Two ASX-listed companies - diversified media business Seven West Media Limited and marketing communications services company WPP AUNZ Limited â recently announced significant updates to the market. Seven West Media Limited made a new CEO appointment, while WPP AUNZ Limited announced to have struck a deal to sell its Kantar business. Letâs take a detailed look into the announcements:

Seven West Media Limited

On 16 August 2019, Seven West Media Limited (ASX:SWM), one of the leading integrated media companies in Australia, announced the appointment of Mr James Warburton as the companyâs Managing Director and Chief Executive Officer after Mr Tim Worner resigned from his post of the CEO of SWM. Mr James would focus on driving new sources of revenue into the company.

Mr James Warburton, who started as SWM CEO effective immediately, holds extensive experience in the industry, in addition to knowledge related to media, sports administration, marketing, advertising and sales. This is Mr Jamesâ second stint at Seven, for which he served at multiple senior positions. After leaving Seven in 2011, he joined Network Ten Pty Limited as the Chief Executive Officer. In 2013, Mr James left Network Ten and joined V8 Supercars as the Chief Executive Officer, serving it until 2017. Before assuming his duties as the CEO of Seven West Media, Mr James was serving as the MD and CEO of APN Outdoor.

FY2019 Results: Seven West Media Limited released its year-end results for FY2019 ended 29 June 2019, on 20 August 2019.

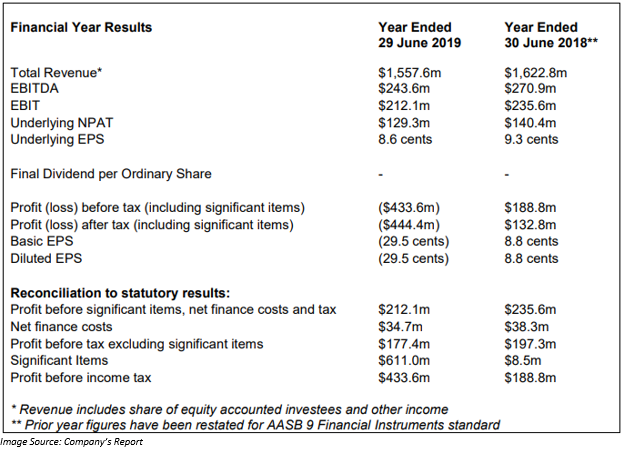

During the period, the company reported total revenue of $ 1,557.6 million and a loss after income tax of $ 444.4 million. Softer advertising market conditions had an impact on the companyâs TV licence and newspaper masthead carrying values during FY19. The company reported net significant items after tax worth $ 573.7 million during the period.

There was an increase of 0.7% points in the Metro TV revenue to 38.8% in FY2019. Due to disciplined cash management, the operating expenses of the company declined by $ 38 million. The underlying Group EBIT for the period was down by 7.5% to $ 212.1 million as compared to the previous corresponding period, excluding 53rd week in FY2018. The company reported $ 59 million in Earnings Before Interest and Tax for Seven Studios during the period, which represents an increase of 5.3%. The value of Ventures portfolio of the company increased by 24% to $ 95 million. The net debt of the Group declined to $ 564 million at the year end.

FY2020 Outlook: Some of the focus areas of the company for the financial year 2020 are:

- Achieving underlying FY20 Group EBIT in the range of $ 190 million to $ 200 million.

- BVOD market is expected to increase by more than 25%.

- Increasing the ratings as well as revenue shares in broadcast and BVOD.

- The company expects eighth consecutive year of EBIT growth for Seven Studios.

- Aid the balance sheet.

Stock Performance: The shares of SWM have given a negative YTD return of 27.36%. On 21 August 2019 (AEST 11:52 AM), the SWM stock was trading at a price of A$ 0.372, down 3.377% from its previous closing price. SWM has a market capitalisation of A$ 580.59 million with approximately 1.51 billion outstanding shares and a PE ratio of 4.87x.

WPP AUNZ Limited

WPP AUNZ Limited (ASX:WPP), a leading creative transformation company in Australasia, on 16 August 2019 announced to have entered into a deal to sell 100% of its stake in the Kantar businesses in Australia and New Zealand. The company statement follows an announcement by WPP plc regarding an agreement to sell a 60% stake in the global Kantar business to Bain Capital Private Equity, while retaining the remaining 40% stake. WPP plc is the major shareholder of WPP AUNZ Limited.

The Kantar business of the company includes entities, namely Kantar Insights, Lightspeed, Colmar Brunton, Kantar Consulting and The Online Research Unit, which form the Data & Insights cluster of WPP. Through the proposed sale of Kantar, the business of WPP AUNZ will get simplified. The Kantar business is value at $ 168 million (transaction). It means that the transaction value is equivalent to 8.2 times the 2019 budgeted EBITDA of the Kantar business. The multiple has been determined on the basis of the multiple that was obtained by WPP for the sale of 60% of its global Kantar stake.

After the completion of the adjustments, which includes the transaction cost, a share of restructure liabilities, proceeds to the company are expected to be around ~ $ 150 million. The payment would be made in cash. Apart from this, the other advantage of this transaction would be a drop in the annual service fee payable to WPP plc. The drop would be witnessed from 3.28%, which is the existing rate of international brand net sales, to 2.31%.

Proceeds Usage: The board of the company would evaluate how the proceeds from this transaction can be optimally used before its expected receipt in early 2020. The review would consider the existing gearing levels, potential expansion, capital requirements, along with the cash flow outlook.

After completion, leverage would be below the targeted gearing ratio of the company of 1.5x - 2.0x net debt / EBITDA, thereby providing flexibility in returning funds to shareholders.

Further Steps: At present, shareholders are not required to take any action. The company has appointed an independent expert, tasked with advising on whether the deal is in favour of the non-WPP plc shareholders of WPP AUNZ.

Further, finalisation of the transaction depends on a thumbs up from the non-WPP plc related shareholders in addition to the conclusion of the proposed transaction. In case the WPP AUNZ shareholders give their approval at the EGM which will be held in November 2019 followed by successful completion of the terms and conditions, the transaction is expected to conclude with proceeds received in Q1 CY2019.

The Proposed Sale of 60% of Kantar: With the acquisition of the 60% Kantar business, a strong partnership would be established between Bain Capital Private Equity and WPP plc, which would help in accelerating the development of Kantar, which is one of the top data, research, consulting as well as analytics businesses, globally. Kantar is a provider of insights into opinions of customers as well as consumers in more than hundred nations. It was rolled out in the year 1992 by WPP after the latter combined its existing businesses engaged in market research.

Kantar Financial Performance for FY18 (Source: WPP Reports)

The proposed transaction values the whole of Kantar at $ 4 billion, equivalent to a multiple of 8.2x 2018 Kantar headline EBITDA. WPP, post finalisation after tax and investments in Kantar, is anticipated to receive ~ $ 3.1 billion. Of the total proceeds, the company plans to direct 60% towards debt reduction to the low side of the target leverage range, which is 1.5 â 1.75x average net debt/EBITDA for 2020. The remaining proceeds would be returned to the shareholders.

The Proposed Transaction: Last year on 25 October, WPP highlighted the significant opportunity for developing Kantar into a leading data, insights and consulting company, globally. The board believed that the most optimal method to unlock the potential of the Kantar business as well as boost the shareholder value was to enter into a deal with a strategic or a financial partner. It was expected that the company would continue to be a share owner with strategic connections so that the advantages to the clients were realised.

The company, which received strong interest from potential financial partners, reached a deal with Bain Capital on 16 August 2019. Through this proposed transaction, Kantar would be able to reinforce its industry-leading position, owing to the joint expertise in addition to the resources of Bain Capital as well as WPP. The transaction would not only help in maintaining its position in the industry but also help in generating significant value for the shareholders by providing them with an exposure to an attractive business and potential for value realisation in the future.

Stock Performance: The shares of WPP have given a positive YTD return of 11.40%. On 21 August 2019 (AEST 11:54 AM), the WPP stock was trading at a price of A$ 0.645, up 1.575% from its previous closing price. WPP has a market capitalisation of A$ 541.12 million with approximately 852.15 million outstanding shares and an annual dividend yield of 9.13%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.