Ansell Limited (ASX: ANN)

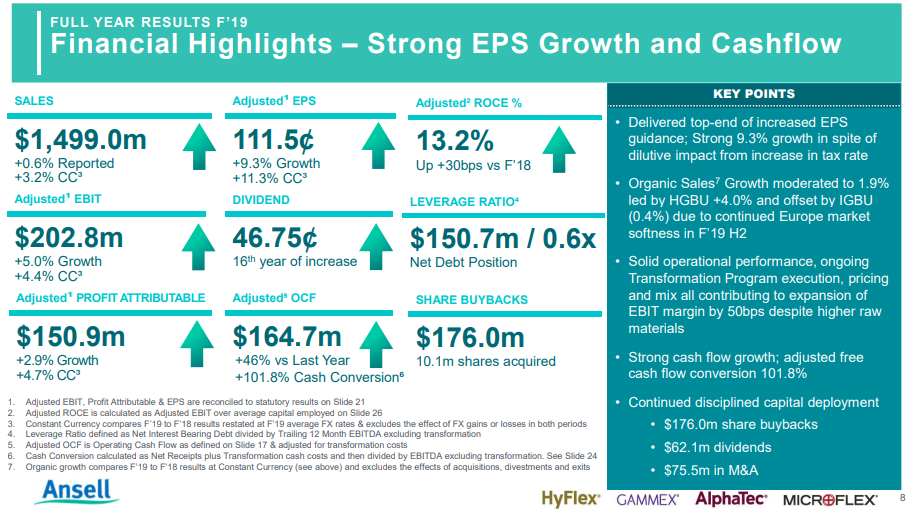

On 12 August 2019, ANN announced results for the full-year ended 30 June 2019. Accordingly, the revenues from continuing operations were US$1,499 million in 2019 compared with US$1489.8 million in 2018. Subsequently, the company reported a profit from continuing operation of US$113.1 million in 2019 against a profit of US$140.6 million in 2018. The EPS from continuing operations was US 82.6 cents in 2019, down from US 96.5 cents in 2018.

Meanwhile, the balance sheet of the company is carrying interest bearing liabilities under non-current liabilities of US$525.3 million in 2019, down by US$552 million in 2018. Cash flow statement does not list any repayment of borrowings during 2019, under the financing activities. However, the US$6.7 million decreases relate to the net exchange differences, other than US$20 million payable in June 2020, which was reclassified under current liabilities. The company was carrying cash & cash equivalent of US$397.5 million as the balance, as on 30 June 2019.

Financial Highlights (Source: FY 2019 Full Year Results)

Financial Highlights (Source: FY 2019 Full Year Results)

Business Unit Performance

Healthcare: Reportedly, the sales were up by 4.8% in constant currency terms along with the contribution of the Digitcare acquisition. The business unit saw organic revenue growth of 4%, excluding acquisition benefits from 8.6% growth in new product sales and 6.8% growth in sales from emerging markets. Besides, the profitability of the unit was impacted due to higher raw material costs, and during the FY19 H2 margins improved on slowing raw material costs and price increases.

Industrial: Reportedly, the sales improved by 1.5% in constant currency, including the contribution of the Ringers acquisition. The growth in the business was impacted by subdued demand in the European market, backed by the challenges in the automobile sector. Besides, the emerging markets depicted a recovery during the second-half of the year following destocking in the market. The slower market in Europe impacted the mechanical sales, and chemical sales were down due to reduced sales of lower end chemical gloves, customer destocking effects on household gloves sold to retail.

Dividend & Dividend Reinvestment Plan (DRP)

The company has declared an unfranked dividend of US26 cents per share, which takes the total dividend for the full year to US46.75 cents per share. Besides, the record date for the dividend is 19 August 2019, and it would be payable on 5 September 2019. The DRP is available for the shareholders residing in Australia, New Zealand and the United Kingdom, last day to elect for DRP is 20 August 2019, and no discount would be available.

FY20 Outlook: The company had acknowledged the prolonged deterioration in the external market conditions along with trade uncertainties, and the business environment remains favourable for growth across some markets. It expects organic sales growth in between 3-5% in FY20, which considers minimal disruption form possible tariffs or Brexit. Besides, the company expects EPS to be in between US 112 cents to US 122 cents.

On 12 August 2019, ANNâs stock was trading at A$27.300, up by 5.528 percent (at AEST 3:13 PM).

GPT Group (ASX: GPT)

On 12 August 2019, GPT announced results for the half-year period ended 30 June 2019. Accordingly, the group reported a net profit after tax of $352.6 million for the first half of the year compared with $728.5 million in the previous corresponding period (pcp). The group reported Funds From Operations (FFO) of $295.9 million for the half-year period, up by 2.2% on pcp from $289.4 million.

Reportedly, Net Tangible Assets (NTA) was $5.66 per security, up by 1.4 per cent on 31 December 2018. Besides, the group had declared an unfranked dividend of 13.11 cents per share on 18 June 2019, which had a record date of 28 June 2019, and it is scheduled for payment on 30 August 2019.

Business Segment Overview

Office: Reportedly, the unit achieved like for like income growth of 6.5 per cent over pcp. The group achieved office occupancy 97.1 per cent, and it signed leases for 37,900 square metres and terms were agreed for further 78,900 square metres. Besides, the portfolio delivered net revaluation gain of $114.8 for the period, up by 1.9 per cent, and the group divested MLC Centre for $800 million, which equates to return of 20 per cent p.a. over the past three years.

Logistics: Reportedly, the unit delivered like-for-like income growth of 2.2 per cent for the period with occupancy of 93.4 per cent and WALE of 7.4 years. Besides, the group signed leases worth 121,300 square metres and agreed on terms for additional 27,000 square metres. An increase of $51.4 million was recorded in the portfolio valuation. In addition, the group acquired five fully leased assets in Sydney for $212 million, a new $70 million facility at Eastern Creek was completed in January 2019, and an additional $200 million of logistics projects are underway.

Retail: Reportedly, the unit achieved like-for-like income growth of 1.4 per cent in the first half, and the occupancy was 99.5 per cent as at 30 June. Besides, the valuation of the portfolio decreased by $35.4 million during the period.

Results Highlights (Source: 2019 Interim Result Presentation)

Results Highlights (Source: 2019 Interim Result Presentation)

Funds Management: As per the release, the division achieved 7.6 per cent in FFO on pcp backed by improvement in assets under management to $13.3 billion. The acquisition, valuation growth in the GPT Wholesale Office Fund (GWOF) improved the assets under management. Besides, the portfolio value was $8.5 billion as of 30 June, driven by acquisition and valuation growth.

Outlook: Reportedly, the company expects the outlook for the office & logistics in Sydney & Melbourne to remain positive, and signs of improvement were noticed in Brisbane. Besides, the retail might experience, and assets in the right locations continue to attract demand. However, the retail environment would benefit from lower interest rates, income tax relief and stabilisation of house prices.

The group has confirmed guidance for FY19 of 2.5 per cent per security growth in FFO, distribution per security growth of 4 per cent.

On 12 August 2019, GPTâs stock was trading at A$6.050, down by 3.2% (at AEST 3: 25 PM).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.