The benchmark index S&P/ASX 200 closed at 6,788.9 on 2 August 2019, down 0.3% from its previous close. On the same day, S&P/ASX 200 Real Estate Sector settled at 3,799.4, up 1.86%, while S&P/ASX 200 Financials Sector last traded at 6,454.4, down 0.4%.

In this article, we would be discussing CMW, a REIT, and GMA, a lenders mortgage insurance provider. In the time span of one month, three months and six months, both the stocks - CMW and GMA â have provided positive returns. Letâs have a broader look at these stocks covering their recent updates.

Cromwell Property Group

Cromwell Property Group (ASX: CMW) is an Australia registered company, which operates as an internally managed Australian REIT and a property fund manager. The company was officially listed on ASX in 1973. On 2nd August 2019, the company declared a dividend of $ 0.181, to be paid on 23rd August 2019.

Oversubscribed SPP Completion

On 31st July 2019, the company updated the market regarding the completion of its security purchase plan on 24th July 2019. It was also mentioned in the release that the share purchase plan was oversubscribed, owing to strong support from the eligible shareholders, by around $ 2.5 million. The company received applications for the plan amounting to around $ 32.5 million. Moreover, CMW has decided to accept the oversubscription in full.

CMW would use the proceeds from the security purchase plan, in addition to funds raised with the completion of the institutional placement on 27 June 2019 amounting to around $ 375 million, to finance numerous strategic growth opportunities as part of its âInvest to Manageâ strategy. Additionally, the strategy includes more than $ 1.0 billion of acquisition opportunities in Europe and Australia. The company would also direct the proceeds, coupled with recycled capital from sale of assets, towards accretive value-add development opportunities worth more than $ 1.0 billion throughout its current core and active real estate portfolio in Australia. Owing to the increased offer size, the company would be issuing 28,294,234 securities.

Northpoint Tower Sale

In another update on 1st July 2019, the company announced a deal with Hong Kong-based Early Light International. Under the deal, Cromwell Property sold its 50% interest in Northpoint Tower for a consideration of $ 300 million. The sale of interest is subject to approval from the Foreign Investment Review Board (Or FIRB) and is anticipated to complete in the mid of September 2019.

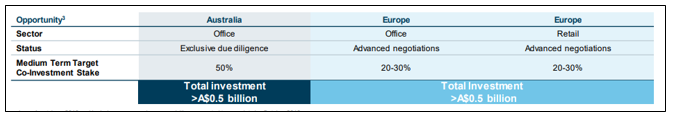

Sale of the stake, in addition to the recent successful transaction amounting to $ 375 million from the institutional placement and new 3-year syndicated facility amounting to ⬠225 million, would give a certainty of funding for more than $ 1.0 billion of acquisition opportunities and more than $1.0 billion of value-add development opportunities. These acquisition opportunities are in either exclusive due diligence or advanced negotiations.

Upcoming Opportunities (Source: Companyâs Report)

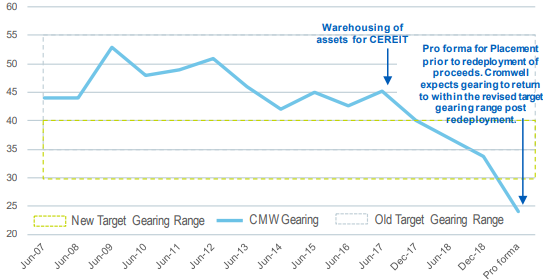

As per the companyâs equity raising presentation released on 26 June 2019, CMW continued to decrease its gearing over the last 18 months. Moreover, the company would aim a gearing in the ambit of 30 â 40%. It added that comprising the effect of the placement, and prior to reinvestment of proceeds in identified opportunities, the pro forma gearing declined to 23.9% and pro forma look-through gearing decreased to 31.3%.

Gearing Trend (Source: Companyâs Report)

Outlook

The company had reconfirmed its guidance for the financial year 2019. It expects operating profit of minimum 8.00 cents per share and distribution of 7.25 cents per share. The company had also provided preliminary projections for the financial year 2020. It is anticipating operating profit in the range of 8.1-8.3 cents per share and distribution of minimum 7.5 cents per share.

The company reported gross margin and EBITDA margin of 85.0% and 51.0% in 1H FY19 against the industry median of 74.1% and 62.2%, respectively. It posted net margin of 69.1% with YoY growth of 17.7%. This reflects that CMW is improving its capability to convert its top line into the bottom line. The current ratio of the company stood at 2.09x in 1H FY19 as compared to the industry median of 0.49x, which represents that the company is well positioned to meet its short-term obligations in comparison to the broader industry.

Stock Performance

The stock of Cromwell Property Group last traded at a price of $ 1.205 per share on 2 August 2019, up 0.837% from its previous closing price. It has a market capitalisation of $ 3.1 billion and approximately 2.59 billion outstanding shares. The stock provided returns of 1.70%, 7.17% and 12.74% for the one month, three months and six months period, respectively.

Genworth Mortgage Insurance Australia Limited

An Australia registered company, Genworth Mortgage Insurance Australia Limited (ASX: GMA) provides lenders mortgage insurance to its clients in Australia. The company was officially listed on ASX in 2014. On 31st July 2019, the company, via a release, unveiled final share buyback, where in the company bought back 24,950,648 shares on market at a consideration of $ 63,903,389.20.

A Look at First Half Result

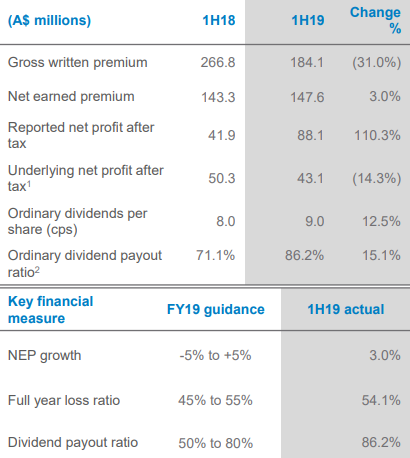

The company published its first half results presentation on 31 July 2019, communicating about its operational and financial performance for the period. It stated that the results for 1H 2019 were in accordance with its guidance. The company reported new insurance written amounting to $ 12.5 billion, reflecting a rise of 20.7% from 1H 2018. It witnessed a decline of 31.0% in GWP in 1H 2019. However, in 1H 2018, the gross written premium of the company was comprised of a bespoke transaction written via GMAâs Bermudian insurance entity. Ex-the above stated transaction, the company witnessed a rise of 6.4% in GWP in 1H 2019. The company reported a rise of 3.0% in net earned premium (or NEP), inclusive of the release of unearned premium amounting to $ 4.5 million in Q1 2019, which formed a part of GMAâs lapsed policy initiative. Adding to that, the company reported a rise of 5.9% in NEP, excluding the lapsed policy initiative in 1H 2018 as well as 1H 2019.

1H19 Results Overview (Source: Companyâs Report)

The company registered reported net profit after tax of $ 88.1 million for the first half of 2019, which includes after tax unrealised gain on investment portfolio amounting to $ 45.4 million, while underlying net profit after tax (or NPAT) stood at $ 43.1 million, including after tax realised gain of $ 5.8 million. In 1H 2019, Genworth Mortgage Insurance Australia Limited reported loss ratio of 54.1% against 53.3% in 1H 2018, which is in accordance with its guidance for fiscal year 2019. This represents the uptick in delinquencies historically, which was experienced in 1H 2019. The company further unveiled $ 79.8 million in net claims incurred in the first half of 2019, reflecting a rise of 4.5% from 1H 2018, which is attributable to rising reserves.

Overview of Balance Sheet

The company reported total assets of $ 3,648.2 million as at 30th June 2019 with a rise of 1.6% from total assets at 31 December 2018. The total assets of the company included a decline in cash amounting to $ 83.6 million mainly due to funding the share buy-back program and payment of the final dividend for fiscal year 2018. It also included an increase of $ 114.3 million in investments, primarily due to unrealised gains from the investment portfolio.

Total liabilities for the period stood at $ 1,925.9 million, reflecting a rise of 3.9% from total liabilities at 31 December 2018. The total liabilities of the company increased largely due to an increase of $ 32.0 million in reinsurance payable, resulting from the renewal of the reinsurance program, and a rise of $ 18.4 million in lease liabilities and an increase of $ 23.4 million in outstanding claims.

A Look at Dividend

The company has paid out 100% of after-tax profits via ordinary and special dividends to shareholders, since its listing in 2014. In the first half of 2019, the company declared an interim ordinary dividend of 9.0 cents per share (fully franked), which demonstrated a dividend payout ratio of 86.2% of underlying net profit after tax. The company also declared a special dividend of 21.9 cents per share (unfranked).

Outlook

GMA is continuing to actively manage its capital position and is constantly evaluating its excess capital and potential uses. The company is expecting net earned premium in the range of -5% to +5%, full year loss ratio to be in the ambit of 45% to 55% and ordinary dividend payout ratio in the vicinity of 50% to 80% for FY19. The company further added that the guidance for FY19 is subject to market conditions and unforeseen circumstances or economic events.

Stock Performance

The stock of Genworth Mortgage Insurance Australia Limited last traded at a price of $ 3.350 per share on 2 August 2019, up 1.515% from its previous closing price. It has a market capitalisation of $ 1.36 billion and approximately 412.51 million outstanding shares. The stock generated returns of 17.02%, 33.60% and 49.32% for the one month, three months and six months period, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.