Companies engaged in the identification, as well as extraction of metals and minerals, are categorised under the metals & mining sector. These companies are involved in metal production, trading as well as investing, which drives their revenue.

The benchmark index S&P/ASX 200 settled at 6,640.3, down 2.5% on 06 August 2019, while S&P/ASX 300 Metals and Mining (Industry) closed the dayâs trading at 4,395.2, reporting a fall of 0.71% from its previous close. In this piece of article, we would have a look at the recent developments in four companies operating in the metals & mining sector.

Leigh Creek Energy Limited

PCD Plant and Operations Compliance Status

Leigh Creek Energy Limited (ASX: LCK), an explorer and developer of minerals, on 2 August 2019, announced that it had substantively completed its consultation with regulatory bodies in South Australia related to the operations and shutdown process for Pre-Commercial Demonstration (PCD) stage of the companyâs namesake Leigh Creek Energy Project (LCEP) in South Australia. The company at present is under a detailed discussion with the Department Energy and Mining (DEM) Mining concerning the approval process pathway for finalising approval of the commercial project.

Completion of Capital Raising worth $ 3.2 Million

On 1 August 2019, the company updated the market regarding securing a further capital funding to support LCEPâs development. The capital raising was through the private placement of 14.32 million ordinary shares at an issue price of $ 0.225 per share.

The fund raised through the placement would support the company to continue with the speedy development of maiden 2P reserve of 1,153PJ, which is the largest uncontracted gas reserve in Australia. The gas reserve is available for delivery to gas buyers in the East Coast.

Q4 Activities Highlights

- LCK on 25 June 2019 unveiled the completion of its program to end operations, shutdown as well as preserve the Pre-Commercial Demonstration (PCD) plant and equipment.

- Outlined plans regarding the commercialisation of proven and probable gas reserves of 1,153PJ in its corporate presentation in May 2019.

- LCK provided information related to the two pre-conditions that are necessary to achieve 2P Reserve status as per the global best-practice for reporting petroleum.

Q4 Financial Highlights:

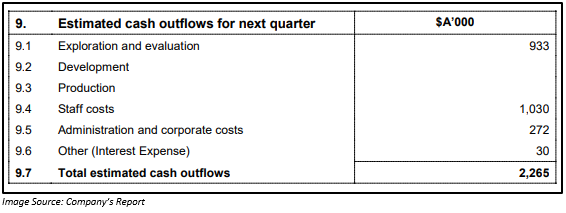

LCK used A$ 3.834 million in its operating activities. The net cash inflow through investing activities was A$ 0.020 million, and through financing activities was A$ 0.312 million. Cash and cash equivalents by the end of Q4 FY2019 was A$ 3.057 million. Estimated cash outflows in the Q1 FY2020 are A$ 2.265 million.

Stock Information

By the end of the trading session on 6 August 2019, the shares of LCK closed at A$ 0.250, up by 2.041% as compared to its previous closing price. LCK has a market cap of A$ 134.3 million and approximately 548.14 million outstanding shares.

Orion Minerals Limited

Diamond Drilling Program

On 5 August 2019, Orion Minerals Limited (ASX:ORN), a company engaged in mineral exploration and development, announced that its joint venture partner Independence Group NL (IGO) had started diamond drilling in the Fraser Range belt in Western Australia. The drilling program is intended towards testing several highly prospective intrusive nickel-copper and VMS zinc-copper targets. The drilling process is under progress at the North-West passage nickel-copper joint venture geophysical prospect on the Fraser Range belt.

Initially, the target was recognised by the company on tenement E39/1654 (IGO 60%, Creasy Group 30% and Orion 10%) during a VTEM survey held in the year 2014.

The drilling would also be testing joint Nickel-Copper Intrusive as well as Copper-Zinc VMS targets that were founded at the Pike, Pike-Eye along with Hook prospects. Also, the Moving Loop Electromagnetic (MLEM) ground surveys helped in defining numerous compelling drill targets at the Pike prospect.

On the same day, i.e. on 5 August 2019, the company released an investor presentation providing an update on its Prieska Copper-Zinc Project situated in South Africa and the IGO â ORN JV.

The company considers Prieska as the mine of the future. The company is implementing a modern operating philosophy in order to achieve quantum changes in key output parameters that are slow for improving or having regressed in the local mining industry.

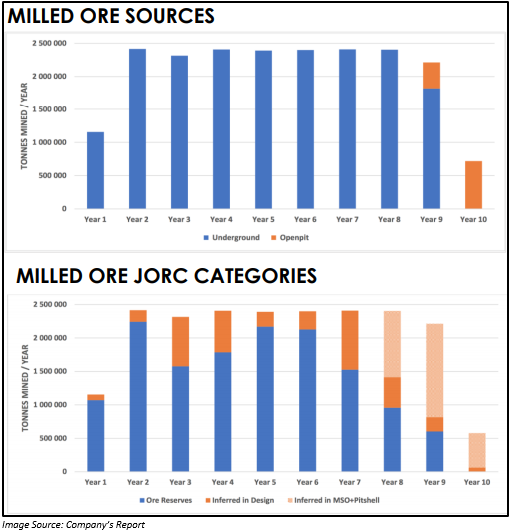

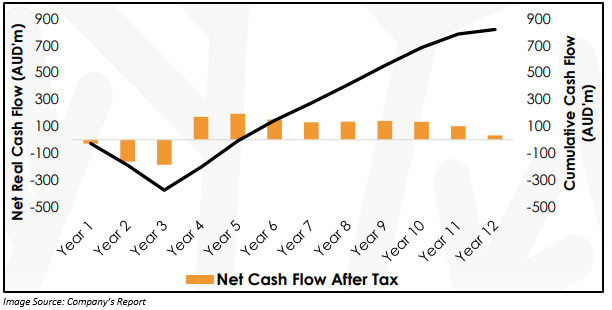

The company also provided an update on the mining production profile.

The company also provided Prieska BFS highlights, covering details related to the foundation phase and low extension phase. Foundation phase demonstrates a compelling investment case to set up financially strong mine with a preliminary 10-year life, and LOM extension phase leverages off foundation phase development with limited or no further capital work. The company also reported to have secured environmental authorisation to develop the Prieska Copper-Zinc project.

Stock Information

By the end of the trading session on 6 August 2019, the shares of ORN closed at A$ 0.025, down by 3.846% as compared to its previous closing price. ORN has a market cap of A$ 54.88 million and approximately 2.11 billion outstanding shares.

Bryah Resources Limited

Resources Update:

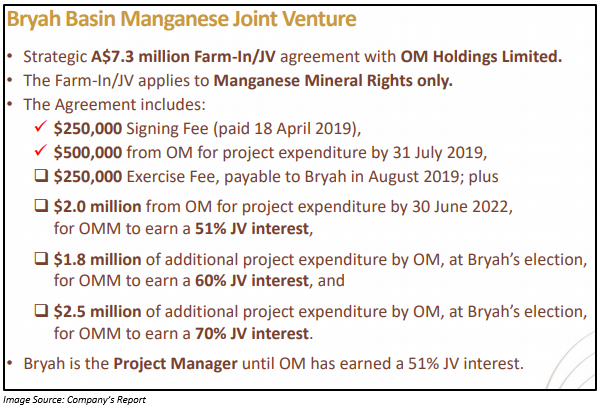

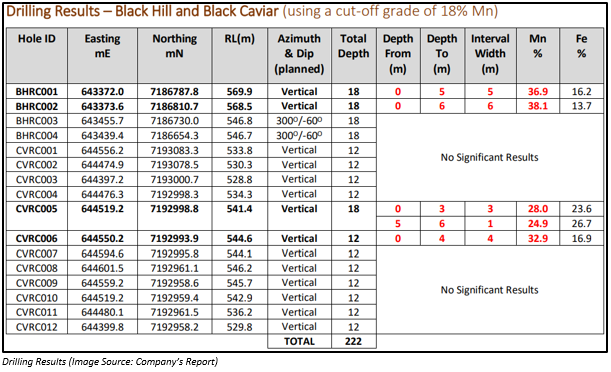

On 2 August 2019, Bryah Resources Limited (ASX: BYH), a Perth-based mineral exploration company focusing on high-grade copper-gold and manganese resources, announced results from the second phase of exploration drilling within the Bryah Basin located in central Western Australia. The drilling program was funded by the subsidiary company of OM Holdings Limited (ASX:OMH), OM (Manganese) Limited (OMM) as per the $ 7.3 million agreement signed by both the parties in April 2019.

In the investor presentation released on 5 August 2019, the company also indicated about the first phase of drilling tested for extensions of manganese mineralisation near HS Extended Pit as well as at Brumby Creek. Brumby Creek yielded a consistent result over a wide region. The reconnaissance drilling programme at the Brumby Creek also helped in understanding the potential of the region.

At Windalah Prospect, the mineralisation is in the right stratigraphy. A substantial copper-gold anomaly was founded in the Wonga war Prospect. Rock sample recorded an assay up to 1.17g/t of gold and 693ppm of copper.

war Prospect. Rock sample recorded an assay up to 1.17g/t of gold and 693ppm of copper.

Stock Information

The shares of BYH last traded at A$ 0.074 on 5 August 2019. BYH has a market cap of A$ 4.72 million and approximately 67.79 million outstanding shares.

MetalsTech Limited

Resource Exploration Tax Credit Refunds Update:

On 2 August 2019, MetalsTech Limited (ASX:MTC), a lithium and cobalt exploration company, announced that it had received final assessments from Revenue Quebec for its claims related to the Resource Exploration Tax credit refunds as well as credits on duties Refundable for losses. After the detailed audit, Revenue Quebec made multiple audit adjustments, which have been accepted by the company. Also, MTCâs Canadian tax advisors have advised Revenue Quebec accordingly. The company now expects to receive refunds around CAD 1.8 million, which is 95% more than the amount originally claimed by the company.

Q4 Highlights:

- The company identified spodumene-bearing pegmatite targets at the Cancet Lithium Project.

- Gold and copper potential examined at this project, and multiple prospective targets were identified on the trend as well as along the strike from Midland Exploration Inc within the recognised greenstone belt.

- The company would conduct a follow-up exploration and aim at the spodumene-bearing pegmatite regions along with the new recognised gold and copper targets.

- MTC also made two appointments during the quarter. The company appointed Dr Qingtao Zeng and Mr Noel OâBrien as Non-Executive Directors.

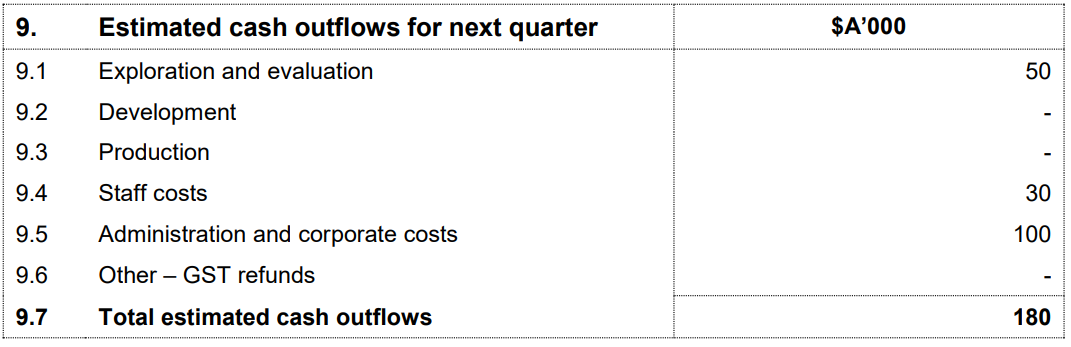

Q4 Financial Highlights:

- A$ 0.111 million cash used in the operating activities.

- Cash available by the end of Q4 was A$ 0.074 million.

- Expected cash outflow in Q1 FY2020 is ~A$ 0.180 million.

Image Source: Companyâs Report

Stock Information

By the end of the trading session on 6 August 2019, the shares of MTC settled at A$ 0.016, down 11.11% as compared to its previous closing price. MTC has a market cap of A$ 1.72 million and approximately 95.45 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.