Summary

- Healthcare companies like CSL Limited are playing critical role in beating the novel coronavirus with expertise, technologies, materials, and efforts to develop a potential treatment.

- While Pro Medicus is expanding its US footprint, OncoSil secured another regulatory approval for its targeted radioactive isotope.

- Mesoblast has achieved promising outcomes from a clinical trial focused on the treatment of lung diseases with lead candidate remestemcel-L.

Globally, major players in the healthcare sector remain focused towards development of a treatment or vaccine against the deadly coronavirus, to save lives. So far, COVID-19 has taken 376,320 lives and infected more than 6.1 million people across the globe, as reported by WHO (at CEST 2:42 PM, 2 June 2020).

COVID-19 related restrictions and necessary measures have impacted almost all industries across the globe. Shaken by the impacts, several countries have gradually started reopening their economies by easing restrictions to recover from economic losses.

Amid the COVID-19 situation, few ASX-listed healthcare players made significant developments.

DO READ: Drivers for Australian Economic Rebuilding

In this article, we will be discussing four ASX-listed healthcare stocks- CSL, MSB, PME and OSL.

CSL Limited Playing Important Role in Battle against COVID-19

Headquartered in Melbourne, CSL Limited (ASX:CSL) is the 3rd largest global biotech player, operating in over 60 countries and employing more than 26K people. The aim of the developer and supplier of biotherapies and influenza vaccines (innovative) is not only to save lives but also to aid patients suffering from life-threatening illnesses.

CSL Limited is offering expertise, equipment, technologies as well as materials as its support in response to the coronavirus pandemic. Remarkably, the company is providing additional influenza vaccine doses in Australia during the tough time of COVID-19. It has also employed business continuity schemes across all its sites.

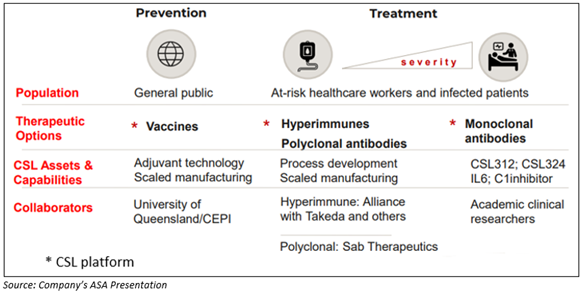

The image provided below highlights CSL’s focused COVID-19 response:

CSL Limited’s subsidiary CSL Behring Australia, early last month, updated the market regarding its plans to start development of an anti-SARS-CoV-2 plasma product with the potential to treat COVID-19 patients having a more severe infection. The product would be designed particularly for seriously ill patients progressing towards ventilator need. The subsidiary would develop the investigational product at its Broadmeadows advanced manufacturing facility.

DID YOU READ: How is the Global Biotech Leader CSL Limited Responding to COVID-19?

The Hon. Greg Hunt Commonwealth Minister for Health stated-

According to an ASX announcement dated 27 May 2020, CSL entered a strategic partnership for a long term with Thermo Fisher Scientific, which is a global leader in serving science. This partnership with Thermo Fisher is for the lease of the state-of-the-art biotech manufacturing facility of CSL, which is currently under construction in Switzerland.

On 3 June 2020 (AEST 01:29 PM), CSL stock was trading at AUD 283.560, down by 0.411% from its previous close. The company has a market cap of AUD 129.28 billion with approximately 454.05 million outstanding shares.

Mesoblast’s Remestemcel-L Delivers Improved Outcomes in Inflammatory Lung Disease

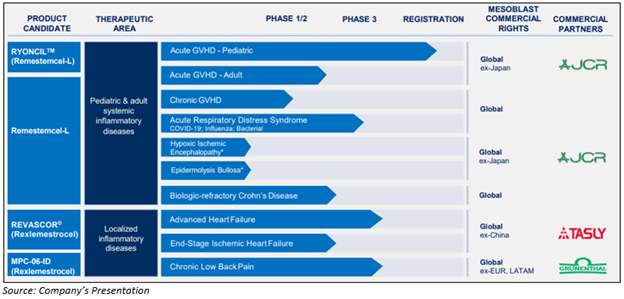

ASX-listed healthcare company, Mesoblast Limited (ASX:MSB) is a global leader in providing off-the-shelf (allogeneic) cellular medicines for inflammatory diseases. The company’s product candidates in phase 3 clinical trials are- RYONCILTM, REVASCOR® and MPC-06-ID.

Recently, MSB revealed encouraging outcomes from a phase 2 clinical study of remestemcel-L, while assessing the ability of its lead MSC (mesenchymal stem cell) product candidate for the treatment of COPD patients and inflammatory lung disease.

The phase 2 trial results have indicated that remestemcel-L substantially enhanced respiratory as well as functional clinical outcomes in patients having increased levels of C-reactive protein (inflammatory biomarker). The study results aid the product’s potential as an effective treatment for patients with inflammatory lung illnesses, such as severely decompensated COPD and acute respiratory distress syndrome (ARDS). Notably, Mesoblast is testing remestemcel-L for treating patients who develop ARDS from COVID-19.

DO READ: How Mesoblast Became a Healthcare Market Darling Amid Coronavirus Pandemic?

Financial Highlights for Nine Months of FY2020

In 9M of FY2020, MSB reported a 113% increase in revenues to USD 31.5 million that comprised 81% growth in royalty revenues to USD 5.9 million from sales of TEMCELL HS Inj.® in Japan, and 127% increase in milestone revenues to USD 25.0 million from strategic partnerships as compared to the previous corresponding period.

Mesoblast has USD 60.1 million cash on hand as of 31 March 2020. Moreover, the company disclosed that up to an additional USD 67.5 million might be accessible via its existing financing capabilities along with strategic partnerships during the next one year.

Moreover, the company plans to direct capital towards commercial launch of RYONCIL for the treatment of acute GVHD, scaling up manufacturing for projected upsurge in capacity requirements for developing pipeline, with GVHD label extensions and COVID-19 ARDS, and for clinical programs.

MSB stock was trading at AUD 3.800 on 3 June 2020 (AEST 01:46 PM), down by 1.554%, with a market cap of AUD 2.24 billion and approximately 580.87 million outstanding shares on ASX.

Pro Medicus Signs 5-Year, AUD 22Mn Deal with Northwestern Memorial HealthCare

Founded in 1983, Pro Medicus Limited (ASX:PME) is a provider of medical imaging IT services, offering a broad range of radiology IT software as well as services to imaging centres, healthcare groups and hospitals at a global level.

The company recently announced that its 100% owned US-based subsidiary, Visage Imaging, Inc. has signed a five-year, AUD 22 million contract with Chicago-based Northwestern Memorial HealthCare (NMHC). The contract, which is based on a transaction-based licensing model, would see the company’s Visage 7 technology implemented at NMHC, commencing in the first quarter of the financial year 2021. The deal would boost the Company’s footprint in the regionally based community hospitals and academic hospital segment in the US.

PME stock was trading downward by 3.702% to AUD 27.310 on 3 June 2020 (AEST 01:58 PM), with a market cap of AUD 2.95 billion.

OncoSil Receives Singapore Regulatory Approval for OncoSilTM Device

ASX-listed Sydney-based medical device company, OncoSil Medical Ltd (ASX:OSL) is focused on interventional oncology. OncoSil™ is the lead product of the Company, which is a targeted radioactive isotope- Phosphorus-32 (P-32), implanted directly into a pancreatic cancer of patient through endoscopic ultrasound.

OncoSil has received regulatory approval for its OncoSilTM device from Singapore’s Health Sciences Authority (HSA). With this approval, OncoSil could sell and market the device across the Asian country for the treatment of locally advanced pancreatic tumour.

As updated via an announcement on 4 May 2020, OncoSil had filed for registrations of the device in Singapore, Hong Kong, and Malaysia, with the CE Marking received on 1 April 2020.

On 3 June 2020 (AEST 02:01 PM), OSL stock was trading at AUD 0.112, up 1.818% from its previous close, with a market cap of AUD 91.53 million.