The retail sector in Australia has been slackening in the last few years, as the consumers are pulling back on spending, owing to household finances remaining under pressure from stagnant wage growth and factoring in declining wealth (crumbling house prices). In fact, there has been a shift in the retail sector landscape on a global level, as the preferences move from high-street and departmental stores to online shopping.

This has posed a major challenge for big store retailers and real estate groups that own medium-sized malls and shopping centres, as the e-commerce giants are gradually flagging their profits and affecting the valuations of these assets.

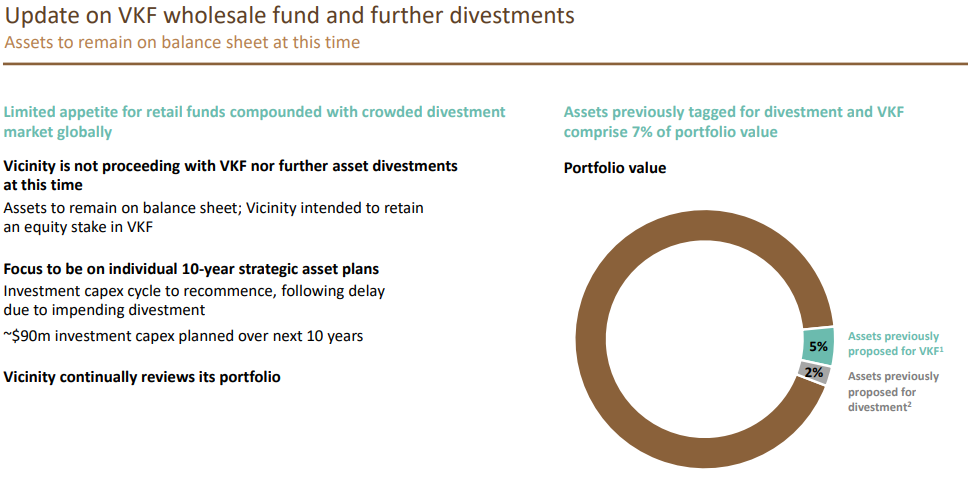

At the backdrop of such an economic atmosphere, Vicinity Centres (ASX: VCX), one of Australia's leading retail property groups with a fully integrated asset management platform and around $ 26 billion in retail assets under management across more than 60 shopping centres, has recently called off the sale of its 12 underperforming shopping centres due to lack of investor interest.

According to Vicinity Centresâ Chief Executive Grant Kelley, the "unforgiving" investor sentiment building towards retail funds worldwide may be termed as a reason behind the Groupâs retraction of the divestment offer. Of the 12 centres, the company had planned to spin off seven centres in the VKF wholesale fund. All the 12 shopping centres under the offer would now be kept on the companyâs books. He also added that the Group would rapidly try and enhance the retail mix, leverage other income opportunities and identify efficiencies to make up for the underperforming assets.

Source: FY19 Annual Results Presentation

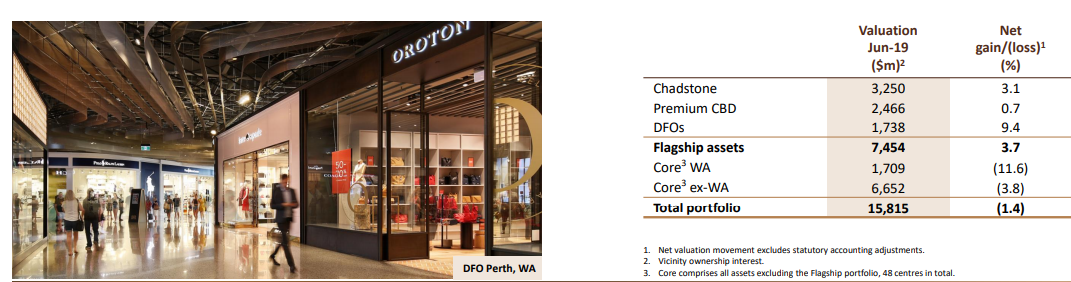

Although Vicinity Centres has not been extremely susceptible to the overall market trend, it reported a revaluation decrement on directly owned investment properties worth $ 239.3 million for the year ended 30 June 2019, leading to a large slump of $ 856.2 million in the statutory net profit after tax to $ 319.4 million for the year ended 30 June 2019. This was partially offset by Vicinity Centresâ development and other capital expenditure, most notably at Chadstone, The Glen, Roselands, QueensPlaza and DFO Perth Airport. Flagship assets including Chadstone and premium centres CBD and DFO continue to drive valuation growth for the Group.

Source: FY19 Annual Results Presentation

The Groupâs total revenue and income amounted to $ 1,232.7 million while the operating cash flows also remained positive at $ 592.2 million.

As at 30 June 2019, the Trust Groupâs net assets stand at $ 11,401.9 million, down $ 536.1 million from $ 11,938.0 million as at 30 June 2018. This movement may be largely attributed to property revaluation decrements of $ 239.3 million, continuation of the Vicinity Centres Group on-market security buy-back program with 99.8 million Trust units purchased for a total of $ 251.0 million, representing an average price of $ 2.56 per unit; and lastly, net foreign exchange movements on interest bearing liabilities.

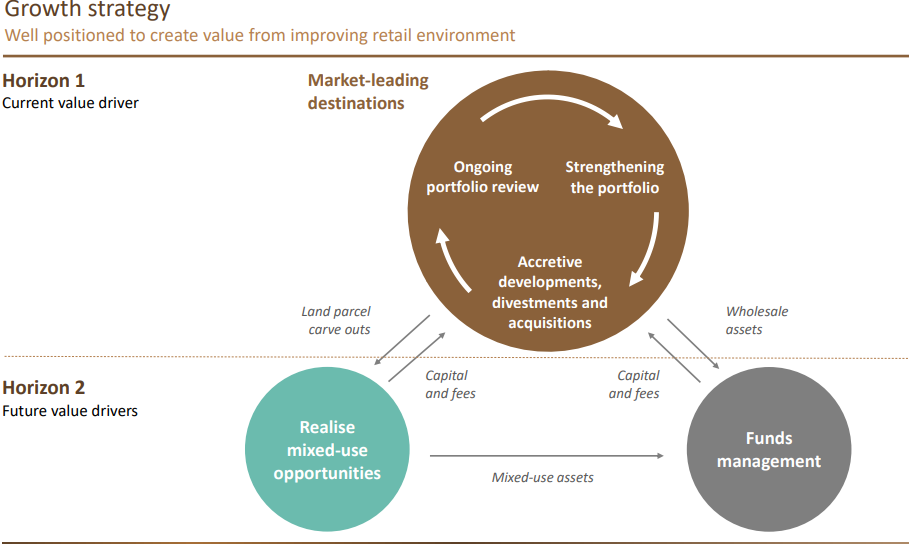

Regardless, the Group is well positioned, with its growth strategy to create value from the very recent improvements observed across the retail environment in the country, where data-led intelligence is improving decision-making and strengthening a range of management functions. Also, a number of new income streams are emerging with the Groupâs ancillary income for FY19 being $ 107 million, up 0.2% on a comparable basis.

Source: FY19 Annual Results Presentation

With a current market capitalisation of AUD 9.17 billion and approximately 3.77 billion outstanding shares, the VCX stock was trading at AUD 2.450 on 16 August 2019 (AEST 02:54 PM), up 0.823% from its previous closing price. The stock has an annual dividend yield of 6.54%, while its EPS stands at AUD 0.090.

Now, letâs take a look at some other retail landlords in Australia that are dedicated to enriching community experiences and developing places where people may connect, shop and indulge.

GPT Group

GPT Group (ASX: GPT), based in Sydney, Australia, owns and manages an extensive portfolio of retail and office properties across the country. Australia Square, Rouse Hill Town Centre and Melbourne Central are among the groupâs primary assets. With a market capitalisation of around AUD 11.88 billion and ~ 1.95 billion shares outstanding, the GPT stock was trading at AUD 6.145 on 16 August 2019 (AEST 03:06 PM), up 0.738% from its previous closing price. Its annual dividend yield stands at 4.26%.

The Group recently disclosed its interim financial results for the six months to 30 June 2019, posting a net profit after tax of $ 352.6 million, down 51.6% on the prior corresponding period (pcp) and Funds From Operations (FFO) of $ 295.9 million, resulting in FFO per security growth of 2.0% on pcp. It reported distribution per security of 13.11 cents for the six months to June 2019, which was 4% higher when compared with the same period a year ago. Besides, GPT Group recorded a net valuation increase of $ 130.8 million for the period, with the office portfolio leading with the largest gains.

Also, the MLC Centre was divested for $ 800 million, with the net tangible assets reaching $ 5.66 per security for the period ended 30 June 2019, up 1.4% on 31 December 2018.

Stockland

Stockland (ASX: SGP) is a diversified Australian property group, engaged in the development and management of retail centers, residential communities and retirement living, while the Group also owns a portfolio of office and industrial assets. With a market cap of AUD 10.56 billion and approximately 2.38 billion outstanding shares, the SGP stock was trading at AUD 4.450 on 16 August 2019 (AEST 03:14 PM), up 0.451% from its previous closing price.

On 4 July 2019, the Group announced a strategic capital partnership in its residential portfolio, with Capital Property Group (CPG) investing a 50% interest in Stocklandâs largest master-planned community, Aura (with an end value of $ 5 billion) on the Sunshine Coast, at around 30% premium to book value.

For the third quarter of FY19 ended 31 March 2019, the Group posted comparable specialty retail sales of $ 9,253 per square metre, reflecting a 3.8% rise on pcp. DDS delivered modest growth while supermarket sales also grew following extreme weather in Queensland. A strong growth was recorded for Homewares and Retail Services, driven by beauty & wellness while the growth across apparel and some fresh food categories remained sluggish.

Lendlease Group

NSW, Australia-based Lendlease Group (ASX: LLC) is engaged in the design, development and management of property and infrastructure assets including apartments, commercial buildings, government offices, retirement living, and educational facilities. With a market cap of AUD 7.72 billion and approximately 564.13 million outstanding shares, the LLC stock was trading at AUD 13.600 on 16 August 2019 (AEST 03:22 PM), down 0.585% from its previous closing price. Besides, LLC has delivered a positive return of 23.13% YTD.

In July 2019, Lendlease announced to have signed a widely reported agreement with Google in the US to develop the companyâs landholdings in San Jose, Sunnyvale and Mountain View into mixed-use communities.

The Group has a development pipeline of around $ 74.5 billion across Australia, Europe, Asia, and Americas, with ~ $ 14.8 billion in construction backlog revenue. Lendlease Groupâs Funds Under Management stand at ~ $ 34.1 billion with $ 3.6 billion worth of investments as reported in its Presentation at the Credit Suisse Asian Investment Conference.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.