmental contexts, further fuelling the complexity in planning, delivering and operating the infrastructure.

Economic Performance

Talking about numbers, the economy of Australia has endured 28 years of uninterrupted growth with an increase in the economy by 130% since 1991. The international trade forms 40% part of the Australian Economy.

The current real GDP of Australia is around $1.8 trillion, making Australia one of the 20 largest economies globally.

As per the estimate made by the Australian Government, future average annual growth in GDP is expected to slow down to an average of 2.8% per year over the next 40 years, compared to 3.1% over the past 40 years.

In a forecast by the International Monetary Fund, Australiaâs GDP is expected to grow at an average of 2.7% per year from 2019 to 2023, the highest for major advanced economies.

Australiaâs future economic performance is highly dependent on the instabilities on international political and economic conditions, along with the changes in Australiaâs own political, environmental and economic conditions. However, the ever- increasing networkability and globalisation of economic activity brings to the table opportunities as well as risks for the Australian economy.

As apparent from the ongoing international trade wars, economic power is believed to make a shift from the west to east, and from north to south, towards the Indo-Pacific region. Moreover, growth in the region is expected to grow by around 5.4% in 2019, with per-capita incomes remaining low.

An opportunity for the Australian economy here is to develop infrastructure that relates to the trade synergies with the countries in the Indo-Pacific region. Australia has an opportunity to capitalise on its proximity to the Indo-Pacific region as two-thirds of the worldâs middle class is expected to live in this region by 2030, concentrated in China and India.

Australiaâs proximity to Asia provides the opportunity for Australians to benefit from the growth in Asian consumers through large proximate markets.

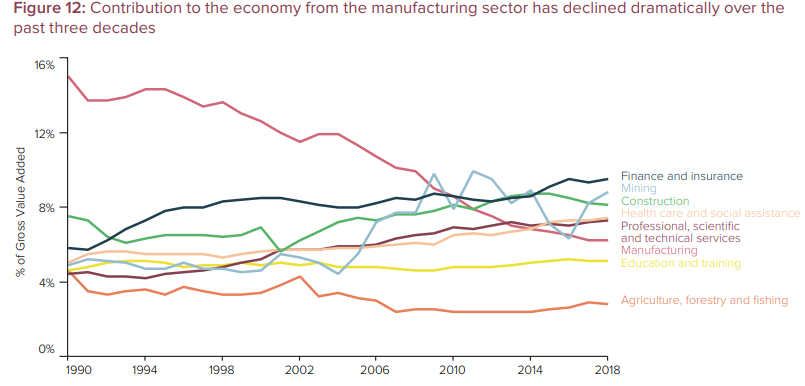

Over the past three decades, the Australian economy has shifted significantly from manufacturing to services, currently accounting for 72% of Australiaâs GDP. According to Infrastructure Australia, the contribution made by the financial and insurance services sector was of the most value to the economy during 2017â18.

Progress in Infrastructure

In the words of Infrastructure Australia Chair, Julieanne Alroe,

âMore than $123 billion of construction work has commenced since 2015, with a committed forward pipeline of over $200 billionâ

âHowever, there is much more to do to ease the pressures of growth, catalyse development and enable our businesses to compete on a global stageâ

Since the last Australian Infrastructure Audit in the year 2015, Australiaâs infrastructure has witnessed positive progress with a significant increase in the level of investment. Moreover, the governments across the board have initiated reforms which aimed at enhancing the performance of the infrastructure.

While the priorities of individuals may vary, the below mentioned significant and interconnected influences for the future Expectations of the infrastructure

- Quality of life and equity: Quality of life is high, but not everyone benefits equally

- Cost of living and incomes: Cost of living is rising for some people, while incomes have not grown substantially

- Community preferences and expectations: Communities are expecting more customised, real-time and interactive services and products from governments and businesses

- Economy and productivity: Economic growth is slowing, while our economy is transitioning towards service and knowledge-based future, which is increasingly located in our cities

- Population and participation: Population is growing and urbanising, and participation in the workforce is increasing for women and older people

- Technology and data: Technology is transforming the way we live, but not everyone benefits equally

- Environment and resilience: Environment is increasingly vulnerable to the effects of climate change, and our response to reducing emissions is falling behind international progress

With the growth and continuous changes in the environment, Infrastructure Australia believes that focus on continued productivity growth through improvements in efficiency and competition is imperative for balancing future advances in the quality of life and wellbeing. Moreover, the influences are also expected to form the basis for future infrastructure decision making.

The Australian government is already carried out significant developments in terms of infrastructural investments. The commitment of the governments to building infrastructure for providing a near term stimulation impact on the economy as well as laying the foundation for future economic and social development is unavoidable.

Highlights from the state wise allocation of funds for infrastructural development are given below:

- NSW ranked first, funding over $65.71 billion in general government infrastructure over the forward estimates, allocation to infrastructure increased by $16.06 billion over four years to FY2021-22, an increase of 32% compared to the 2017-18 Budget

- Victoria jumped to second place in the rankings this year, committing $33.65 billion to general government infrastructure funding, representing an increase of $806 million on last year

- Queensland moves to third place in rankings, with $29.11 billion of general government sector infrastructure funding committed over the forward estimates, which is an increase of $2.38 billion (9%) compared to last yearâs Budget

- Northern Territory committing to the highest level of infrastructure funding per capita over the forward estimates, with a marginal increase in real funding sees the share of GGE spent on infrastructure increase to 11.39% from 11.07%

- ACT holds infrastructure funding steady, with the $2.76 billion committed over the forward estimates broadly consistent with last yearâs Budget

- Over the forward estimates, South Australiaâs infrastructure funding projected to increase by $836 million

- Western Australia lags on infrastructure funding with this Budget continuing the declining trend with $1.14 billion decreases reflecting the Governmentâs fiscal constraints

Bottomline

The world is also rapidly changing, and at a faster rate than ever experienced in the past. These changes bring along potential opportunities to capitalize on them and further improve the living standard of the Australians. However, there are equal chances for exposure to challenges regarding how the government and authorities plan, deliver and operate the infrastructure.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.