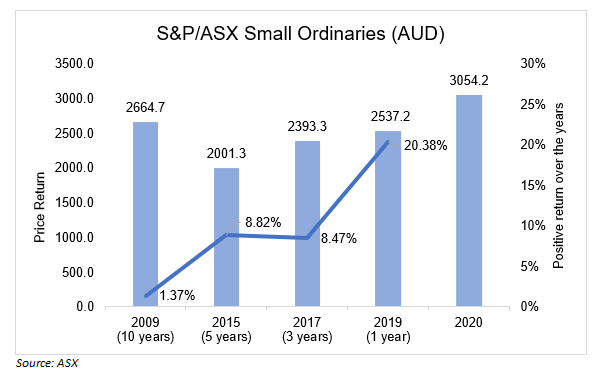

The Australian Stock Exchange has a separate index, S&P/ASX Small Ordinaries (AUD), this is utilised as a benchmark for tracking the performance of small-cap stocks. MSCI Australian Shares Small Cap Index also tracks small capital companies in Australia.

The S&P/ASX Small Ordinaries index has shown substantial growth with a 20.38% return in the last one year, 8.47% return in last three years, 8.82% return in the last five years, and 1.37% in the last ten years.

This consistent growth of the index motivates an investor to invest in small-cap stocks as they provide a higher rate of return compared to other stocks. Another reason for investing in small-size companies is the high growth potential which a small business operation possesses. Such companies are usually in the developmental stage of the business cycle and thus, have a significant amount of time to reach the maturity level. This makes it an excellent time to invest in small-cap companies.

Among the multiple sectors small-cap companies operate in, information technology is gaining huge attraction as the future lies in technologies such as artificial intelligence and machine learning which are incorporated by many small-cap companies in Australia. These technologies are used in almost every industry, be it healthcare, travel management or even human capital area (e.g., Gooroo Ventures Limited (ASX: GOO)).

Let us look at three ASX listed small-cap companies - ALC, AD8, SKO which are into the business sector of information technology.

Alcidion Group Limited (ASX:ALC)

An ASX-listed company, Alcidion Group Limited is engaged in licensing of healthcare software products and reselling selected products through tactical partners. The company was incorporated in 2011 and uses predictive analysis/algorithms to create products including Smartpage, Patientrack, Miya MEMRs and Miya Precision.

Alcidion has well-aligned technology in the business of healthcare sector with its products gaining momentum in today’s world of digitalization. In FY2019, the company recorded $16.9 million in revenue, with operational cash inflow of $2 million and a 98% improvement in EBITDA.

As per the company’s strategic plans, two different deals have been signed with companies. The company entered into an agreement, worth $1.9 million, on 27 December 2019 with Dartford and Gravesham NHS Trust for supervising medications in the UK. On 19 December 2019, Alcidion signed an agreement with Taunton and Somerset NHS Foundation Trust worth $500,000 for the improvement of patient care.

Stock Performance

On 17 January 2020, the stock of ALC was trading at $0.200 (at 03:04 AEDT), an increase of 2.564% compared to the previous closing price. The company has outstanding shares of around 990.69 million and a market capitalisation of nearly $193.19 million. The 52 weeks low and high price of the stock is $0.038 and $0.305, respectively. The stock has delivered a positive return of 12.5%and 309.09% in the last six months and last one year, respectively.

Audinate Group Limited (ASX:AD8)

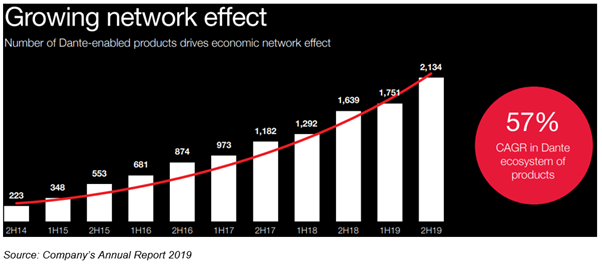

An ASX-listed digital media company, Audinate Group Limited is in the business of distributing digital video and audio signals over computer networks. The company’s product list comprises Dante devices, software, manufacturers products and Dante-enabled products (over 1,600). Audinate was founded in 2003.

In FY2019, the company’s revenue grew 44% with an EBITDA improvement of $2.8 million. Operating cash flows increased from $ 1 million (FY2018) to $ 3.6 million (FY2019). In mid-2019, AD8 raised an additional capital of $24 million via private placement and share purchase plan.

Stock Performance

On 17 January 2020, the stock of Ad8 was trading at $8.640 (at 03:04 AEDT), a decline of 2.373% compared to the previous closing price. The company has outstanding shares of around 67.8 million and a market capitalisation of nearly $600.01 million. The 52 weeks low and high price of the stock is $3.570 and $9.300, respectively. The stock has delivered a positive return of 12.31%and 141.80% in the last six months and last one year, respectively.

Serko Limited (ASX:SKO)

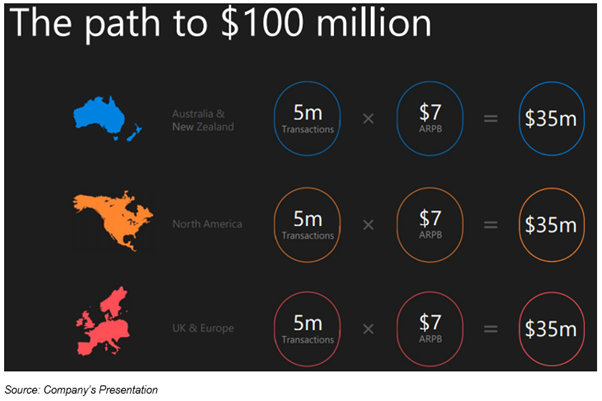

Serko Limited is a company which leverages technology into the business of corporate travel management. Serko’s technology is used by ~6000 travel management companies and corporate organizations across 35 countries worldwide. The company has developed a travel interface, Zeno for companies to have access to ground and air transport with hotel booking in an effective manner. SKO is headquartered in New Zealand and has operating offices in Australia, China, India and the United States.

In FY2019, the company witnessed a growth of 28% in operating revenue ($23.4 million) with a PAT of $1.6 million and total income of $24.6 million, an increase of 28%. The booking transactions increased by 17% in FY2019.

For FY2020, the company plans to grow its customer base with Zeno and even retain more customers. Moreover, it aims to extend the marketplace framework by including new categories in travel spend. Serko further commits to continue working on the creation of innovative products by using technology.

Stock Performance

On 17 January 2020, the stock of SKO was trading at $5.150 (at 03:04 AEDT), an increase of 1.179% compared to the previous closing price. The company has outstanding shares of around 92.09 million and a market capitalisation of nearly $468.72 million. The 52 weeks low and high price of the stock is $2.720 and $5.200, respectively. The stock has delivered a positive return of 29.52%and 84.42% in the last six months and last one year, respectively.