Lithium Market investors are in a dilemma, as they are caught between the oversupplied market conditions and the global lithium outlook. ASX-listed lithium miners have already felt the pressure of low lithium component prices in the global market.

However, the Australian lithium industry is adapting towards the rapid change, and few lithium miners have recently decided to limit production to match the customers' demand.

Despite oversupplied conditions, many industry experts are bullish on the lithium market over the upcoming high demand estimation of lithium-ion batteries to meet the EV demand.

Also Read: Lithium Demand Plays Spoilsport; Alita, Galaxy and Pilbara Limits Production

Why is the market still positive on lithium?

- Estimated increase in demand for plug-in vehicles (or EVs)

- Growing demand for smart devices and other industrial goods

- High requirement of lithium-ion batteries for industrial applications

- Global transformation towards zero-emission

- Rising demand for an efficient energy storage system (ESS)

- Government initiatives to promote EV sales and for job creation

As per the industry experts and independent analyst consensus, the lithium-ion battery market is anticipated to grow from over US$37 billion to over US$92 billion by 2024, which in turn, underpins a compounded annual growth rate (CAGR) of more than 16 per cent from 2018 to 2024.

With the industry estimation of over 16 per cent compounded growth and above-mentioned reasons, the market remains bullish on the lithium growth despite the supply glut.

Automotive Sector and Lithium:

The automotive segment dominates the demand for lithium ion-based batteries, in particular, the electric vehicles require high energy density, which in turn, provides a boost to the lithium and other base metals batteries.

High energy density requirement of the electric vehicles provide an impetus for lithium nickel manganese oxide (or Li-NMC) and for the other lithium-based battery chemistries.

However, the safety issues related to storage and transportation of spent batteries remain a potential risk for the growth and the measure adopted by various governments should be monitored closely to reckon the future demand.

Government Initiatives:

The government across the globe are adopting rapid measures to address global emission issues. China, in particular, favoured the EV penetration by providing higher subsidies to the industry; however, in the status quo, the subsidiary on an electric vehicle has been reduced drastically.

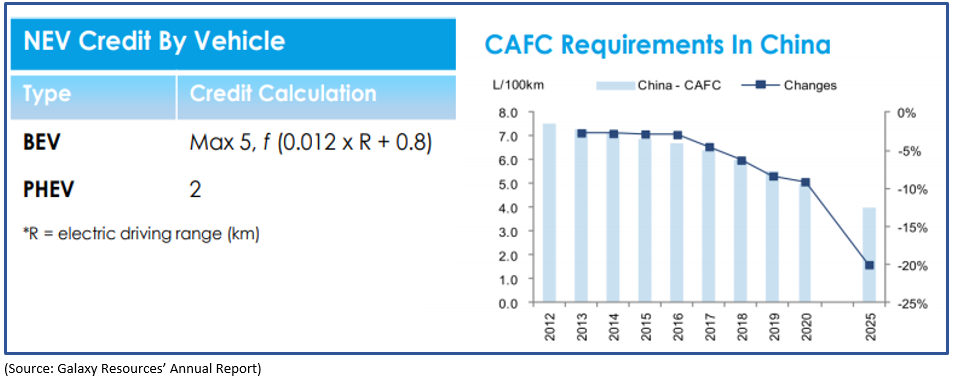

But, the NEV Credit Scheme in China is live now, and as per the data, an original equipment manufacturer producing 1M vehicles will need 100k NEV credits (or 10 per cent) in 2019, which would be further increased to 12 per cent in 2020.

The NEV Credit Scheme in China combined with the Corporate Average Fuel Consumption (CAFC) scheme, could encourage more NEV production and sales.

Apart from that, major cities in China are applying license plate restrictions to promote NEV sales as the NEV plates in these major cities are cheaper and much easy to obtain.

The NEV credit calculation formula and the CAFC requirements are as below:

Likewise, various government across the globe took different initiatives to promote electric vehicle sales to reduce the carbon emission in accordance with the Euro 6 emission standards.

McGowan Ministry and the Battery Industry:

In February 2019, the McGowan government delivered on the election promise after it launched the Western Australian Future Battery Industry Strategy to grow Western Australia into a world-leading exporting hub of future battery minerals, materials and technologies.

The McGowan government targeted jobs, diversification and skills development to benefit the local people by utilising the increased demand for electric vehicles and ESS (Energy Storage System), which also created an opportunity for WA to become a central player in the global lithium-based battery value chain.

WA Future Battery Industry Strategy:

- The McGowan Governmentâs Future Battery Industry Ministerial taskforce started engagement with different stakeholders of the lithium market such as research organisation, Government, industry players etc.

- First initiative of the strategy is to develop and strengthen relationships with investors and global battery and EV manufacturers.

- McGowan government would enable the setup of new battery projects through the approvals process.

- The Government would explore the opportunities to increase the acceptance of batteries both at the state and in the global market.

- The McGowan government would commit six million dollars once it succeeds to host the Future Battery Industries Cooperative Research Centre in Perth.

While the Government are promoting electric vehicles and lithium-based materials, technologies, etc., the Australian, as well as the global lithium players such as the Chilean giant-SQM and U.S- based mammoth Albemarle are also bullish on the lithium market.

Despite recording losses in the previous quarters, SQM is still ramping up the production as the lithium chemical giant remains committed to the industry and its future demand forecast.

To Know More, Do Read: Chile And SQM Leap To Regain The Market Share Posses Headwinds For Australian Lithium Miners Ahead

Challenges for the Lithium Demand Forecast:

While the lithium market is anticipated to show a bull run over the coming years amid high EV and Gigafactory penetration, there are certain challenges for the lithium industries are taking root in the international market.

- The U.S-China trade war is at the top place when it comes to risk for the lithium industry.

- The development of the polymer and graphene-based battery technology also possess a substantial risk for the lithium industry.

The ongoing U.S-China trade war affected the demand for lithium-based chemicals in China, which in turn, prompted the lithium chemical manufactures to defer their shipments of lithium components from Australia.

Not just the lithium chemicals, the overall EV sales also took a minor hit amidst the U.S-China trade war. As per the United States officials, the U.S-China trade war could take years to resolve, which in turn, possess headwinds for the global economic conditions, and in a loop, contains potential risks for the worldwide lithium and lithium components market.

Apart from the U.S-China trade war, the development of polymer and graphene-based batteries contains a substantial risk for the lithium industry.

To Know More, Do Read: Would The Australian Lithium Industry Survive The Battery Technology Wave?

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.