Cannabis Industry in Australia has been flourishing for some time now, and the Australian regulators have been gung-ho on the medicinal use of cannabis. The progress and competition would gradually rise every day with companies unlocking the GMP (Good Manufacturing Practices) and API (Active Pharmaceutical Ingredient) capabilities. Further, the other companies are sourcing products based on GMP & API to keep up with the pace.

These two processes are used to extract the cannabis resin, which is utilised widely in the production of medicinal products such as capsules or oil. In this article, we have discussed two stocks from the Australian-listed cannabis space.

THC Global Group Limited (ASX: THC)

On 9 July 2019, THC Global Group (ASX: THC) notified the market on receiving the licence to function the biggest bio-pharma extraction facility in the Southern Hemisphere area, and only production facility in the Australian region capable of GMP API production at this scale.

Capabilities (Source: Companyâs Website)

Capabilities (Source: Companyâs Website)

On 09 July 2019, THC announced that THC Pharma Pty Ltd â 100% owned subsidiary company of THC, has secured a Manufacture Licence from the Australian Office of Drug Control. Besides, the licence is for the companyâs Southport Manufacturing Facility.

As per the release, the cannabis company anticipates the annual production from the Southport Manufacturing Facility to be over 12k kilogram of GMP compliant API isolates. Also, the THC anticipates that it would be able to produce equal amounts of both full and wide-spectrum extracts. Furthermore, THC anticipates processing the extracts into complete medicines like capsules, tinctures, and so forth where essential.

Reportedly, the natively generated product from Southport region is expected to be accessible for Australian the purpose of clinical and study related trials.

Also, THC is amid discussions regarding the foreign clinical and study trials in Asia, and it anticipates exporting the product for the cause as well. Furthermore, the licence to manufacture also allows in increasing the product formulation and development related activities into evolving the new-age medicinal cannabis produces. Besides, these developments would steer medium-term revenue due to the companyâs commitment to launch these new registered products into both- native Australian and international markets.

THC anticipates that the product validation related activities at the Southport Manufacturing Facility would conclude in Q4 2019 period. Subsequently, it also anticipates generating revenue from the medicinal cannabis production commencing in early 2020.

Ken Charteris, CEO of THC Group, stated that the newly granted license is the most important one in Australian region, and the company has the biggest bio-pharma facility for extraction in the Southern Hemisphere area. Also, he mentioned that the THC is now placed to initiate the GMI API production of medicinal cannabis at heavy scale and competitive prices. In addition to this, he said that the company anticipates delivering the patients of Australian region with Australian generated medicinal products by the initial 2020 period.

On 09 July 2019, THC also forwarded the announcement made by EVE Investments Limited (ASX: EVE), which enumerated the update in the agreements with the company. As per the release, the agreements are directed for the organic farming operations of THC Global but not limited to tea-tree off-take, cannabis off-take and site lease.

Medicinal Cannabis Honey: According to the release, the company has an agreement with THC Group to grow cannabis at the site of THCâs tea tree plantation. Also, Meluka Honey (EVEâs subsidiary) and incorporation of Melaleuca tea tree extract would utilise the medicinal cannabis for product development; the medicinal cannabis would be provided by THC Group. Importantly, THC Group would aid in the dispersal of proposed Meluka Honey cannabis and honey products of tea tree by the subsidiaries of EVE Investments. Lastly, the Manufacture Licence receipt at Southport is an imminent development in collaborative strategy between EVE and THC Global to develop medicinal cannabis honey, and subsequent activities between both companies.

Tea Tree Extract R&D: Reportedly, Eve Investments has also been engaged in an R&D program regarding the production of a specialised ancestral melaleuca tea tree extract at Southport facility, which has reached the testing phase. In addition, the advanced technology hosted at the companyâs facility for botanical extractions is being utilised by EVE Investments for progressing the route to the market for the honey-based tea tree products by EVE.

It is interesting to notice that the company has announced its second license in the span of less than one month. On 13 June 2019, the company had reported a grant of Manufacturing Licence to Canndeo Limited (a wholly-owned subsidiary of THC) for the production of extracts & tinctures of cannabis and cannabis resin.

As per the release, the grant of the license depicts a milestone as the âFarm to Pharmaâ vertical integration strategy was completed post the grant of licence. Now, THC would be able to cultivate owned proprietary strains, processing cannabis plant material, manufacture, extract tinctures from the cannabis. Furthermore, the company would be looking forward to commencing the delivery of Australian grown, Australian manufactured medicinal cannabis products to domestic patients and the global export market.

It was also reported that collectively THC Global with its subsidiaries holds all three licence â Cannabis Research Licence, Medicinal Cannabis Licence (Cultivation), and Manufacture Licence. Further, the company is engaged in the cultivation of medicinal cannabis at its Strain R&D and manufacturing facility in Bundaberg, Queensland. Additionally, the grant of the licence enables Canndeo to apply for the permit to utilise its own plant material in the newly licensed manufacturing facility.

The stock of the company was trading at A$0.475, up by 6.742% (as on 10 July 2019, AEST 01:04 PM). The stock has given a mixed performance in this calendar year with the last three month returns at -18.35%, and as of now, the stock is making recoveries from its decline in the month of May and June. Over the past one year, the return of the stock has been -21.93%.

AusCann Group Holdings Limited (ASX: AC8)

AusCann Group Holdings Limited (ASX: AC8) is engaged in the production, development and marketing of cannabinoid-based products in Australia and international sphere. Currently, the group is targeting the treatment of Chronic pain in Australia, exploring export opportunities and expansion into further medicinal areas.

On 01 July 2019, the company announced it had signed a new supply agreement with Tasmanian Alkaloids (TasAlk) for purchasing cannabis resin. Accordingly, TasAlk is a large manufacturer of controlled substances producing alkaloid raw material in Tasmania for medicinal purposes. Also, medicinal cannabis would be added to the portfolio for analytical testing, cultivating and manufacturing services to be available in 2020.

As per the release, AusCann and TasAlk entered into a strategic alliance in the CY17 to make parallel use of the competencies in the cultivation of medicinal cannabis, manufacture and distribution of cannabis products. Since the alliance, AusCann has advanced its strategy to provide cannabinoids-based pharmaceuticals to healthcare practitioners with reliable, dose-controlled products and tools to personalise treatment outcomes for patients. In this regard, TasAlk is specialised in supplying the pharmaceutical industry with plant-derived raw material Active Pharmaceutical Ingredient (API).

Reportedly, the new agreement with TasAlk succeeds the original alliance and improves a valuable partnership between the parties, whereby TasAlk would provide high-quality cannabis raw material for the development and production of reliable and consistent cannabinoids-based pharmaceuticals by AusCann Group.

Under the agreement, AusCann would purchase a minimum of 30% of the resin supply requirement from TasAlk for an initial three-year period, which could be extended for another three-year term. Further, this allows AusCann to tap the raw material supply of the highest quality standard for the hard-shell capsules and product pipeline.

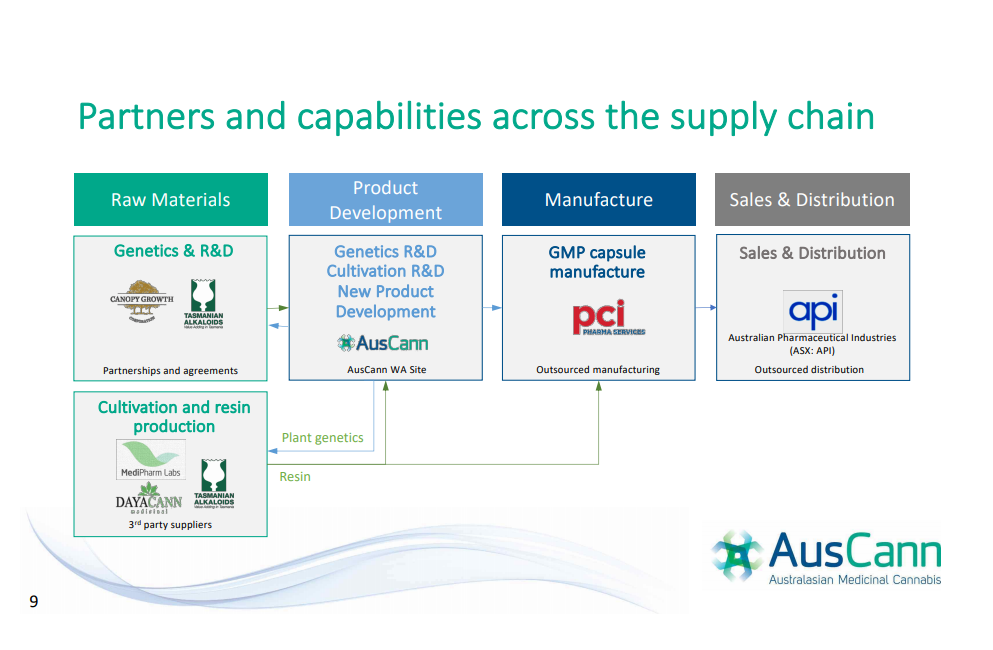

Supply Chain Capability (Source: Investor Presentation, March 2019)

Supply Chain Capability (Source: Investor Presentation, March 2019)

As per the release, the agreement is a part of the strategy to de-risk the supply chain of various GMP resin suppliers, consistently with the agreement collaborated with MediPharm Labs in February this year. Also, the urge for stability and consistency of dose in cannabinoids-based medicines would be addressed using its hard-shell capsules which addresses the requirement for steadiness of dose in cannabinoids-based medicines.

In a notice to the exchange on 12 June 2019, AusCann reported that Canopy Growth Corporation increased the interest in the company to 13.28% from 11.13%. Previously, on 22 May 2019, AusCann had announced that Mr Ido Kanyon joined the company as Chief Executive Officer (CEO). As per the release, Mr Ido Kanyon has demonstrated capabilities in global pharmaceuticals, and medical device business experience across the life science value chain. Also, he had demonstrated the successful launch of innovative medicines globally, tapping more patients with access to cost-effective, superior quality and life-changing treatment options. Furthermore, the experience of the new CEO extends to a comprehensive range of health care technologies and commercial strategies, which includes capsule inhalers to innovative biologics and digital health solutions.

On 10 July 2019, AC8âs stock was trading at A$0.380 (at AEST 1:02 PM), up by 1.333%. Over the past one year, the return of the stock has been at -68.49%. However, the stock witnessed an increase of 5.63% in the past one month. Further, the market capitalisation of the stock is ~118.87 million, with ~317 million shares outstanding.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.