Post closure of the trading session on 23 August 2019, the S&P/ASX 200 Information Technology Sector closed at 1,319.5, down by 0.5% against the S&P/ASX 200 which closed at 6,523.1, up by 0.33%.

In this article, we would look at 5 IT stocks, with their recent updates and the influence of the index on their stock price.

Computershare Limited

Computershare Limited (ASX:CPU), a global market leader in transfer agency and share registration, proxy solicitation, employee equity plans as well as stakeholder communications, released its preliminary final report for the period ended 30 June 2019 on 14 August 2019.

The company during FY2019 reported an increase in the revenue by 4.8% to $2,411.4 million, EBITDA by 10.2% to $685.9 million, EPS by 12.8% to 71.46 cents and statutory EPS by 38.8% to 76.57 cents. The company declared a dividend of A$ 23 cents per share.

During the period, Equatex, which was acquired by CPU in 2018 and is the leading European employee share plan administration business, performed better than expected and gave a satisfactory contribution towards the Employee Share Plansâ second half of FY2019. The performance of the US Mortgage Services gave a better result in 2H FY2019 with a margin of 20% PBT towards the end of the year. UPB was above $100 billion with scope to further scale to ~$150 billion UPB. The UK Mortgage Services experienced a delay in the migrating loans to CPUâs platform as well as the fall in the fixed fee revenue, which might impact the Management EPS for FY2020. CPU is under the process of restructuring in order to improve the profitability.

The Register Maintenance business of the company delivered an outstanding result during the period supported by revenue growth and margin expansion in spite weaker corporate action. There was an increase in the margin income by $71.2 million to $251 million.

The balance sheet of the company remained strong, and the leverage ratio was below the mid-point of the target range. CPU declared a market share buy-back in its report, of A$200m.

Outlook:

The company expects a fall in the Management EPS by ~5%. The guidance would also have an adverse impact due to delay of platform migration advantages for UK Mortgage Services and the IFRS16 accounting. However, other than these two elements, CPU expects a 5% growth in Management EPS.

Stock Performance:

By the end of the trading session on 23 August 2019, the closing price of the share was A$15.070, up by 0.87% as compared to its previous closing price. CPU has a market cap of A$8.11 billion and traded with almost 542.96 million outstanding stocks. The annual dividend yield is 2.95% and the PE ratio of 13.68x. The CPU stock has yielded a YTD return of -12.12%.

Link Administration Holdings Limited

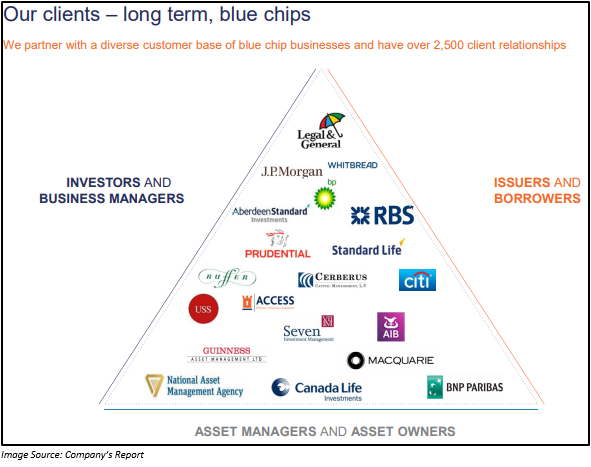

Link Administration Holdings Limited (ASX:LNK), the largest provider of services in superannuation fund administration industry of Australia, signed a new administration contract on 21 August 2019 with Retail Employees Superannuation Pty Limited, which would be effective from 1 September 2019. Retail Employees Superannuation Pty Limited is one of the largest industry superannuation funds in Australia with ~ 1.9 million members, ~ 190k employers and more than $57 billion FUM (funds under management).

As per the new agreement which is for a period of 3 years and 8 months, LNK would provide its market-leading superannuation administration and member engagement services to Retail Employees Superannuation Pty Limited. The contract would also support Retail Employees Superannuation Pty Limited in the development of new products and service, to promote sustainable performance and service excellence to its members. There is also an option for further extension of the contract duration for consecutive 12 months.

Key Terms of the Contract:

- There would be a fixed core fee along with the variable based fees for the engagement services along with further charges in the form of transactional fees and fee for service for additional services.

- Agreed performance standards with a risk / reward service relating to the performance.

- The contract may terminate in case of a material breach.

Stock Performance:

By the end of the trading session on 23 August 2019, the closing price of the share was A$4.910, down by 0.20% as compared to its previous closing price. LNK has a market capitalisation of A$2.63 billion with approximately 533.95 million outstanding shares. The annual dividend yield is 4.37% and a PE ratio of 9.75x. The shares of LNK have given a negative YTD return of 26.57%.

Altium Limited

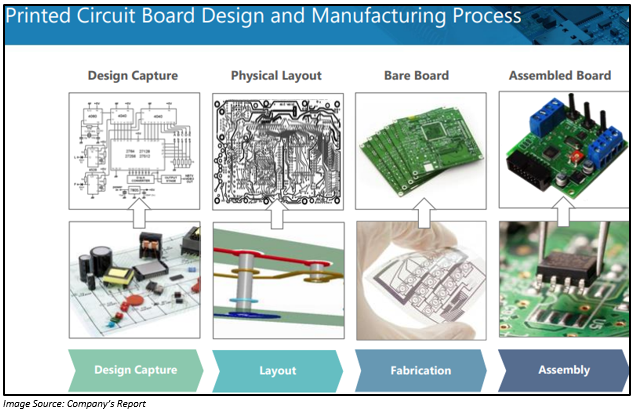

On 19 August 2019, Altium Limited (ASX: ALU), the electronic design software company released its final, audited results for the FY2019.

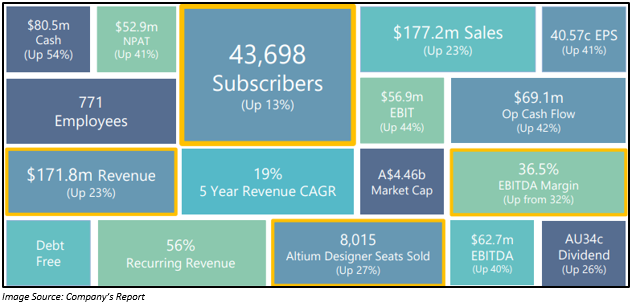

The company during FY2019 witnessed outstanding growth in its revenue across all business units and vital regions by 23% to US$171.8 million. The profit margins expanded to record levels with a growth of 41% in NPAT to US$52.9 million and EPS by 41%.

The company reported a strong revenue from China with a growth of 37%. The US and the EMEA region delivered revenue growth of 14% and 20%, respectively. There was an increase in the Board and Systems revenue by 17% to US$126.8 million. Octopart performed well with a revenue growth of 49% and TASKING reported 37%. The EBITDA margin was up from 32% to 36.5%. EPS increased by 41% to 40.57 cents. There was a substantial increase in the cash inflow from the operating activities by 42% to US$69.1 million. ALU declared a final dividend of A$18 cpc, up by 26% as compared to pcp, which would be paid on 25 September 2019.

Stock Performance:

Post the trading session on 23 August 2019, the closing price of the share was A$36.170, up by 0.19 % as compared to its previous closing price. ALU has a market cap of A$4.71 billion with almost 130.51 million outstanding shares. The annual dividend yield is 0.94% and a PE ratio of 62.40x. The shares of ALU have given a good YTD return of 67.05%.

WiseTech Global Limited

The supplier of the software solutions catering to the logistics industry, WiseTech Global Limited (ASX: WTC), reported strong growth in FY2019. It released its FY2019 report on 21 August 2019, the influence of which was seen in the stock price as well as the market cap which exceeded $1 billion on that particular day.

Letâs look at the financial highlights:

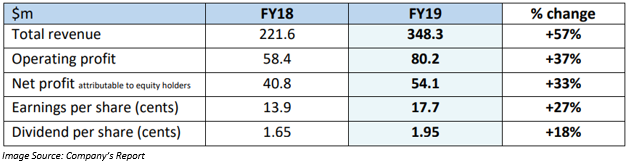

- There was an increase in the total revenue by more than 57% in FY2019 to $348.3 million as compared to pcp.

- The operating profit during the year increased by 37% to $80.2 million.

- The NPAT was up from $40.8 million in FY2018 to $54.1 in FY2019.

- EPS went up by 27% to 17.7 cents.

- Dividend for FY2019 increased by 18% to 1.95 cents.

Stock Performance:

Post the trading session on 23 August 2019, the closing price of the share was A$33.250, up by 1.09% as compared to its previous closing price. WTC has a market cap of A$10.47 billion with almost 318.18 million outstanding shares. The WTC stock has generated a good YTD return of 93.13%.

Praemium Limited

Praemium Limited (ASX:PPS), the provider of portfolio administration services on 12 August 2019 released its FY2019 results.

In FY2019, PPS delivered a 25% growth in the platform Funds Under Administration to $9.5 billion. As a result of the expansion of the VMA Administration Service, the total FUA increased by 108% to $16.1 billion. VMA stands for virtually managed accounts, which helps the advisers to manage the off-platform assets of clients directly with the ASX in a HIN-based structure. It provides full administration such as Mail processing, Account reconciliation, Corporate action elections and processing, Billing and fee generation, Quarterly reporting, Annual tax statements,

Optional year-end SMSF accounting, audit and lodgment.

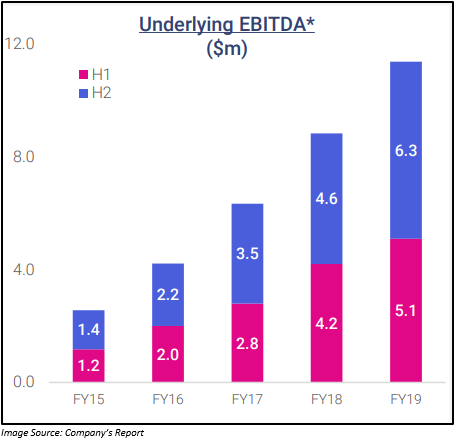

The revenue and other income increased by 5% to $45.1 million on pcp. The underlying EBITDA increased by 29% to $11.4 million on pcp. There was 80% growth in the NPAT to $2.5 million.

Activities:

During February 2019, the company released its next generation Integrated Managed Accounts platform to the market which can provide its advisers and wealth managers and has the potential to build the full breadth of managed accounts solutions for customers using a seamless digital platform.

To support the launch of this new platform, the company initiated a marketing campaign with a brand re-fresh and new website. Post the campaign, Praemium was the only investment platform that was selected as a finalist for Financial Standardâs MAX Marketing Campaign of the Year Award.

On a global scale, the Praemiumâs UK SIPP grew to more than 1000 members, which represents a growth of 350% after acquiring the business in October 2016.

Stock Performance:

Post the trading session on 23 August 2019, the closing price of the share was A$0.490, down by 2% as compared to its previous closing price. PPS has a market capitalisation of A$202.64 million with approximately 405.29 million outstanding shares, and a PE ratio of 79.37x. The shares of PPS have given a negative YTD return of 24.24%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.