Nickel mining was in stagnation for quite sometime but has started on a bounce back journey since early September 2019. Itâs an important commodity to make stainless steel for household items, pipes, etc. Electric battery makers have increased its use to boast their firepower. We will be discussing four metal and mining companies which are operating in Australia. The companies have their respective road map for the coming quarters. Many projects of the companies are going through expansion phases and are expected to discover respective minerals in coming years.

Western Areas Limited (ASX: WSA)

Western Areas Limited operates in mining and exploration of nickel, copper across Australia.

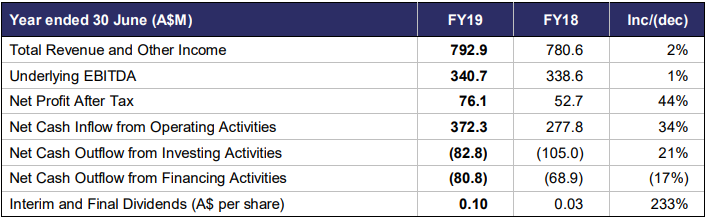

Operating Highlights: WSA reported achievement in product specification along with filtration and bagging facilities to sell a new highgrade nickel sulphide product. The Company reported back-end plant capability of up to 4,000t of nickel per annum while Mill Scats, New Morning, Flying Fox LG will provide future feed options.

MREP Flowsheet (Source: Companyâs Reports)

During the year, the Company updated that it has commenced mining from January 2019 in its second operational hub named Cosmos. WSA completed the acquisition of this Odysseus mine during Oct 2018.

WSA also updated that it has witnessed decline in rehabilitation to 500m below surface, commencement of underground pump station, and completion of construction activities of Water Management Ponds. The Company informed commissioning of 250 rooms out of 520 rooms. Odysseus is a low-cost project where Ore Reserve came in at 8.1mt @ 2.0% for 164 kt nickel. The average mine life stands at more than ten years with an average nickel in concentrate production more than 13.0ktpa. AM5 & AM6 deposits contain an Indicated Mineral Resource of 57.6kt of nickel which was currently completing reserve estimation. The company recorded massive sulphide intersections. The Company reported capital expenditure of $80 million for FY20, $ 66 million for FY21 and $143 million for FY22-23. Annual production was recorded at 900 kt.

Stock Update: The stock of WSA closed at $3.010, down 2.589% as on 18 October 2019. The stock has a market capitalization of $858.26 million. The stock has generated stellar returns of 45.50% and 32.33% during the last three-months and six-months, respectively. The stock has generated dividend yield of 0.66% on an annualized basis. The stock is trading toward the upper band of its 52-weeks trading range of $1.835 to $3.38.

Independence Group NL (ASX: IGO)

Independence Group NL is a metal and mining company which operates in mining and processing of nickel, copper and cobalt. On 16 October 2019, the company has updated about its activities in Lake Mackay Joint Venture:

- A total of 73 RC holes for 15,528m of drilling completed in CY2019

- New gold prospects identified

- Additional copper sulphide mineralisation intersected at the Phreaker Prospect â followup diamond drilling planned H1 2020

- 1km long multi-element soil anomaly and adjacent conductor modelled at >400m from surface at Raw Prospect â follow-up diamond drilling planned H1 2020

- Arcee is an 800m long gold soil anomaly which remains open to the west with further RC drilling to be completed this quarter

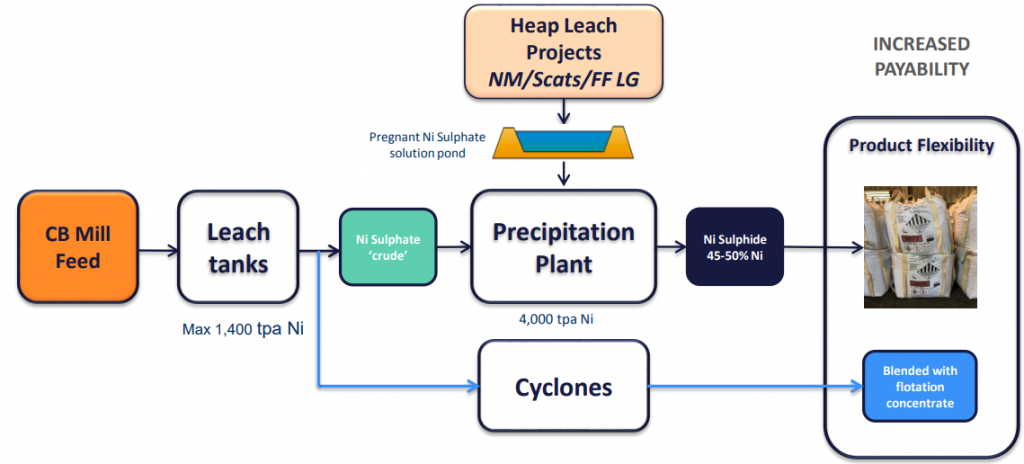

FY19 Operating highlights for year ended 30 June 2019: IGO announced its FY19 results wherein revenue and other income stood at $792.9 million, ~2% y-o-y driven by higher product revenue from Nova facility. The Company reported NPAT at $76.1million, up 44% on y-o-y basis. Underlying EBITDA during the year came in at $340.7million, grew 1% from FY18 while EBITDA margin stood at ~43%. The Business reported Production from Tropicana plant at 518,172oz, up ~11% higher than FY18. IGO posted total gold sales at 154,402oz, registering a growth of 11% YoY. One of the major highlights of FY19, was that the company delivered high margin gold production at continuous basis, delivering cash costs at $680/oz, down by 5% pcp. All-in Sustaining Costs (AISC) stood at $951/oz, down 10% on y-o-y. During the year, the company has successfully reduced debt from $142.9 million in FY18 to $85.7million in FY19. The company reported Shareholdersâ Equity $1,849.1 million as on 30 June 2019.

FY19 Financial Highlights (Source: Companyâs Reports)

Outlook: As per the management guidance, the company is expecting to produce 28,500 tonnes of nickel, 11,750 tonnes of copper and 900 tonnes cobalt in FY20. Exploration expenditure and Evaluation expenditure is expected to be $66 million and $7 million, respectively.

Stock Update: The stock of IGO ended the day at $5.75 on 18 October 2019 with a market capitalization of $3.6 billion. The 52-week trading range of the stock stood at $3.560 to $6.64 and currently, the stock price is quoting near the upper band of its 52-week range. The stock has delivered robust returns of ~22.80% and ~28.18% during the last three- months and six-months, respectively.

Ardea Resources Limited (ASX: ARL)

Ardea Resources Limited is engaged in mineral exploration and development in Western Australia and New South Wales. Recently, ARL issued 1,630,000 fully paid ordinary shares as conversion of IPO options.

FY19 Financial Highlights for the year ending 30 June 2019: ARL reported full year results for FY19 wherein the company posted other income of $333,044 as compared to $208,696 on previous financial year. The company reported net loss of $1,487,734 as compared to $3,814,139 during previous year. Cash balance of the company, during the year stood at $11,188,295, while total current assets stood at $13,190,655. Plant and equipment and motor vehicles were reported at $618,232, investment at $10,000. The total assets during the end of FY19 came in at $38,280,688. Net asset of the business came in at $37,649,625 as on 30 June 2019.

Operating Highlights as per Australian Nickel Conference:

- One of the projects of Ardea is Kalgoorlie Nickel Project (KNP) which has a mineral resource of 773Mt at 0.7% Nickel and 0.05% cobalt. During the year the company explored 5.6 million tonnes of nickel and 405,000 tonnes of cobalt.

- The Goongarrie Nickel Cobalt Project is a part of Ardea which with a resource of 216Mt at 0.71% Nickel and 0.06% Cobalt which has minned 1.5 million of contained nickel, 130,700 tonnes of cobalt.

- Expansion study of 2.25 Mtpa with a 25-year mine life completed

- 5% nickel and 95.5% cobalt recovery â life of mine

- Pre-cobalt credit C1 costs in line with current worldwide operators

- Pressure Acid Leach (PAL) 5th generation plant is a proven design, successfully operated in other laterite projects globally

- 25Mtpa case based on only 26% of Goongarrie Resource

Snapshot of current projects (Source: Companyâs reports)

Stock Update: The stock of ARL is trading at $0.47 with a market capitalization of $52.78 million. The 52-week trading range of the stock stood at $0.355 to $0.760 and currently. The stock has delivered decent returns of ~21.25% and ~6.59% during the last three- months and six-months, respectively.

Mincor Resources NL (ASX: MCR)

Mincor Resources NL operates in mining and mineral exploration across Australia and specializes in minerals like nickel.

The Company has highlighted the sectorial scenario of Nickel.

- Demand of EV batteries likely to drive demand of nickel and the overall demand is expected to remain strong.

- As per Analysts CY2020 supply shortfall forecasts are estimated for nickel.

- As per the update, Indonesia to bring forward the laterite export ban from CY20 which is expected to impact ~10% of the global supply.

The Company sales agreement with BHP includes the following

- Utilisation of the Kambalda Nickel Concentrator located adjacent to Northern Kambalda Operations.

- The management is expecting higher economic outcomes due to parity with risk and fund management.

FY19 Financial Highlights for year ending 30 June 2019: The Company reported full year financial results wherein the company reported gross profit of $0.294 million, operating loss at $13.749 million as compared to $4.655 million. The Company cash and cash equivalent at $29.01 million and total current assets at $34.692 million. The Company reported plant, property and equipment at $6.361 million and exploration activities at $19.027 million. The company reported total assets and net assets at $60.08 million and $37.54 million as on 30 June 2019. Net Cash flow from operating activities stood at $7.36 million, while net cash outflow from investing came in at $14.91 million and cash flows from financing activities came in at $22.452 million.

Stock Update: The stock of MCR ended the day at $0.635 on 18 October 2019 with a market capitalization of $177.78 million. The 52-week trading range of the stock stood at $0.32 to $0.735 and currently, the stock price is quoting at the upper band of its 52-week range. The stock has delivered decent returns of ~41.57% and ~29.9% during the last three- months and six-months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.