AppsVillage Australia Limited (Proposed ASX Code: APV)

AppsVillage Australia Limited is an information technology company that is due to be listed on the Australian Securities Exchange on the proposed listing date of 23 July 2019. Its proposed ASX code is APV.

About the Company:

AppsVillage Australia Limited has acquired 100% of the shares in Israeli company, AppsVillage Ltd (AppsVillage). The core business of AppsVillage is to provide its proprietary software-as-a-service cloud-based platform to small-to-medium businesses to develop their own branded mobile app and connect with their clients.

Business Objective: The purpose of AppsVillage Australia Limited is to recognise technology companies that have future growth potential and then acquire them.

Timeline:

- AppsVillage Australia Limited was incorporated on 1 June 2018 and is expected to get listed on ASX on 23 July 2019.

- On 5 June 2019, AppsVillage Australia inked an agreement to acquire Israeli company AppsVillage Ltd.

- AppsVillage Ltd was incorporated on 3 September 2015. It commenced generating revenues from 2016 and to the date of the IPO Prospectus, it has reportedly generated total income of over A$1,000,000.

- AppsVillage has secured a global presence with active users across 142 countries and has generated a total sales of more than A$300,000 in Q1 2019.

Vision: AppsVillage was founded on the vision of empowering small-to-medium businesses (SMEs) to manage, create and share their own apps to accelerate their sales and marketing through AppsVillageâs personal mobile apps channel.

USP: The Australian market has an excellent reputation for incubating and growing Israeli technology companies and therefore, the company believes that Australian market is perfect to execute its long-term growth strategy to become a market leader with an innovative SaaS offering.

Research indicates that mobile phone users spend ~90% of their mobile usage time using apps and AppsVillageâs technology has revolutionised the development of mobile apps, allowing any business to launch and build their own mobile apps without any requirement to write code by themselves or acquire digital marketing know-how.

Since 2016, AppsVillage has achieved a number of milestones including its strategic partnerships with company such as Facebook.

One of the biggest USP of AppsVillageâs platform is that it allows Instagram and Facebook Instagram users to create their app in minutes by automating all the branding and design of the app. clubbing the already existing information sources from its Facebook or Instagram page.

Process of developing App using Facebook and AppsVillage Platform (Source: Company Prospectus)

Revenue Generation: As per AppsVillage Australia Limited, the company will generate revenue through the AppsVillage business, which allows SMEs to create and maintain their own mobile app by purchasing a subscription via AppsVillageâs website in a SaaS model.

Income is presently derived from:

- monthly and annual subscription fees paid by customers for use of the AppsVillage platform;

- commission received on each sale of premium app features made through the AppsVillage platform; and

- commission received on customersâ advertising on selected social media platforms.

However, following its listing, the company intends to consider other opportunities to generate revenue from the AppsVillage business.

IPO Details:

In the Initial Public Offering (IPO) to get listed on ASX, the company has placed an offer to raise minimum $5 million by the issue of 25 million shares at an issue price of $0.20. The company has also placed the upper cap of further $1,000,000 wherein it ensures to accept the oversubscription of up to a further 5,000,000 shares at the same issue price.

Purpose of the Offer:

- To facilitate the listing of AppsVillage Australia Limited on ASX,

- To achieve its business objective of identifying prospective technology companies for acquisition.

- Further, the company plans to focus on scaling the business and growing revenues, following the completion of the Offer.

QuickFee Limited (Proposed ASX Code: QFE)

QuickFee Limited is a fintech company that is proposed to be listed on the Australian Securities Exchange (as per prospectus 3 July 2019).

About the Company:

QuickFee Limited has entered into agreements for the acquisitions of QuickFee Australia Pty Ltd (QuickFee AU) and QuickFee Group, LLC (QuickFee US), which are involved in the provision of payment portal and SME lending to clients of accounting and law firms in Australia and accounting firms in the USA.

Timeline: QuickFee Limited was incorporated on 15 February 2018 for the primary purpose of completing the acquisitions of QuickFee AU and QuickFee US. QuickFee AU was founded in March 2009 and developed a unique payment gateway for Australian accounting and law firms, allowing them to accept monthly payment plans where clients obtain finance online from QuickFee AU to facilitate invoice payments to the professional services firm in full. Following the success of QuickFee AU in the Australian market, management of QuickFee AU incorporated QuickFee US in 2016 as an entirely separate operating entity to pursue opportunities in the much larger market in the USA where no direct competitor exists.

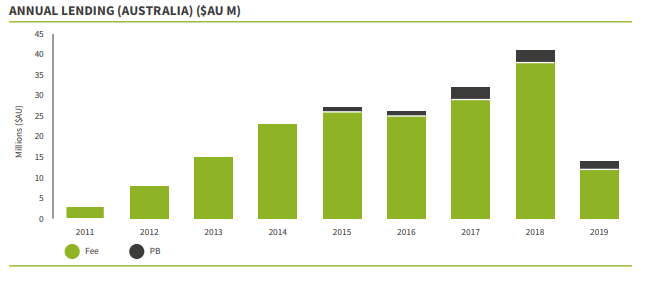

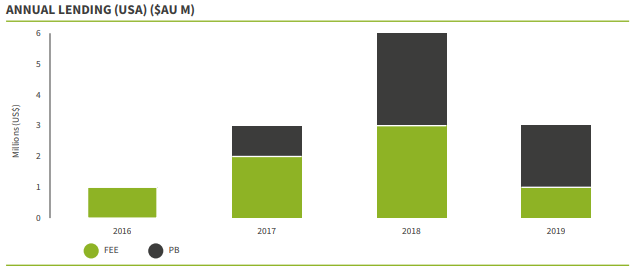

Breakdown of loans granted by QuickFee AU and QuickFee US through the QuickFee Portal (PB) versus loans generated by Firms without use of the QuickFee Portal (FEE). (Source: Company Prospectus)

Business Objective: The companyâs strategy is to build on QuickFee AUâs profitable operating history and significant market position in Australia and to take advantage of the largely untapped growth opportunity identified in the much larger USA market for professional services fee funding.

Post-listing, the company aims to achieve the following objectives as it grows:

- achieve scale and enhance profitability by pursuing a strategy of rapid Firm acquisition, and growth in its book of loans;

- increase awareness of the QuickFee Platform by growing outbound marketing and sales efforts with a view to expanding system sales and monthly recurring revenue aggressively; and

- capture a market-leading position in the USA and grow its market share in Australia.

Revenue Generation: The QuickFee Business generates revenue from selling its services to users by marketing to firms and having them host the QuickFee Platform while recommending the loan services provided by the QuickFee Business to their Clients. QuickFee AU also generates revenue through Disbursement Funding and Family Law Funding.

Specifically, the QuickFee Business earns revenue from:

- monthly hosting fees;

- credit card processing;

- rapid settlement of EFT transactions in the US;

- interest accrued and facility fees through debt financing of Client invoice payments; and

- interest accrued and facility fees through debt financing disbursements and family law proceedings for Australian legal Firms.

IPO Details:

QuickFeeâs Initial Public Offering (IPO) is of a total of 67,500,000 shares at $0.20 per share to raise $13,500,000. The public offer with the closing date of 26 June 2019 (as stated in the prospectus) invited application from retail and sophisticated investors in Australia.

The company intends to utilise the funds raised from offer in ongoing lending activities to clients of professional services firms within Australia and USA. The other areas of funds utilisation include marketing of the QuickFee Platform, meeting working capital requirement, integration with accounting software vendors and, foremost, admission to ASX.

Sezzle Inc. (Proposed ASX Code: SZL)

US-based Fintech company, Sezzle Inc. is set to get listed on the Australian Securities Exchange by the issue of 35,714,286 CHESS Depositary Interests (CDIs) over shares of common stock in the company at an issue price per CDI of A$1.22 to raise approximately A$43.6 million in the Initial Public Offering (IPO).

Business Model: Sezzleâs base product is an interest-free instalment payment solution that benefits both consumers and the retailers that partner with the company. Sezzleâs payment platform reaches consumers through its merchant partners as a payment option in the online checkout. It allows the consumers to have a budget-focused purchasing power by using the Sezzle option at payment gateway to make the payment and pay it over four instalments, interest-free.

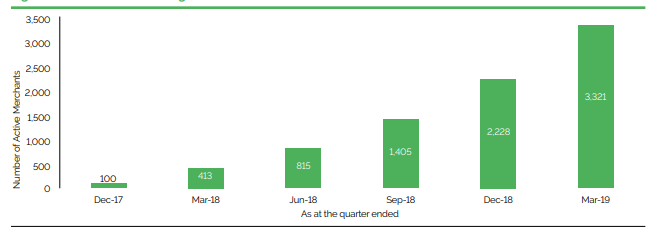

Growth: As at 31 March 2019, the company had 3,321 Active Merchants in 12 countries, with the vast majority in the United States, and had 269,820 Active Customers. Since launching its payment platform in 2017, Sezzle has grown at a tremendous pace. In 2018, Sezzleâs Total Income grew by an average quarterly growth rate of 101% and its end-customer and retail merchant client growth also closely matched that rate.

Sezzle Active Merchants growth (Source: Company Prospectus)

Revenue Generation: Sezzle generates income from two main sources that includes Merchant Fees and Reschedule Fees. The company charges Merchant Fees from its affiliated merchants for facilitating the purchases by end-customers transacted on their web sites. The fees is charged on the interest-free lending to End-customers who purchase goods from those merchants; the fees includes both fixed and variable component, which is a percentage of Merchant Underlying Sales. In FY17 and FY18 Merchant Fees as a percentage of Merchant Underlying Sales were 3.0% and 4.8%, respectively.

Whereas, Reschedule Fees are applied to End-customers where the shopper requests to shift their instalment schedule. Sezzle limits reschedules to two weeks from the originally scheduled date and allows End-customers to reschedule once per order for free. Additional reschedules on the order are levied a US$5.00 fee and are dependent on the shopper agreeing to that additional fee.

The offer settlement date is scheduled to 24 July 2019. Sezzle is expected to begin trading on ASX from 30 July 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.