August has maintained its stance of being the most anticipated month for the Australian stock market enthusiasts. The ASX-listed companies have been releasing their earnings report, depicting the businessâ performances and providing the outlook and overlay of the events to watch out for.

On the similar lines, three stocks would be discussed in this article, which have maintained the reporting season momentum buzz on:

Computershare Limited

Company Profile: With its approach based on three long-held attributes of certainty, ingenuity and advantage, Computershare Limited (ASX: CPU) offers specialist computer bureau services of compliance, audit, risk, financial crime, disaster recovery and business continuity planning programs to Australian share registrars. The company is spread out in 21 countries, reaching out to approximately 16,000 clients. CPU is amongst Melbourneâs first start-up technology companies and was listed on the ASX in 1994. In 2018, the company acquired Equatex, a European employee share plan administration business.

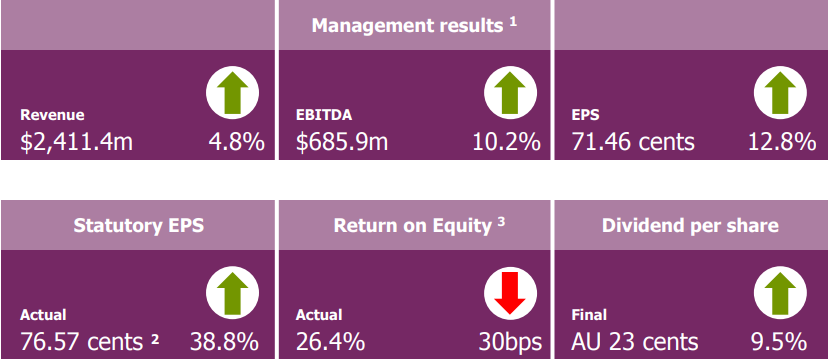

FY19 Results: On 14 August 2019, CPU released its FY19 results, posting a strong performance with Management EPS up by 12.8% in constant currency terms. The group EBITDA margins were up by 130 basis points to 28.4% whereas the ROE surpassed 26%. The recently acquired Equatex was a boon for CPU this year making a pleasing contribution (revenue growth up by 29.6%, EBITDA growth up by 31.6%) to the ESPâs second half results and the integration remains well underway, with a $30 million synergy benefit target affirmed. The Mortgage and Issuer services posted strong results too.

CPU Results (Source: CPU Report)

The Balance Sheet had a leverage ratio below mid-point of target range of 1.75x-2.25x. Along with the results, the company announced a new on market share buy-back worth A$200 million and an AU 23 cent per share final dividend, up by 9.5%. As outlook, CPU expects the Management EPS to be down by approximately 5%, driven by the delay of platform migration benefits for UK Mortgage Services and the adoption of IFRS16 accounting for leases. Apart from these two adverse factors, the FY20 Management EPS would be up by almost 5%. The margin income revenue is expected to remain similar to FY19. The Group tax rate would likely be ~27% in FY20 compared to 26.5% in FY19.

Stock Performance and Returns: At the time of writing on 15 August 2019 at 12:19 PM AEST, the stock was quoting A$14.535, trading down by 3.933%. The market capitalisation of the company is A$8.21 billion and there are approximately 542 million outstanding shares. With an annual dividend yield of 2.91%, the stock has generated negative returns of 14.71% and 18.96% in the last three and six months, respectively. Its YTD return is a negative 11.00%.

Caltex Australia Limited

Company Profile: Owner of StarCard, which was the number one fuel card for small businesses in Australia for 2019 as accoladed by Canstar Blue, Caltex Australia Limited (ASX:CTX) is the countryâs largest transport fuel supplier. The company has been in media coverage lately due to its new convenience hub, The Foodary and its app, which provides fresh and healthy food across the country. The companyâs payment option FuelPay® allow users to pay for fuel without the hassle of store queues. Listed on the ASX in 1980, CTX is headquartered in Sydney.

Commencement of CEO Transition: On 14 August 2019, the company informed that Mr Julian Segal, CTXâs Managing Director and CEO would retire from his post after a decade of leading the company, as soon as a formal search and transition process concludes. Mr Julian would extend his support in the hunt and transition process to ensure a hassle-free handover of responsibilities to the next CEO.

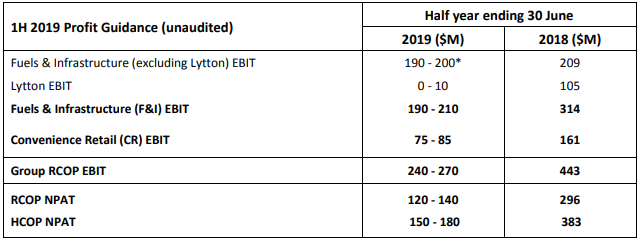

Market enthusiasts are awaiting two events to unfold in the near future - the arrival of a new CEO and the companyâs 2019 half year results which is due to arrive on 27 August 2019. Below is the profit guidance that the company had provided on 20 June 2019 for 1H19:

1H19 Guidance (Source: CTXâs Report)

New Substantial Holder: On 1 August 2019, the company notified that it has a new substantial shareholder in its kitty. State Street Corporation had become a substantial shareholder in the company with 12,634,363 securities, representing a 5.06% voting power.

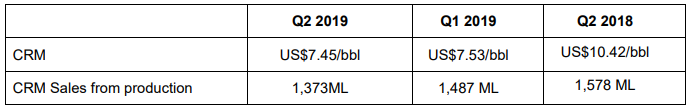

The Caltex Refiner Margin: On 23 July 2019, the company notified that the Q2 2019 CRM was US$7.45/bbl, below the Q1 2019 CRM of US$7.53/bbl.

Latest CRM Update (Source: CTXâs Report)

Stock Performance and Returns: At the time of writing on 15 August 2019 at 12:25 PM AEST, the CTX stock was quoting A$25.860, trading down by 3.327%. The market capitalisation of the company is A$6.6 billion and approximately 249.7 million outstanding shares. With an annual dividend yield of 4.41%, the stock has generated returns of 4.94% and 3.96 in the last one and three months, respectively. Its YTD return is 6.28%.

GBST Holdings Limited

Company Profile: Focussed on the evolution of FinTech since 1983, GBST Holdings Limited (ASX: GBT) creates specialist technology solutions for businesses. The company offers broking and wealth management along with solutions (related to calculators, tools and GBST digital) to its clients. The company caters to the brands associated with capital markets and wealth management across the globe and was listed on the ASX in 2005. It has its registered office in Brisbane.

FY19 Results: On 14 August 2019, GBT released its results for FY19, stating that the Total revenue and other income was $94.3 million, up by 7% from the corresponding year-ago period. The Operating EBITDA was $19 million, surging up by 52% from FY18. The NPAT was spectacularly up by 103% year over year at $12.7 million and the adoption of AASB15 had resulted in $1.2 million of the NPAT. The company was debt free at the end of FY19 and had $17.9 million cash in hand.

GBT FY19 Results (Source: GBTâs Report)

The Strategic R&D program made significant progress in the year, and E-VOLVE was on track with clients, 34% complete with clients using delivered components or in the process of upgrading. An icing on the cake in the year was the signing of a 10-year deal with Canada Life, which expanded GBTâs market opportunity in annuities and bonds.

The company notified that as there were significant investments required in Strategic research and development, no dividend would be declared for FY19.

Stock Performance and Returns: At the time of writing on 15 August 2019 at 12:29 PM AEST, the GBT stock was quoting A$3.850, trading up by 0.26%. The market capitalisation of the company is A$260.78 million and approximately 68 million outstanding shares. With an annual dividend yield of 0.65%, the stock has generated returns of 7.89% and 46.18% in the last one and three months, respectively. Its YTD return is 147.10%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.