Factors to consider while Investing in Technology Stocks

While choosing a stock to invest in, an investor will first of all look for the financial position of the company in terms of revenue generated, profits earned, the companyâs balance sheet position with a focus on key items including cash and debt component and the major steps taken to drive future earnings. Development may take the shape of acquisitions to widen the scope of offerings, increase customer base & geographical expansion, that can improve operational as well as financial performance through synergies. Development can also involve continued advancement in technologies being offered to cope up with the rapid changes in trends and long-term sustainability in the competitive environment. Investor usually look for companies that have a strong growth trajectory with steady stream of growth from new and innovative products.

Although, the financial trajectory of the business may look like the most important factor contributing to an investing decision, investors do need to keep a track on the rapid technological changes that can completely change their perspective about the business despite a strong financial profile. The technology sector is characterised by robust competition on account of innovation that leads to rapid cycle of obsolescence. To keep pace with changes on the technology space, both businesses and investors should keep an eye on what dominates the market and look forward to innovation that will automatically generate better financial outcomes.

Bravura Solutions Limited

Bravura Solutions Limited (ASX: BVS) is engaged in development, licensing and maintenance of highly specialised administration and management software applications for the wealth management and fund administration sectors.

Dividend: On 27 September 2019, the company paid a dividend amounting to A$ 0.0480 per ordinary share, with full-year dividends representing 70% of NPAT in FY19.

FY19 Financial Highlights:

- During the 12 months to 30 June 2019, Bravura recorded a revenue growth of 16% to A$257.7 million.

- EBITDA for the year amounted to A$49.1 million, representing an increase of 27% on prior corresponding period EBITDA of A$38.6 million.

- Group NPAT stood at A$32.8 million, rising 21% in comparison to pcp NPAT of A$27.0 million.

- Earnings per share for the year amounted to 15.0 cents per share, up 19% on previous year.

- The period saw robust growth across the Bravura product suite, with strong revenue growth from Sonata that dominates the Wealth Management segment of Bravura.

Wealth Management Segment Performance: During the year, revenue for the wealth management segment amounted to A$176.8 million, up 14% in comparison to pcp revenue of A$155.1 million. EBITDA for the segment stood at A$53.9 million, representing an increase of 17% on EBITDA of A$46.2 million in prior corresponding year.

Fund Administration Segment Performance: Revenue for the fund administration segment was amounted to A$80.9 million, up 22% relative to pcp while the EBITDA for the segment stood at A$32.3 million, up 21% on pcp. Renewal of a contract with a significant global client acted as a key contributor towards growth in the segment.

FY20 Guidance & Outlook: The company expects NPAT for FY20 to witness growth in the mid-teens while revenue growth would be supported by strong recurring revenue and new sales opportunities. Going forward, the company is eyeing continued long-term demand from the client base across the Bravura product suite.

The BVS stock has delivered negative returns of 17.86% and 16.09% for the last 1 month and 3 months, respectively. The stock closed trading on 4 October 2019b at A$3.870, down 1.023% and has a market capitalisation of A$952.52 million.

IRESS Limited

IRESS Limited (ASX: IRE) provides software to the financial services industry.

Change in Directorâs Interest: The company recently updated that Jennifer Anne Seabrook, one of the directors, acquired 543 ordinary shares for a total consideration of $6,559.44.

Dividend: The company paid a dividend amounting to AUD 0.1600 per ordinary share, on 27 September 2019.

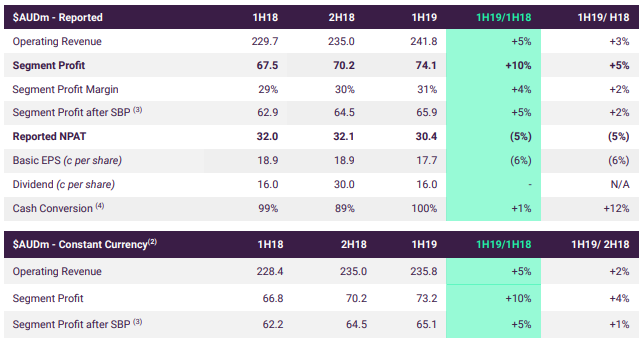

1H19 Highlights:

- During the half year ended 30 June 2019, group revenue amounted to $241.8 million, up 5% on prior corresponding period and 3% on the second half of FY18.

- Group segment profit witnessed an increase of 10% on prior corresponding period, at $74.1 million.

- Reported NPAT for the six months period amounted to $30.4 million, down 5% on prior corresponding period, including the impact of new leasing standard and QuantHouse acquisition.

- Excluding the above two aspects, NPAT for the period increased by 2% on pcp.

- During the period, the company witnessed continued demand in both the UK and Australian markets.

- The period was also marked by successful deliveries to large clients in UK, South Africa and Australia.

1H19 Financial Summary (Source: Company Reports)

Operating revenue from the UK & Europe segment reported the highest increase of 10% followed by South Africa reporting a 6% increase in operating revenue. North America witnessed an increase of 3% in revenue. While growth in North America was driven by stable recurring revenue and a positive revenue contribution from QuantHouse acquisition, South Africaâs revenue was driven by successful client deployments, revenue from investment in trading software and ongoing demand for software.

The stock of the company generated negative returns of 8.31% and 20.70% over a time frame of 1 month and 3 months, respectively. On 4 October 2019, the IRE stock closed trading at A$11.130.

Hansen Technologies Limited

Hansen Technologies Limited (ASX: HSN) is engaged in development and integration as well as providing services for billing systems software across utilities, energy, pay-TV and telecommunications sectors.

Change in Directorâs Interest: As per a recent announcement, David Trude, one of the directors of the company, acquired 920 ordinary shares for a consideration of $3,063.

Multi-year Contract with Elenia: In another recent update, the company notified about a contract signed with Finland based Elenia involving the implementation of meter data management product for the Nordic energy market.

Dividend: On 26 September 2019, the company paid a dividend amounting to AUD 0.0300 per ordinary share.

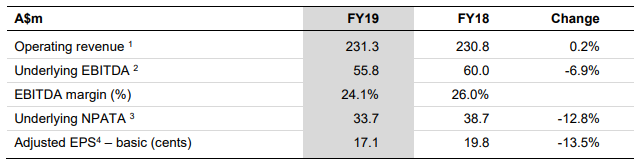

FY19 Results: During the year ended 30 June 2019, the company generated operating revenue amounting to $231.3 million, up 0.2% on prior corresponding period revenue of $230.8 million. Underlying EBITDA for the year stood at $55.8 million, down 6.9% on prior corresponding period EBITDA of $60.0 million. Underlying NPATA stood at $33.7 million, that went down on pcp value of $38.7 million.

Financial Highlights (Source: Company Reports)

The period was marked by a significant milestone in the form of acquisition of Toronto based Sigma Systems, that significantly increase the companyâs scale and expertise in the communications sector. Various new contracts were also signed in Australia, Sweden and Finland with 8 client upgrades to the US municipalities billing systemâs new version.

FY20 Guidance: The company entered FY20 with great momentum with the acquisition of Sigma providing entry into new markets of India and Hong Kong. Operating revenue for FY20 is anticipated to be in the range of $305 million - $310 million. EBITDA for the year is expected to be between $70 million and $76 million.

The stock of the company generated returns of 20.68% over a period of 6 months and has a market capitalisation of A$703.69 million. On 4 October 2019, HSN closed trading at A$ 3.540, down 0.562%.

Over the Wire Holdings Limited

Over the Wire Holdings Limited (ASX: OTW) is a provider of telecommunications, cloud-based and IT solutions to clients.

Dividend: The company will pay a dividend amounting to AUD 0.0200 per ordinary share on 10 October 2019.

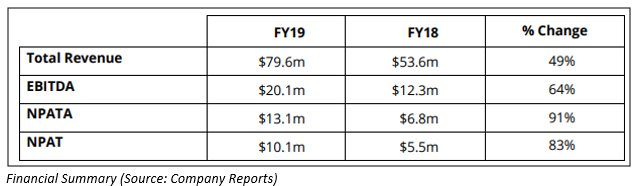

- During the year ended 30 June 2019, the company generated revenue amounting to $79.6 million, up 49% on prior corresponding period.

- EBITDA for the period stood at $20.1 million, up 64% on prior corresponding year.

- During the year, the company reported NPAT of $10.1 million, up 83% on FY18. During the year,

- Cloud/managed services segment reported a remarkable growth of 217% in total revenue.

- On the geographical front, strong growth was achieved across all states with Queensland being the leader in terms of organic growth at 17%.

- Total dividend: 3.25 cents per share.

The stock of the company generated returns of 16.47% over a period of 1 month and has a market capitalisation of A$251.82 million. On 4 October 2019, the OTW stock closed trading at A$ 4.780, down 2.049%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.