Over the last one year, the metal and mining segment saw remarkable capital infusion from investors. Most of the mining companies across Australia are engaged in the exploration of gold, lithium, manganese, cobalt, etc. Playersâ focus on lithium is expected to grow at a rapid pace, owing to the anticipated surge in demand for lithium batteries in the coming years. Lithium batteries are primarily used in electric vehicles, which are expected to register sky-high demand over the coming years, backed by governmentsâ focus on reducing pollution across the globe. At the same time, gold is believed to be one of the precious metals and the demand for this metal always remains high. On the other hand, demand for coal is anticipated to drop, owing to environmental issues. Additionally, major coal mines are undergoing shut down across the globe.

Letâs have a look at recent updates from some of the players in the metals & mining space.

Boadicea Resources Limited

Boadicea Resources Limited (ASX: BOA) is involved in the exploration of minerals like nickel, copper, lithium and gold across Western Australia. The ongoing projects of the company are Symons Hill Project, Fraser South Project, White Knight Project, Horseshoe Project and Wildara Project.

BOA Awarded Licence in Fraser Range:

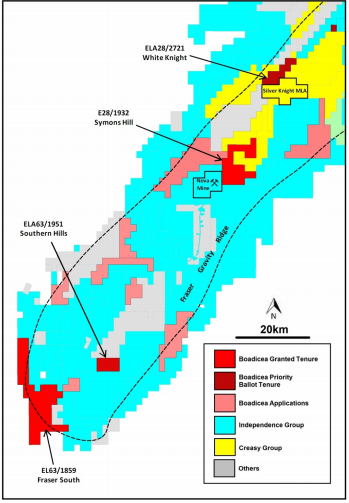

On 2 September 2019, Boadicea Resources informed that it has received the license, ELA63/1951 for approximately 23 square kilometres in the southern portion of the Fraser Gravity Ridge in Western Australia. The company had applied for the licence in on 4 January 2019, while the notification regarding the company securing the licence from the Department of Mines, Industry Regulation and Safety was received on 27 August 2019. This additional tenure boosts BOAâs landholding in the region to a total of 406 square kilometres.

License Location (Source: Companyâs Report)

FY19 Financial Highlights:

The company posted loss before income tax of $795,385 in FY19 as compared to a loss of $422,262 in FY18. In the expensesâ category, BOA registered $466,235 as write off exploration and evaluation assets. Employee benefits expense stood at $226,860 against $225,138 in the previous corresponding year. The company reported lower corporate expenses at $79,403 versus $88,359 in FY18. BOA reported total current assets of $5,71,532 at the end of 30 June 2019 including cash of $501,803 and receivables of $69,729. Exploration and evaluation assets stood at $2,525,160 and total equity came at $2,942,196 as on 30 June 2019. Cash flows from investing activities during FY19 stood at $399,304.

Stock Update:

The stock of BOA last traded at a price of $0.160 on 30 August 2019. The stock has gained ~52.38 % in the last one year. BOA has a market capitalisation of $8.46 million and approx. 52.85 million outstanding shares.

Bryah Resources Limited

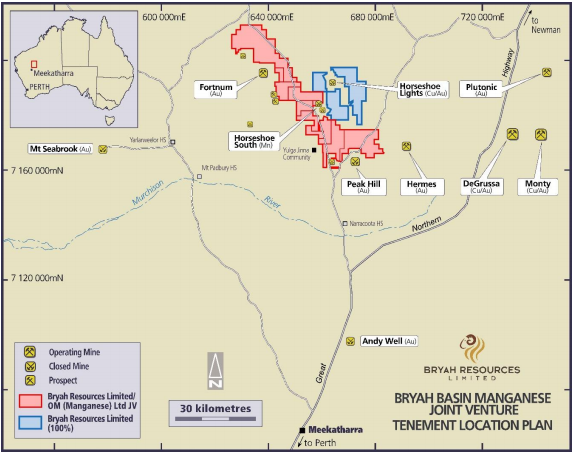

Bryah Resources Limited (ASX : BYH) is engaged in the mining and exploration of copper, gold and manganese in central Western Australia. The company has two projects named Bryah Basin Project and Gabanintha Project. The Bryah Basin project covers 880 square kilometres, while Gabanintha has a total area of 200 square kilometres. For the Gabanintha project, Bryah holds the rights to explore all minerals excluding vanadium, uranium, cobalt, lithium, tantalum, manganese, titanium, chromium, and iron ore.

BYH Receives $250,000 Exercise Fee from OM Holdings:

With a market update on 2 September 2019, BYH informed that it secured an exercise fee of $250,000 from OM Holdings Limitedâs wholly owned subsidiary OM (Manganese) Limited (OMM) on 30 August 2019. As a result, OMM holds an initial 10% interest in the joint venture in the Bryah Basin Project, as part of the farm-in and joint venture agreement signed between OMM and BYH in in April 2019. OMM would also fund $2.0 million of the JV expenses, boosting its stake from 10% to 51%.

The joint venture is aimed towards defining manganese that is commercially mineable. BYH is set to re-start exploration across the project, focused towards high priority prospects located near the Horseshoe South Manganese Mine.

Tenement Location Plan (Source: Company Reports)

Firm Commitments for $2.0 Million Capital Raising:

Recently, Bryah Resources also updated the market regarding firm commitments for a capital raising of $2 million at a price of $0.06 per share. BYH informed that the funds would be use for funding activities at its two projects in Western Australia. The proceeds would be directed towards advancing exploration at the Bryah Basin. Moreover, the company would use the funds to perform drilling at the Gabanintha gold project to determine an initial mineral resource estimate and for working capital. However, the placement is subject to approval from the companyâs shareholders.

Cash Flow Highlights:

During the quarter ended 30 June 2019, BYH reported $25,000 as cash from operating activities, $88,000 as cash from investing activities and $568,000 in cash and cash equivalents. The company made an expenditure of $348,000 for exploration and evaluation, followed by $132,000 and $45,000 as staff costs and administration & corporation costs.

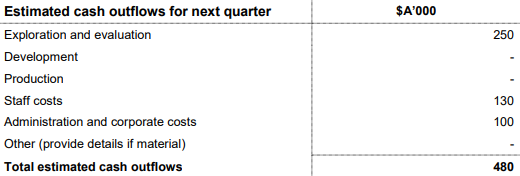

Outlook:

The company has given guidance for cash outflows during the next quarter ending 30 September 2019. It expects cash outflows of $250,000 in exploration and evaluation, while staff costs and administration & corporate costs are expected to be at $130,000 and $100,000, respectively. The company estimated a cash outflow of $480,000 for the next quarter.

Source: Companyâs Report

Stock Update:

The stock of BYH was trading at $0.072 on 03 September 2019 (AEST 02:06 PM). The 52-week trading range of the stock is at $0.056 to $0.120. The stock has given a negative return of 2.70% and 4% in the last three months and six months, respectively. BGH has a market capitalisation of $4.59 million with ~ 63.79 million outstanding shares.

Jameson Resources Limited

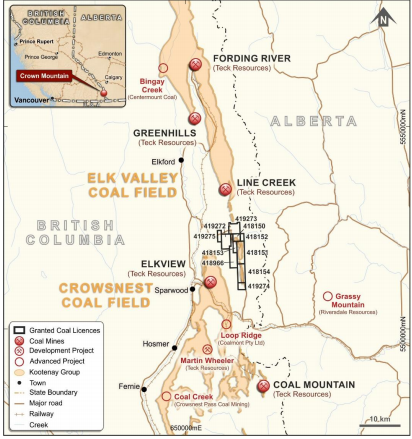

Jameson Resources Limited (ASX : JAL) is an explorer focused on coal projects in western Canada. The company is engaged in activities like project acquisition, exploration and development. The company has 80% stake in NWP Coal Canada Limited. Its tenement portfolio in British Columbia is positioned in coalfields responsible for most of Canadaâs metallurgical coal exports and are near to railways that connect export facilities.

Bathurst Agrees for Next Funding Tranche:

With a market update on 2 September 2019, Bathurst Resources Limited (ASX: BRL) confirmed the exercise of Tranche One investment option in the Crown Mountain Coking Coal Project. The project is a joint venture between Jameson Resources Limited and BRL. After subscription payment in Tranche One, BRL will hold a 20% equity investment in NWP Coal Canada Limited, which is the Canadian subsidiary of Jameson Resources and has the Crown Mountain project as its main asset. The subscription payment includes a further cash investment of C$7.5 million in NWP

Crown Mountain Coking Coal Project (Source: Company Reports)

FY19 Financial Highlights:

During FY19, JAL posted revenue of $21,287, lower than FY18 revenue of $84,445 and a bottom-line of $(1,125,360) against a profit of $84,051 in FY18. Corporate and compliance fees stood at $254,429 in FY19, in addition to employee benefits expense at $611,445. During the year, total current assets stood at $3,017,096 including cash and cash equivalents of $2,699,857 and trade and other receivables of $231,335. Deferred exploration and evaluation expenditure stood at $22,307,976, while plant and equipment under the non-current assetsâ category reached $43,107. Net assets stood at $26,003,396 as on 30 June 2019. Cash outflow in operating activities of the company stood at $1,139,576, while cash outflows in investing activities stood at $8,045,806. The company reported $10,119,154 in cash inflows from financing activities.

Stock update:

The stock of JAL last traded at $0.205 on 02 September 2019. The stock has given mixed returns of -4.65% and 17.14% in the last three months and six months, respectively. The market capitalisation of the stock stands at $57.07 million with approximately 263.77 million shares outstanding.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.