The Australian Securities and Investment Commission (ASIC) releases short positions report, which allows checking the companies that were sold short by the market participants. As of 15 November 2019, the data on short positions at the ASIC website is for 11 November 2019.

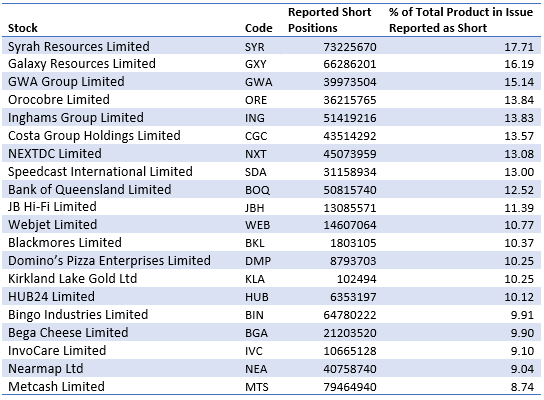

Most Shorted Stocks (Source: ASIC)

Short Selling

Short selling is a popular activity in the market, where an investor sells a security at the prevailing prices to benefit from the expected loss in the market value of that particular security.

Theoretically, the loss in a short-selling transaction could be unlimited while the profits are limited. It is due to the fact that the price of any security can only reach the lowest level of zero; however, the upside price potential of any security is unlimited.

Market regulators closely monitor short selling in order to maintain a fair and robust market while protecting investors interest

In addition, short selling carried by market participants mostly requires them to borrow the securities initially, followed by any transaction made by the borrower. Later, the securities are returned to the lender, and this whole activity is called security lending, which is often facilitated by large brokerages, custodians, depositories etc.

Short Activism

The short-sellers have also targeted Australian companies this year and accused companies of various allegations. As a result, there was a substantial loss in the market value of those companies following the attack by short-activists.

Short activists usually carry research on companies, evaluate their business models, perform accounting checks to find discrepancies. And, these efforts are later drafted into a report which is released in the market to gain from the anticipated fall in the market value of those particular securities.

Most recently, WiseTech Global Limited (ASX: WTC) was attacked by a short seller, and there was a significant fall in the market value. WiseTech was accused of misrepresentation of financial statements, inflation accounting, among others. However, the company has denied the claims.

Earlier this year, Rural Funds Group (ASX: RFF) was under pressure by short activists, the group was attacked twice this year. Meanwhile, RFF has also initiated legal proceedings against Bonitas Research LLC and its principal to recover for loss and damage suffered.

Letâs look at top twenty shorted stocks as of 11 November 2019:

Syrah Resources Limited (ASX: SYR)

As of 11 November 2019, around 17.71% out of the total product in issue was reported in short positions.

On 15 November 2019, SYR closed at $0.46, down by 4.167% relative to the last close. In the past five days, the stock is down by 5.15%.

Galaxy Resources Limited (ASX: GXY)

As of 11 November 2019, around 16.19% out of the total product in issue was reported in short positions.

On 15 November 2019, GXY closed at $1.080, up by 5.882% relative to the last close. In the past five days, the stock is down by 1.37%.

GWA Group Limited (ASX: GWA)

As of 11 November 2019, around 15.14% out of the total product in issue was reported in short positions.

On 15 November 2019, GWA closed at $3.190, up by 3.909% relative to the last close. In the past five days, the stock is up by 4.25%.

Orocobre Limited (ASX: ORE)

As of 11 November 2019, around 13.84% out of the total product in issue was reported in short positions.

On 15 November 2019, ORE closed at $2.720, up by 3.817% relative to the last close. In the past five days, the stock is down by 2.51%.

Inghams Group Limited (ASX: ING)

As of 11 November 2019, around 13.83% out of the total product in issue was reported in short positions.

On 15 November 2019, ING closed at $3.240, down by 0.308% relative to the last close. In the past five days, the stock is down by 0.92%.

Costa Group Holdings Limited (ASX: CGC)

As of 11 November 2019, around 13.57% out of the total product in issue was reported in short positions.

On 15 November 2019, CGC closed at $2.750, up by 3.774% relative to the last close. In the past five days, the stock is up by 0.73%.

NEXTDC Limited (ASX: NXT)

As of 11 November 2019, around 13.08% out of the total product in issue was reported in short positions.

On 15 November 2019, NXT closed at $6.93, up by 4.054% relative to the last close. In the past five days, the stock is up by 4.21%.

Speedcast International Limited (ASX: SDA)

As of 11 November 2019, around 13% out of the total product in issue was reported in short positions.

On 15 November 2019, SDA closed at $0.910, down by 3.704% relative to the last close. In the past five days, the stock is down by 12.08%.

Bank of Queensland Limited (ASX: BOQ)

As of 11 November 2019, around 12.52% out of the total product in issue was reported in short positions.

On 15 November 2019, BOQ closed at $8.620, up by 0.583% relative to the last close. In the past five days, the stock is down by 2.49%.

JB Hi-Fi Limited (ASX: JBH)

As of 11 November 2019, around 11.39% out of the total product in issue was reported in short positions.

On 15 November 2019, JBH closed at $36.610, up by 0.356% relative to the last close. In the past five days, the stock is up by 0.38%.

Webjet Limited (ASX: WEB)

As of 11 November 2019, around 10.77% out of the total product in issue was reported in short positions.

On 15 November 2019, WEB closed at $12.010, up by 2.30% relative to the last close. In the past five days, the stock is up by 3.89%.

Blackmores Limited (ASX: BKL)

As of 11 November 2019, around 10.37% out of the total product in issue was reported in short positions.

On 15 November 2019, BKL closed at $81.00, up by 0.099% relative to the last close. In the past five days, the stock is down by 2.24%.

Dominoâs Pizza Enterprises Limited (ASX: DMP)

As of 11 November 2019, around 10.25% out of the total product in issue was reported in short positions.

On 15 November 2019, DMP closed at $53.310, up by 2.303% relative to the last close. In the past five days, the stock is up by 5.94%.

Kirkland Lake Gold Ltd (ASX: KLA)

As of 11 November 2019, around 10.25% out of the total product in issue was reported in short positions.

On 15 November 2019, KLA closed at $70.5, up by 0.642% relative to the last close. In the past five days, the stock is up by 7.32%.

HUB24 Limited (ASX: HUB)

As of 11 November 2019, around 10.12% out of the total product in issue was reported in short positions.

On 15 November 2019, HUB closed at $12.220, down by 0.082% relative to the last close. In the past five days, the stock is down by 3.55%.

Bingo Industries Limited (ASX: BIN)

As of 11 November 2019, around 9.91% out of the total product in issue was reported in short positions.

On 15 November 2019, BIN closed at $2.94, up by 4.255% relative to the last close. In the past five days, the stock is up by 16.21%.

Bega Cheese Limited (ASX: BGA)

As of 11 November 2019, around 9.90% out of the total product in issue was reported in short positions.

On 15 November 2019, BGA closed at $3.930, down by 1.289 % relative to the last close. In the past five days, the stock is down by 0.51%.

InvoCare Limited (ASX: IVC)

As of 11 November 2019, around 9.10% out of the total product in issue was reported in short positions.

On 15 November 2019, IVC closed at $13.830, up by 0.363% relative to the last close. In the past five days, the stock is up by 2.60%.

Nearmap Ltd (ASX: NEA)

As of 11 November 2019, around 9.04% out of the total product in issue was reported in short positions.

On 15 November 2019, NEA closed at $2.880 up by 1.408% relative to the last close. In the past five days, the stock is up by 16.13%.

Metcash Limited (ASX: MTS)

As of 11 November 2019, around 8.74% out of the total product in issue was reported in short positions.

On 15 November 2019, MTS closed at $3.02, up by 1.003% relative to the last close. In the past five days, the stock is down by 0.66%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.