Iluka Resources Limited (ASX:ILU)

Australiaâs metals and mining sector company, Iluka Resources Limited (ASX: ILU) recently showcased the presentation at 2019 Bank of America Merrill Lynch Global Metal, Mining and Steel Conference, held in Barcelona. It also showed up in the inaugural TZMI TiO2 Congress NYC 2019, New York.

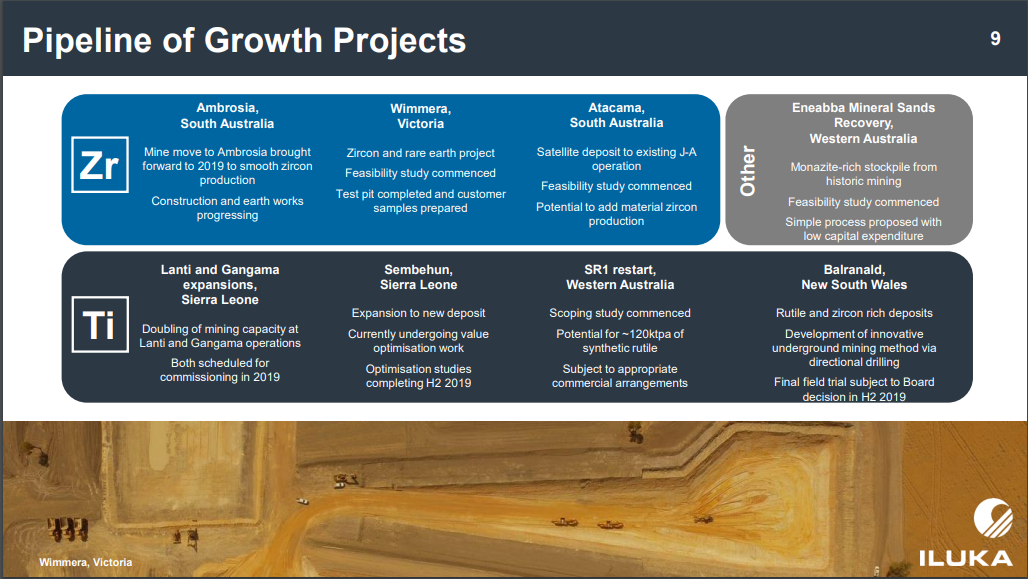

The presentations highlighted the sustainable approach adopted by the company along with the promising pipeline of growth projects.

Iluka is an owner of the worldâs largest zircon mine which was discovered in 2004. This mine named, Jacinth-Ambrosia South Australia, forms the major source of the companyâs zircon production. Iluka reported the growth of 41% in zircon prices, steering the companyâs mineral sands revenue which grew 22% in 2018.

Titanium Feedstocks marks another high-grade product of Iluka that has natural advantage in production processes with high âvalue in useâ. The presentation also unleashed the high-grade titanium pricing dynamics driven by the recent decoupling of rutile and pigment prices due to supply tightness in very high-grade feedstock market.

Pipeline of Growth Projects (Source: Companyâs Presentation to BoAML Conference, Barcelona, May 2019)

Pipeline of Growth Projects (Source: Companyâs Presentation to BoAML Conference, Barcelona, May 2019)

Looking forward with respect to titanium, the company eyes stable pigment demand in Q1 2019, which may lead to stronger demand in H2 2019. The company holds minimal inventories through value chain and have most of product contracted or committed for 2019, as per the presentation.

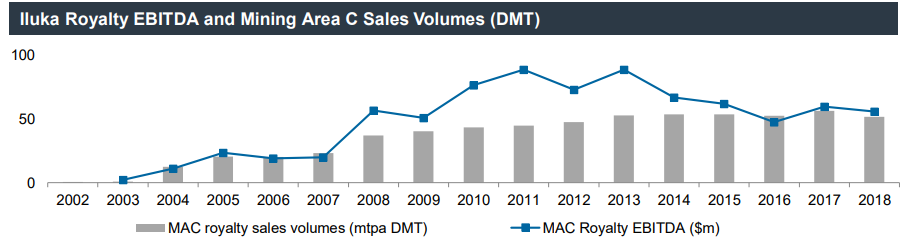

Further, Iluka holds a royalty over iron ore from BHPâs Mining Area C (MAC) in Western Australia. The group expects its royalty revenue to grow with BHPâs South Flank development.

Mining Royalty & MAC Sales (Source: Companyâs Presentation to BoAML Conference, Barcelona, May 2019)

Mining Royalty & MAC Sales (Source: Companyâs Presentation to BoAML Conference, Barcelona, May 2019)

On 27 May 2019, the company announced that Perpetual Limited and its related bodies corporate became a substantial holder of Iluka, effective 23 May 2019. As per the notification, the substantial holders now have a voting power of 5.10% in the company.

Iluka Resources Limited is a Metal & Mining company based in Perth, Western Australia. ILU has experience of more than 60 years in the minerals and sand industry, and it provides expertise in mining, processing, exploration, development, marketing and rehabilitation.

ILU last traded at $9.740, down 1.715%, on 31 May 2019.

Western Areas Limited (ASX:WSA)

Western Areas Limited (ASX:WSA) is a metals and mining company based in Australia. Last month, WSA released its WA Mining Club Luncheon - Corporate Presentation, wherein focused remained on innovation, nickel market and its latest project in the pipeline- Odysseus.

WSA purchased the Odysseus Project from Glencore for $24 million in Oct 2015. The PFS study of the project was completed in March 2017 following which the group completed the DFS study of the project in 2018 with Board approval to start mining.

In January this year, Western Areas got a schlumberger submersible pump on the site to accelerate dewatering from the project. As per the presentation, Odysseus Project is a long-life, low cost project with Ore Reserve 8.1mt @ 2.0% for 164kt nickel at a mine life greater than 10 years.

Odysseusâ pre-production capex stands at A$299 million which includes shaft hoisting and larger mill. It also presents a significant upside underpinned by record massive sulphide intersections and AM5 & AM6 deposits containing an Indicated Mineral Resource of 57.6kt of nickel (not included in DFS).

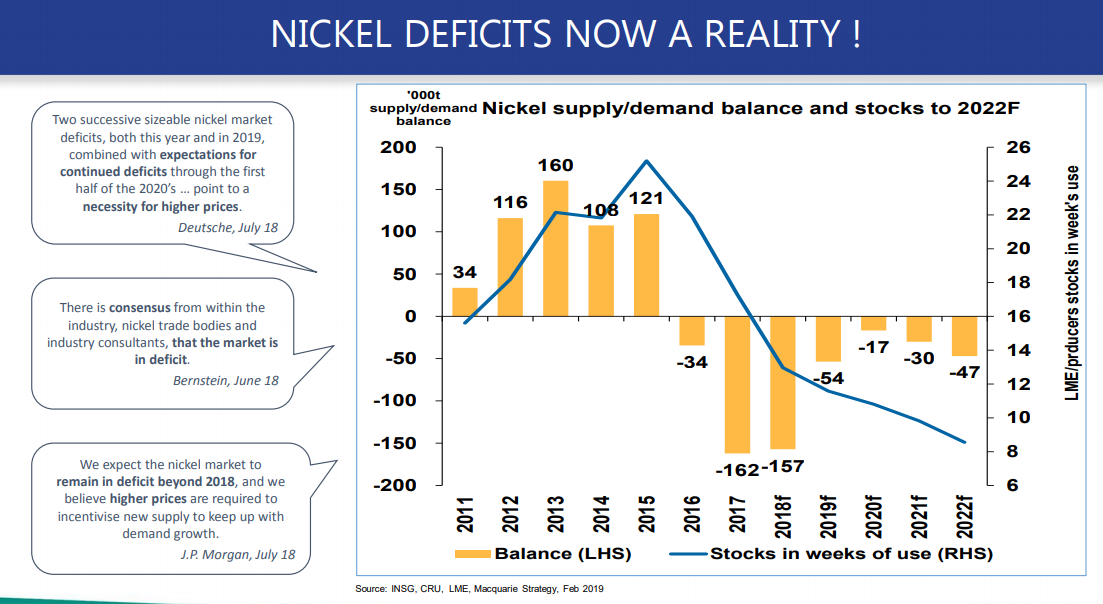

The companyâs Mill Recovery Enhancement Project (MERP) produces additional new higher-grade product (45-50% Ni), utilising waste tailings. Further, the WSA expects an upside in the nickel market with a significant increase in inbound offtake enquiries and escalated demand for nickel from the Chinese partner (stainless steel producer). The company had also reflected that the Nickel Deficits would be a reality now.

Nickel Deficits (Source: Companyâs WA Mining Club Luncheon - Corporate Presentation)

Nickel Deficits (Source: Companyâs WA Mining Club Luncheon - Corporate Presentation)

WSA last traded at $2.180, down 0.457%, on 31 May 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_02_05_2025_05_53_40_418159.jpg)