ASX-listed companies have been the centre of interest for Australian and overseas investors, media and market experts. The earnings results, outlooks and vital announcements have been an everyday activity in August 2019.

In this article, we have custom-selected three diversified stocks - communication services, consumer discretionary and industrials, to ease investors in making investment decisions as per their respective preference. Let us dig right in!

Seven West Media Limited

Company Profile: Creator of premium entertainment, news and lifestyle content for local and international audiences, Seven West Media Limited (ASX: SWM) is Australiaâs largest producer of premium television. According to the company, each month, around 19 million Australians turn towards SWMâs offerings. The company has a three strategic pillar for long-term growth- Focus on the Core, Transform the Operating Model and Grow new Revenue Streams. SWM was listed on the ASX on 1992 and has its registered office in Osborne Park.

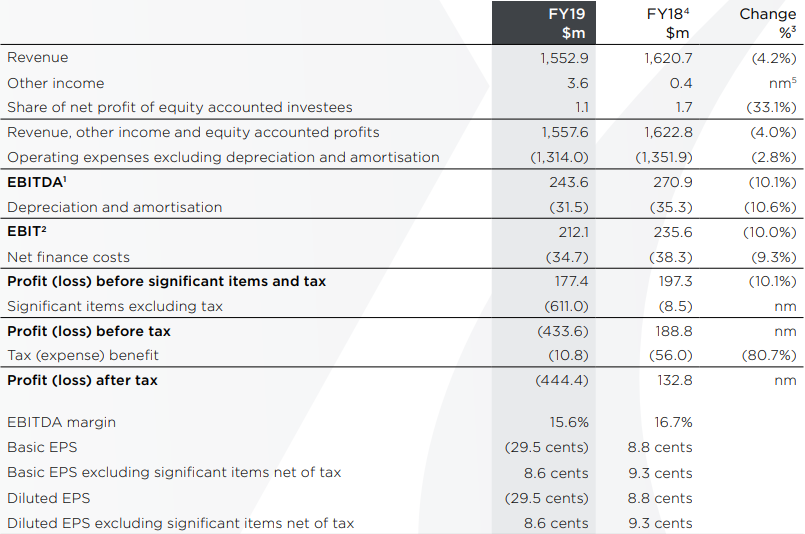

FY19 Results: On 20 August 2019, SWM released its Year End Results for the financial year ended 29 June 2019, stating that it recorded Total significant items of $573.7 million, net of tax. SWM marked its 13th consecutive year of ratings leadership, with 40.3 per cent commercial ratings share for FY19. Despite a soft ad market scenario in FY19, the Metro TV revenue share grew 0.7 per cent pts to 38.8 per cent. Cost discipline delivered was $38 million and the Underlying Group EBIT was at $212.1 million, down by 7.5 per cent on a YoY basis. Group net debt slipped down to $564 million, with debt facilities refinanced to 2021/2022. SWM recorded a revenue including share of equity, that accounted investees profits of $1,557.6 million, down by 4 per cent on pcp.

SWMâs Financial Highlights (Source: SWMâs Report)

The highlight of the report was the companyâs stance on being the number one in the key advertising demographic of people in the age bracket of 25 to 54 throughout the day. The company was successful in receiving New commissions from Netflix and Facebook. 7NEWS.com.au was launched in the year, and was an instant hit, ranking as the number 5 News site within 90 days of its launch.

On the outlook front, the company is expecting its FY20 EBIT to range between $190 and $200 million, inclusive of the impact of new accounting standard AASB 16. Moreover, the BVOD market was likely to grow over 25 per cent. The company is prepping for Tokyo 2020, anticipated to be the most-watched Olympic Games ever and perhaps the biggest digital event in Australiaâs history.

Stock Performance and Returns: After the close of business on 23 August 2019, SWMâs stock was valued at A$0.385, up by 2.667 per cent, with a market cap of A$565.51 million and ~1.51 billion outstanding shares. The YTD return of the stock is negative 29.25 per cent. In the last one, three and six months, it has delivered returns of -12.79 per cent, -29.25 per cent and -30.56 per cent, respectively.

SkyCity Entertainment Group Limited

Company Profile: A premiere entertainment destination and dually-listed on the ASX and NZX, SkyCity Entertainment Group Limited (ASX:SKC) offers casino and latest gaming machines. Also, SKC is New Zealand regionâs biggest tourism, leisure and entertainment entity. It is amongst the three major publicly listed casino operators in Australasia and offers premium restaurants, bars and conference facilities along with the gaming services. The company was listed on the ASX in 1999 and has its registered office in Auckland.

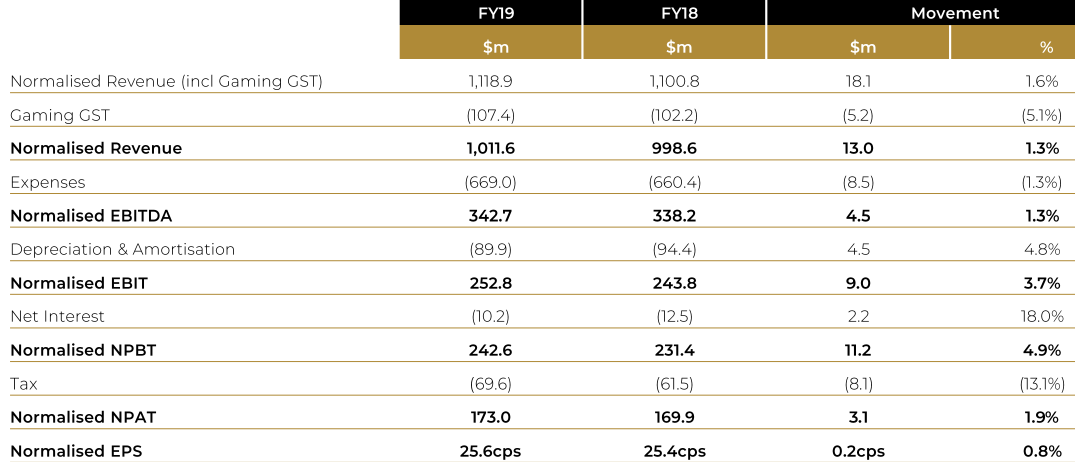

FY19 Results: On 14 August 2019, SKC unveiled its Group results for the year ended 30 June 2019. Compared to pcp, the Reported EBITDA was down 3.9 per cent to $297.8 million and reported NPAT was down by 14.7 per cent to $144.6 million, catalysed by the lower win rate in International Business (turnover being $14.1 billion) and other significant items. However, combating a challenging environment, Normalised EBITDA was up by 1.3% to $342.7 million, and normalised NPAT was up by 1.9% to $173.0 million.

The below image provides the EBITDA details:

Normalised EBITDA (Source: SKCâs Report)

During the year, the company delivered Net asset sale proceeds of $450 million. Along with these results, SKC declared a dividend of $0.10 to be paid on 13 September 2019 to all shareholders and has a record date of 30 August this year.

Few highlights of the result include the establishment of the SkyCity Inclusion Council. The company paid a total of $4.0 million to the four New Zealand SkyCity Community Trusts for distribution to communities and distributed over $1.6 million in sponsorships to individuals and organisations. SKC is likely to be the first major New Zealand player to go carbon neutral. The company proceeded with an on-market share buy-back programme during 2H19, through which $39 million in total shares were acquired, as on 30 June 2019. It also partnered up with Gaming Innovation Group, to provide an offshore online casino gaming platform for NZ users.

On the outlook front, SkyCity mentioned that it was making an investment of over $700 million towards its Auckland precinct, along with the growth of the NZ International Convention Centre, a nearby laneway, with more than 1,300 more automobile parking areas and a brand new 300-room, 5-star Horizon Hotel. All of them are due for finalisation in the 2020 period. The company describes FY20 and FY21 as transitory years, as it gears up to open two major projects (Auckland and Adelaide Projects).

Besides this, SKC informed on 19 August 2019 that it has successfully concluded the long-awaited sale of its Auckland car parks to Macquarie Principal Finance Group for $220 million.

Stock Performance and Returns: After the close of business on 23 August 2019, SKCâs stock was valued at A$3.71, up by 0.27 per cent, with a market cap of A$2.48 billion and ~671.38 million outstanding shares. With a P/E ratio of 18.090x, the YTD return of the stock is 14.55 per cent. In the last one, three and six months, it has delivered returns of -1.33 per cent, 2.21 per cent and -2.37 per cent, respectively.

IPH Limited

Company Profile: A leading intellectual property services group in the APAC region, IPH Limited (ASX: IPH) offers a wide range of IP services and products across ANZ, PNG, the Pacific Islands and Asia. The company was the first ever IP services group to list itself on the Australian Securities Exchange in 2014. IPHâs registered office is in Sydney and it consists of multi-disciplinary team of almost 1000 people. The company would be conducting its AGM on 21 November 2019.

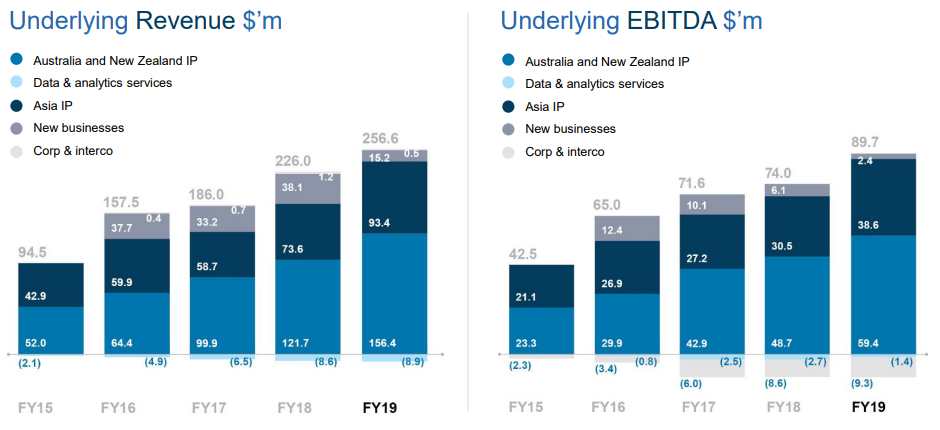

FY19 Results: On 20 August 2019, IPH Limited pleasingly provided its Financial Results for year ended 30 June 2019, highlighting its growth of the Asian business, which led to increase in Underlying EBITDA, reported to be $89.7 million, up by 21 per cent. The company posted a Statutory NPAT of $53.1 million, up by 31 per cent and a Diluted EPS of 26.7 cps, up by 29 per cent.

IPHâs Revenue and EBITDA (Source: IPHâs Report)

The company declared a 60% franked Final dividend of AU 13 cps, up by 13%. This brought the full year dividend to 25 cps, up by 11 per cent on the prior year. The record date for determining entitlements to the final dividend is 26 August 2019 and the scheduled payment date for the same would be 18 September 2019. IPH activated the DRP, which would be operative in the final dividend.

One highlight of the announcement was the increase of the companyâs Like-for-like revenue by 2 per cent, at $231.4 million and the businessâ EBITDA increased by 9 per cent to $80.4 million.

Pleased by the result, CEO Mr Andrew Blattman stated that the Asian IP business was the core focus of IPHâs growth strategy. He notified that the Total Australian market patent filings were up by 0.8 per cent for the period, though IPHâs Groupâs filing decreased by 3.5 per cent. Positive for the company, it did not witness any significant loss of clientele and maintained its number one position with IPH combined group market share of 22.1 per cent in Australia as on 30 June 2019.

Two other highlights of the year included the sale of Filing Analytics and Citation Eagle, to CPA Global for $10 million, net proceeds of which were utilised for debt clearance, and the acquisition of all the shares in the capital of Xenith IP Group Limited (ASX:XIP). IPHâs current focus is the integration of Xenith, which is under work-in-progress phase.

Stock Performance and Returns: After the close of business on 23 August 2019, SKCâs stock was valued at A$9.16, down by 0.435 per cent, with a market cap of A$1.96 billion and ~212.92 million outstanding shares. With a P/E ratio of 34.190 x, the YTD return of the stock is 69.74 per cent. In the last one, three and six months, it has delivered returns of 10.84 per cent, 31.81 per cent and 50.82 per cent, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.