Medlab Clinical Ltd

Medlab Clinical Limited (ASX:MDC) is primarily engaged in sale of nutraceutical products (a mix of nutrition and pharmaceutical food product). It is also involved in pharmaceutical research and commercialisation. On 18 June 2019, the company announced that it has received the human ethics approval for a second NanaBis⢠trial, known as an Observational study. NanaBis⢠is Medlabâs patented cannabis-based medicine. The trial will include a study of how NanaBis⢠is used by the Australian doctors, involve patient feedback and provide supportive data for its global regulatory efforts. Medlab is planning to roll out the trial to 2000 patients in Australia.

Simultaneously, the company also has the Royal North Shore (RNS) trial going on which has provided encouraging data and can prove to be a strong contender for pain management in conjunction with NanaBisâ¢.

Since Cannabis is an illicit narcotic drug Australia, Medlab has government approval to supply NanaBis⢠nationally and sell it when prescribed by a medical practioner under the Governmentâs SAS. The company is also allowed to import the raw material required for production of NanaBis⢠and export the drug to foreign countries. In the midst of opioid crisis which is causing death and rising healthcare costs, NanaBis⢠serves as a real alternative with its reduced psycho-toxicity component.

On the financial front, Medlabs recorded monthly sales of over $1 million for the first time in April 2019 along with best ever quarterly sales in March quarter 2019. Cash balance as at 31 March 2019 was $13.169 million. The company reported a strong intellectual property standing with a total of 28 patents and an additional 3 in filing. On the product front, NanaBis⢠reported continued growth with a Head of Agreement executed with Canada based Pharmascience Inc. for distribution in Canada. In May 2019, it executed another HoA with Mega Lifesciences Public Company Limited, a Thai company, for distribution of NanaBisâ¢. Its second cannabis product NanaBidial was released to Australian doctors under Govtâs SAS.

The stock of the company on 18 June 2019 closed flat at a market price of $0.360.

Creso Pharma Limited

Creso Pharma Limited (ASX:CPH) is engaged in development, registration and commercialisation of pharmaceutical-grade cannabis and hemp-based nutraceutical products and treatments. The company makes products for humans and animals.

On 07 June 2019, the company informed the exchange that the company would be acquired by PharmaCielo Ltd, the Canadian parent of PharmaCielo Colombia Holdings S.A.S., the largest producer of cannabis as well as a fully licensed producer of medicinal cannabis oil products in Colombia. The acquisition will be for a consideration of AUD$122 million at AUD$ 0.63 per share.

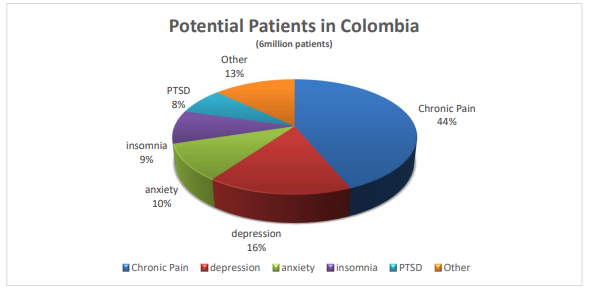

Potential Patients in Colombia (Source: Company Reports)

The acquisition is said to take place through two schemes of arrangement. One between Creso Pharma and its shareholders and another between Creso Pharma and its optionholders. The companyâs shareholders will get 0.0775 shares of PharmaCielo for every Creso Pharma share held. The optionholders will receive 0.0185 PharmCielo shares for each listed option in Creso Pharma. Other holders in Creso Pharma, for instance performance shares, performance rights and other unlisted securities will also be entitled to receive share in PharmaCielo subject to agreed ratios. After the implementation of the scheme, Creso Pharma securityholders will hold approximately 13% stake in PharmaCielo and the remainder will be owned by its own shareholders.

Through a combination of PharmaCieloâs leadership in terms of price, quantity and quality in cannabis and Creso Pharmaâs early mover advantage in human and animal cannabis-based products, the acquisition will help create a vertically integrated supply chain. The cultivation and processing facilities will expand which in turn will also diversify the product portfolio.

Q3FY19 was characterised by global expansion across Australia, Europe and North America through collaborations and agreements. In February, the company signed a collaboration agreement with Hempmate AG, a Switzerland based company, for co-developing products in the area of CBD hemp products. In January 2019, it signed a Letter of Intent with Ceyoka Health Private Limited for expansion of medical cannabis across Sri Lanka. Another agreement with New Zealandâs Medleaf Ltd was also signed in January aimed at building a comprehensive cannabis business in New Zealand. It raised AUD$ 3 million in a placement to assist the sales and marketing of its human and animal products in Europe and Canada. The company reported revenue from sales of human and animal products of approximately AUD$ 167,633. Construction expenditure for the quarter amounted to AUD$ 1.78 million.

The stock closed the dayâs trade at a market price of $0.525, up 3.96% on 18 June 2019.

AusCann Group Holdings Ltd

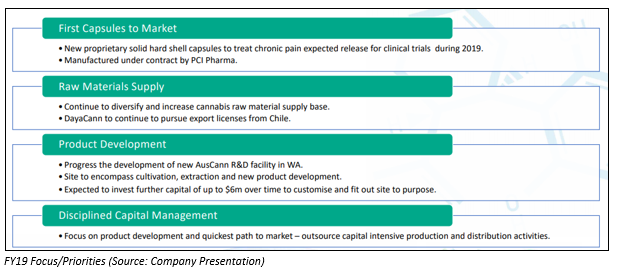

AusCann Group Holdings Ltd (ASX:AC8) manufactures clinically validated cannabinoid medicines. On 12 June 2019, the company made an announcement regarding change in substantial holding of Canopy Growth Corporation. The voting power of the shareholder increased from 11.13% to 13.28%. A day before, it made another announcement to the exchange for the issue of 7,807,509 fully paid ordinary shares.

The quarter ending March 2019 was characterised by the appointment of Ido Kanyon as the new CEO. He holds extensive experience in the pharmaceutical industry and brings an in-depth understanding of product development and commercialisation.

The period also saw a set of agreements and acquisitions for development of business. AusCann signed an agreement with Canadaâs MediPharm Labs for the supply of cannabis resin for development and production of its first line of hard-shell capsules. The agreement has strengthened the companyâs raw material supply chain and will support the development of safe and consistent quality cannabinoid medicines. The period also saw acquisition of an R&D facility site in Perth, Western Australia for a price of $5.25 million. Alongside, AusCannâs joint venture with DayaCann continued its advancements in Chile through commencement. The JV is expected to commence its first cannabis cultivation activities with a Canadian listed medical cannabis company, Khiron Life Sciences later this year.

The stock of the company closed the dayâs trade on 18 June 2019 at $0.375, up by 1.351% as compared to previous dayâs closing price.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.