Annual General Meeting

A gathering of the companyâs shareholders is known as the Annual General Meeting. In the AGM or Annual General Meeting, board of directors of the company present its annual report comprising of performance, strategy and financial results. The AGM allows the shareholders to vote on various resolutions proposed in the Annual General Meeting. The common resolutions proposed in the AGM are: Remuneration Report, Election and Re-election of Director, Financial Report etc. The AGM of the company is held every year, and the first AGM should be conducted within nine months from the closing of the financial year.

The Notice period for before holding an AGM

Private Company â A private company can conduct an Annual General Meeting by giving the notice of 14 days to its member.

Public Company â A non-traded public company can host an AGM by providing a notice of 21 days to its members.

Metals & Mining Sector Overview

Australia has the worldâs largest reserves of lead, nickel, uranium and zinc. There are approximately 26 listed companies in ASX200. The share market of Australia is strongly dominated by the underlying strength of the mining industry.

On 25 November, the S&P/ASX 300 Metals and Mining (Industry) index last traded higher at 4,326.4 points, rising by 0.92 per cent from its previous close. Also, S&P/ASX 200 Energy (Sector) closed the trading session at 11,326.3 points or 1 percent from its prior close. While S&P/ASX 200 index closed the market session, up by 0.3 per cent from the previous close.

Letâs discuss AGM results of three out of four Resources sector stocks along with their other updates:

Paladin Energy Ltd (ASX: PDN)

Paladin Energy Ltd is an Australian-based global uranium leader. The company has two mines in Africa, Kayelekera in Malawi and Langer Heinrich in Namibia. The company is listed on multiple stock exchanges namely - Namibian Stock Exchange (NSX) and Australian Securities Exchange under the symbol PDN.

Results of Annual General Meeting

The company has declared the Annual General Meeting results held on 19 November 2019, below are the resolutions which were passed during the AGM:

Resolution 1 â Re-election of Director â Mr Daniel Harris

The companyâs shareholders have re-elected, Mr Daniel Harris as a director. Mr Harris got 53.94 per cent or 602,161,191 votes in his favour and 46.06 per cent or 514,196,657 votes against the resolution.

Resolution 2 - Re-election of Director â Mr John Hodder

The companyâs shareholders have re-elected Mr John Hodder as a director. Mr Hodder got 53.99 per cent or 602,725,332 votes in his favour and 46.01 per cent or 513,633,113 votes against the resolution.

Resolution 3 â Remuneration Report

The votes received in the favour of remuneration report was 52.95 percent or 583, 430,302. While the votes received against it was 47.05 percent or 518,352,960.

Resolution 4 - Election of Director â Mr Cliff Lawrenson

The companyâs shareholders have re-elected, Mr Cliff Lawrenson as a director. Mr Lawrenson got 99.85 per cent or 846,250,188 votes in his favour and 0.15 per cent or 1,288,640 votes against the resolution.

Appointment of non-Executive Chairman

On 29 October 2019, the company announced the appointment of Mr Cliff Lawrenson (a well-known industry professional) as its Non-Executive Chairman. Mr. Lawrenson is currently the Non-Executive Chairman of ASX-listed Pacific Energy Ltd (ASX: PEA) and Non-executive director of Primero Group Ltd (ASX: PGX).

To know about the companyâs Langer Heinrich Mine in Namibia click here

Stock Performance

The stock of PDN last traded at $0.085, down by 2.299 percent from its last close. The company has approximately 2.03 billion outstanding shares and a market cap of $176.43 million. The stock has generated a negative return of 30.40 per cent in the last six months and a negative return of 47.27 per cent on year to date basis.

Independence Group NL (ASX: IGO)

Independence Group NL is a mining and exploration company. IGO has been involved with nickel, copper and such metals mining and processing at the Nova operation.

Off-market takeover bid for Panoramic Resources

On 22 November 2019, the company provided an update on its off-market takeover offer (Offer) for Panoramic Resources Limited (ASX: PAN) as was previously notified on 4 November 2019.

After the recent discussion with the board of directors of Panoramic, a Confidential Deed was inked between IGO and PAN, which allows the company to conduct due diligence on Panoramic and the Savannah Project. The due diligence was anticipated to start immediately but was subject to the availability of information and a site visit to the Savannah Project and would continue until at least early-December.

Panoramic is currently evaluating options to raise additional capital which is likely to involve an entitlement offer.

The company was expecting its Bidderâs statements to be mailed to the PANâs shareholders on 25 November 2019 and encouraged PAN shareholders to ACCEPT the OFFER.

Results of Annual General Meeting

On 21 November 2019, the company declared the Annual General Meeting results, which was held on 20 November 2019, and below are the resolutions passed during the AGM:

- Resolution 1 - Re-election of Mr Peter Buck

- Resolution 2 - Election of Ms Kathleen Bozanic

- Resolution 3 - Remuneration Report

- Resolution 4 - IGO Employee Incentive Plan Approval

- Resolution 5 - Issue of Service Rights to Mr. Peter Bradford

- Resolution 6 - Issue of Performance Rights to Mr. Peter Bradford

- Resolution 7 - Change of Company Type

- Resolution 8 - Change of Company Name

- Resolution 9 - Replacement of Constitution

Stock Performance

The stock of IGO last traded at $5.95 on 25 November 2019, falling by 1.977 per cent from its previous close. The company has approximately.590.8 million outstanding shares and a market cap of $3.59 billion. The stock has generated a positive return of 25.41 per cent in the last six months and a positive return of 67.22 per cent on year to date basis.

The companyâs Q1 2020 financial performance can be read here

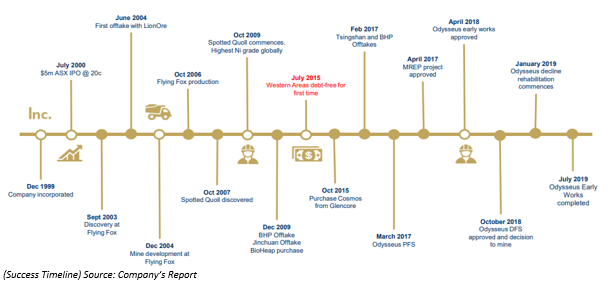

Western Areas Limited (ASX: WSA)

Australia based Western Areas Limited is high-grade, low cash cost nickel producer. Western Areas owns 100 per cent stake in Forrestania and Cosmos Nickel operation located in Western Australia region.

Results of Annual General Meeting

On 22 November 2019, the company declared the Annual General Meeting results, which was held on 21 November 2019, below are the resolutions passed during the AGM:

- Resolution 1 â Re-election of Independent Non-Executive Director â Ian Macliver

- Resolution 2 â Adoption of Remuneration Report

- Resolution 3 â Re-approval of the Western Areas Ltd Performance Rights Plan

- Resolution 4 â Grant of Performance Rights to Daniel Lougher

To read more about WSA click here

Stock Performance

The stock of WSA last traded flat at $2.920 on ASX on 25 November 2019. The company has approximately 273.55 million outstanding shares and a market cap of $798.75 million. The stock has generated a positive return of 28.63 per cent in the last six months and a positive return of 53.68 per cent on year to date basis.

Nickel Mines Limited (ASX: NIC)

Nickel Mines Limited, incorporated on 12 September 2007, is a low-cost producer of nickel pig iron. The company holds a 60 per cent interest in 2 Line RKEF or Rotary Kiln Electric Furnace plant and 17 per cent interest in another 2-line RKEF plant.

Quarterly Activities Report

On 31 October 2019, the company released quarter ended 30 September 2019 activities report, and a few highlights of the report are as follows:

- The commissioning and ramp-up phase of Hengjaya Nickel and Ranger Nickel RKEF projects has been completed.

- 10,019 tonnes of nickel were produced by RKEF during the quarter.

- The September quarter production increased by 33.5 per cent above monthly nameplate capacity.

- US$117.2 million quarterly sales produced by RKEF.

- The RKEF EBITDA stood at US$50.2 million.

Stock Performance

The stock of NIC last traded at $0.595 on 25 November 2019, rising by 1.709 per cent from its previous close. The company has approximately 1.67 billion outstanding shares and a market cap of $974.3 million. The stock has generated a positive return of 36.05 per cent in the last six months and a positive return of 120.75 per cent on year to date basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.