The benchmark Index S&P/ASX 200 closed the dayâs trading at 6,408.1 on 16 August 2019, down 0.04%. On the same day, S&P/ASX 200 Resources settled at 4,605.5, down 0.84%, compared with the recent high of 5098.50 on 24 July 2019. The resources sector is under pressure due to the sluggish global economic growth, owing to ongoing trade dispute between the US and China, which is adding to the uncertainty.

Three important resources stocks with recent updates are Fortescue Metals Group Limited, Rio Tinto Limited and Kirkland Lake Gold Ltd.

Fortescue Metals Group Limited

Fortescue Metals Group Limited (ASX:FMG) is engaged in exploration, development, production, processing and sale of iron ore.

According to a company announcement on 13 August 2019, a contract for its new Eliwana Mine and Rail project, located in the Pilbara region of Western Australia, has been awarded to Civmec Limited, a construction and engineering services provider. As part of the contract, Civmec Limited is responsible for the delivery of the ore processing and primary crushing facility for the project. Work is scheduled to start over the coming months and complete by late 2020.

June Quarter Results:

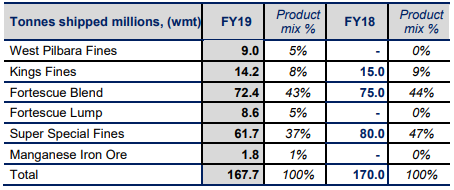

During the quarter ended 30 June 2019, the company reported Total Recordable Injury Frequency Rate (TRIFR) of 2.8, compared with 3.6 at the end of the March quarter and an improvement of 24% when compared with the same period a year ago. This represented a record annual result in terms of safety TRIFR. Shipments pertaining to West Pilbara Fines during the quarter were reported at 46.6 million metric tonnes. In order to meet the strong demand for its 60.1% iron content product, West Pilbara Fines, the company focuses on optimising its product mix through marketing strategy and integrated operations. Full year shipments for FY19 were reported at 167.7 million metric tonnes, which went down by 1% on the prior corresponding period due to the impact of Cyclone Veronica.

FY19 Shipments (Source: Company Reports)

Average revenue received during the period was reported at US$92 per dry metric tonnes, increasing 30% in comparison to the March quarter average revenue of US$71 per dry metric tonne. C1 costs during the period stood at US$12.78 per wet metric tonne, 5% lower than the previous quarter C1 costs of US$13.51/wmt. Majority of the shipments during the quarter were made to China. Non-China markets accounted for 6% of total shipments during the quarter and 8% for the entire year.

In June 2019, the company paid a fully franked dividend of A$0.60 per share, with total FY19 dividend payments to date amounting to A$0.90 per share. This came as a result of strong operational performance and cashflow generation. With the growth and development projects at Eliwana and Iron Bridge well on schedule and budget along with other initiatives involving the Queens Valley development, ongoing investment in autonomy and relocatable conveyors, the company is aiming to further maximise the returns to shareholders.

Sales Entity in China:

In order to support direct product supply from regional Chinese ports, the company set up a wholly owned entity in China, to provide its customers with an option to purchase smaller volumes, in Renminbi.

Balance Sheet Position:

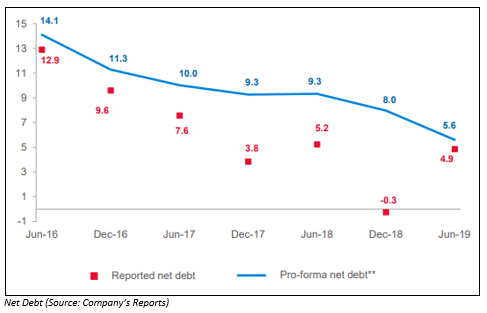

As at 30 June 2019, cash on hand amounted to US$1.9 billion, as compared to US$1.1 billion as at 31 March 2019. Gross debt as at 30 June 2019 stood at US$4.0 billion. Net debt during the year reduced to its lowest level at US$2.1 billion.

Stock Information: FMG closed the dayâs trading at A$7.660 on 16 August 2019, up 2.133% from its previous closing price, with a market cap of A$23.09 billion and ~3.06 billion outstanding shares.

Rio Tinto Limited

Rio Tinto Limited (ASX: RIO) is an Australia registered company, which is involved in the production of copper, gold, iron ore, coal, aluminium, borates and other minerals and metals. The company was officially listed on the Australian Stock Exchange in 1962.

First Half Performance:

The company recently released its H1CY19 presentation, communicating about its financial and operational performance for the period. The company stated that safety is the highest priority of RIO. It witnessed improved AIFR of 0.41 in 1H 2019 and launched new safety maturity model while reinforcing strong focus on critical risk management (CRM) with 710,000 verifications in the first half of the year, 2019. During the period, the company continued its focus on mental health as well as wellbeing through the application of a standardised framework throughout the Group.

In the first half, the company reported growth of 4.4% in in global steel production and a decline of around 6% in seaborne supply. In addition, the company also saw a decline of app. 20% in iron ore stocks at port.

Overview of Iron Ore and Aluminium Segment:

The company witnessed a rise in underlying EBITDA and underlying EBITDA margin during the first half of the year due to higher pricing of iron ore. It witnessed a shortfall of 14Mt because of Tropical Cyclone Veronica and fire at Cape Lambert A. It added that Koodaideri Phase 1 and Robe JV Sustaining development projects are continuing to progress. When it comes to aluminium, it stated that the lower prices affected EBITDA by $0.8 billion, notably primary metal as well as there was impact of alumina legacy contracts on EBITDA of $0.15 billion, from peak in 2H 2019. There was also an impact of weather on the production of bauxite in Q1, but Amrun ramp-up is progressing.

Financials

RIO reported gross revenue of $21.8 billion in 1H 2019 in comparison to $21.2 billion in the same period a year ago, reflecting a rise of 3%. The underlying EBITDA of the company stood at $10.3 billion in 1H19, up 11% from $9.2 billion in the year-ago period. The free cash flow of the company stood at $4.7 billion, while capital expenditure reached $2.4 billion in 1H19, comprising of sustaining capital expenditure amounting to $1.2 billion and development capital expenditure of $1.2 billion. Going forward, the company has a strong balance sheet with declining debt on YoY basis. Its net debt for the period (1H19) stood at $4.9 billion.

Value Creation

The company announced an amount of $3.5 billion as returns to shareholders, which includes interim dividend of $2.5 billion, which is to be paid in September 2019 and special dividend of $1.0 billion to be paid in September 2019. The above stated returns represent 70% of underlying earnings. The company is expecting M2M (mine-to-market) free cash flow target in the range of $1-1.5 billion run-rate from 2021.

Stock Information: RIO closed the dayâs trading at A$84.720 on 16 August 2019, down 1.028% from its previous closing price, with a market cap of A$31.78 billion and ~371.22 million outstanding shares.

Kirkland Lake Gold Ltd

Kirkland Lake Gold Ltd (ASX:KLA) is involved in gold mining with assets located in Canada and Argentina. It recently published its 2Q19 report, under which it reported an increase of 30% in production to 214,593 ounces from 164,685 ounces in 2Q18. The result can be attributed to a record production of 140,701 ounces at Fosterville, which is an increase of 82% as compared to the previous corresponding period. Production at Fosterville offset the lower production at Macassa and the Holt Complex. Macassa produced 49,196 ounces in 2Q19 versus 60,571 ounces in 2Q18 and a record 72,776 ounces in the previous quarter, while the Holt Complex produced 24,696 ounces compared to 26,652 ounces for the same period in 2018 and 30,658 ounces in 1Q19.

During the period, total production costs were reported at $66.2 million as compared to $66.5 million in 2Q18 and $70 million in the previous quarter. The operating cash costs per ounce sold was reported at ~$312, which is a 23% increase from $404 in 2Q18, majorly due to a 40% enhancement in the companyâs average grade from 13.1 g/t to 18.4 g/t for the same period a year earlier. The All-In Sustaining costs (AISC) per ounce sold at around $638, which is 16% better than the 2Q18 average of $757, with the improvement mainly resulting from the impact of higher average grades compared to the prior yearâs second quarter.

In its condensed consolidated interim financial statement, KLA highlighted that its cash and cash equivalents on 30 June 2019 stood at $469.39 million. Its account receivable was reported at $19.32 million, while inventories were reported at $40.81 million, prepaid expenses at $6.32 million and income tax receivable at $3.85 million The current asset in total was reported at ~$539.70. Its other long-term assets were reported at ~$148.60 million, while mining interests and plant equipment was reported at $1,318.98 million. The deferred tax assets were reported at $12.23 million. The companyâs total assets stood at ~$2,019.50 million.

Under current liabilities, accounts payable and accrued liabilities were reported at ~$143.80 million, while share-based liabilities were reported at $6.217 million, lease obligations at $11.90 million and income tax payable at $86.45 million. Under non-current liabilities, the provisions were reported at $41.42 million, deferred tax liabilities at $231.42 million and lease obligations at $7.249 million. Total liabilities at the end of 30 June 2019 were reported at $545.91 million as compared to $447.05 million on 31 December 2018. The shareholdersâ equity at the end of the June quarter reached $1,473.59 million as compared to $1,263.106 million on 31 December 2018.

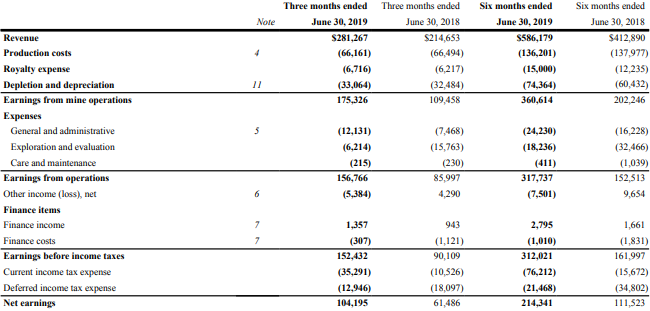

On income statement, revenue for the June 2019 quarter was reported at $281.267 million as compared to $214.653 million in the previous corresponding period. Its earnings from mine operations for the period was reported at $175.326 million as compared to $109.458 million in the previous corresponding period. The earnings before income taxes for the period was reported at $152.432 million as compared to $90.109 million in the same period a year ago. The net earnings for the period was reported at $104.195 million as compared to $61.486 million in the year-ago period. Under earnings per share, its basic EPS and diluted EPS for the period were reported at $0.50 and $0.49, respectively.

KLAâs June Quarter Income Statement (Source: Company Reports)

Stock Information: KLA closed the dayâs trading at A$67.100 on 16 August 2019, down 2.044% from its previous closing price, with a market cap of A$14.37 billion and ~209.79 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.