Amidst disrupting relations of the US and China due to harsh trade tariffs, the Australian benchmark index S&P/ASX 200 closed the trading session lower at 6,768.6 points on 2nd August 2019, down by 20.3 points or 0.3% from the previous close. The S&P/ASX 200 Resources index also witnessed a significant fall of 1.87%, closing at 4,867.4 points.

This article discusses the recent updates of three companies - Lynas, Alacer and Ausdrill -operating in the resources sector. Accordingly, Lynas â one of the largest mining companies in the country has provided some positive updates on the Malaysian business of the company. Alacer Gold has reported an update related to amendments in the financing facility with the syndicate of lenders. Recently, Ausdrill has also provided an update on its major Botswana Project. Let us take a deep dive into the recently released updates of these companies:

Lynas Corporation Limited (ASX: LYC)

On 2 August 2019, Lynas Corporation reported the Malaysian Regulatory Update. Accordingly, the company reiterated the comments made by Malaysian Prime Minister, which stated that the export of WLP residue would not be the condition for the renewal of Lynasâs operating license.

Besides, the company has been waiting for formal notification from the government regarding the conditions for the operating license. Further, the officials from the concerned ministry have said that the decision would be made by the Cabinet, and it is anticipated to be made public in mid-August 2019.

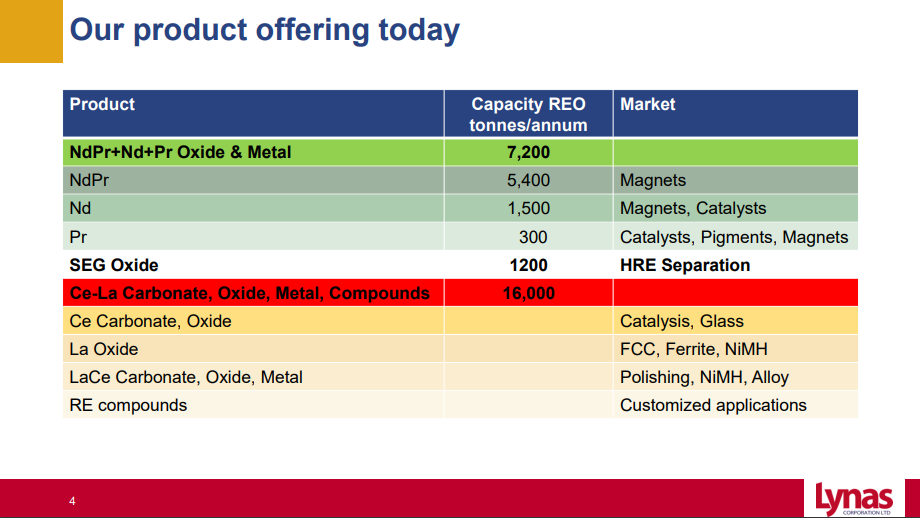

Offering (Source: Companyâs Argus Specialty Metals Conference Presentation, June 2019)

Lynas asserted that the preliminary work is underway for the outcomes that have been subject of media speculation, and it is conducting preliminary work for a Permanent Disposal Facility (PDF) for the WLP residue. Besides, it was reported that preliminary work is a follow-up on previously completed work, including the previously approved PDF Planning Framework by the AELB in 2014.

Recently, Lynas released its Quarterly Report for the quarter ended 30 June 2019. Accordingly, the company had provided an update on the Malaysian license, and it was said that the plant produced two solid residues, including WLP â a low level radioactive material regulated by the Atomic Energy Licensing Board (AELB), and NUF â a non-radioactive, non-toxic scheduled wasted regulated by the Department of Environment (DOE).

Also, the company is confident of resolution to the issues regarding WLP residue, and it has applied for the renewal of the operating license. Previously, in February 2019, the company had announced an agreed framework of the management of NUF residue, and it anticipates that after the finalisation of the conditions related to the operating license, the government would take a call on the NUF.

The total operating cash flow for the quarter was positive at A$37 million, which included A$105.5 million through receipts from customers, and the company incurred ~A$68.5 million in operating costs. Also, the investing activities recorded a net outflow of A$8.7 million, which included capex and net movement in term deposits.

Besides, the company recorded a net outflow of A$6.1 million in financing activities, which comprised of repayment of borrowing and net interest paid. Further, the closing balance of the company stood at A$89.7 million. Importantly, it was notified that the 2019 Annual General Meeting of Lynas is scheduled on 26 November 2019.

The company also produced about 1,500 tonnes of NdPr during the quarter, and the production was focused on stabilisation & optimisation of the new separated Nd & Pr circuits to match a range of product specification.

On 2 August 2019, LYC ended the dayâs trade at A$2.690, up by 6.32% from the previous close. Over the past one year, the return of the stock has been +11.95%. Besides, the year-to-date and three-months returns have been +64.82% and +27.46%, respectively. The market capitalisation of the stock is ~A$1.75 billion, with approximately 691.06 million shares outstanding.

Alacer Gold Corp. (ASX: AQG)

On 2 August 2019, the company reported that Ãöpler Sulfide Plant cleared the completion test by the syndicate of lenders. Consequently, the interest rate margin was reduced by 25 basis points to 3.5% to 3.7%, and the parent guarantee was released as well. It was asserted that the key amendments provided the company with better financial flexibility through reduction of lender cash sweeps while restricted cash in debt service reserve account would be $20 million from $46 million, which depicts a reduction of over 50% in restricted cash.

Reportedly, the syndicate lenders of the facility include Societe Generale London Branch, BNP Paribas SA, ING Bank NV and UniCredit S.p.A. Also, the finance facility does not entail compulsory hedging, no-prepayment penalties, and the last repayment is scheduled for fourth quarter of 2023. The company had US$315 million of outstanding debt on 31st July 2019, and consolidated cash of US$152 million, resulting in a net debt position of 163 million dollars.

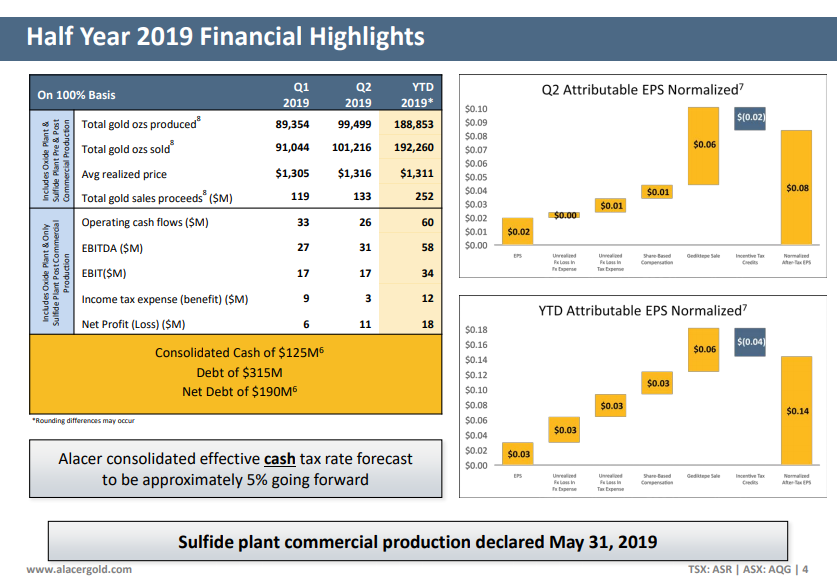

Recently, the company released second quarter 2019 operating financial results. The company closed the quarter with consolidated cash of $125 million which excludes $20 million in bullion sales made on 28th June 2019 and received on the first day of July. Also, the debt of the company stood at $315 million with net debt at $190 million â lower by $54 million from the start of the year. Besides, the company sold 192,260 ounces of gold, resulting in sale proceeds of $252 million.

The company reported the divesting of 50% non-operating interest in the Gediktepe Project. The consideration included a 10% Net Smelter Return on all oxide ore production, 2% Net Smelter Return on all sulfide ore production and cash consideration of US$10 million on contingent terms. Besides, drilling has been ongoing in the Ãöpler District with nine active diamond drills, and drilling analysis continues in the Ãöpler Saddle, where some mineralized areas have been identified.

Half Year Results (Source: Companyâs Presentation - Q2 2019, July 2019)

On 2 August 2019, AQG ended the trading at A$6.00, up by 3.44% from the previous close. Over the past one year, the return of the stock has been +102.8%. Also, the year-to-date and three-months returns have been +123.08% and +55.08%, respectively. The market capitalisation of the stock is ~A$1.74 billion, with approximately 300.39 million shares outstanding.

Ausdrill Limited (ASX: ASL)

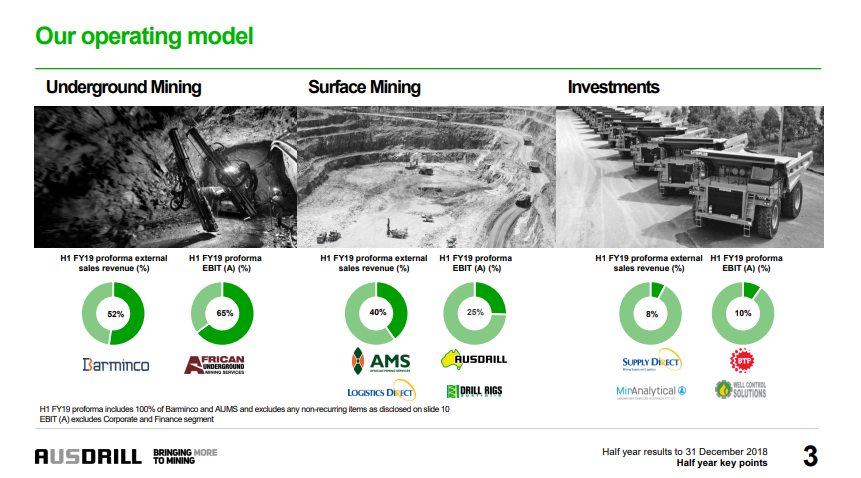

On 19 July 2019, the company announced an update on approximately A$800 million, five-year underground mining contract at the Zone 5 Mine in Botswana. Accordingly, Barminco , a subsidiary of Ausdrill, has bagged the contract from Khoemacau Copper Mines.

Previously, on 24 June 2019, the company had announced that the contract was subject to the close of project funding for Khoemacau. Recently, Khoemacau has intimated that project funding was successfully closed. Under the contract, the subsidiary would undertake mine development, construction of underground mine infrastructure, diamond drilling and more.

Mark Nowell, Managing Director of Ausdrill, stated that it is one of the largest contracts ever awarded to Barminco and a major opportunity for the company to pursue an international growth strategy. He also said that the company looks forward to delivering on the project, and the preparations have been underway to commence the mining services in December 2019.

On 6 June 2019, the company had reported an update on estimate of non-cash impairment for FY2019. Accordingly, the company has been preparing the financial report for FY2019 along with a review of working capital and balance sheet. The company expects that review would result in a non-cash impairment for the year ended 30 June 2019. Also, it estimates the impairment to be in the range of $75 million to $95 million, which equates to 2.8% to 3.6% of Ausdrillâs total assets. Besides, the adjustment would be included in FY2019 financial results.

The impairment would be non-cash in nature and it would not impact cash flow, operations and its compliance with banking covenants. The impairment would also not affect the companyâs $98 million underlying net profit after tax guidance for FY2019.

Besides, the financial report for FY2019 would comprise a positive non-cash fair value adjustment related to the appreciation of the company 50% interest in AUMS of $198.4 million, and taxation benefit worth $30.7 million mainly due to Barminco acquisition.

Operating Model (Source: Half Year Results Presentation, February 2019)

On 22 May 2019, the company reported that its subsidiary, BPT, secured a three-year extension worth $126 million in its existing contract with Peabody Australia. Accordingly, under the extension, the company would extend the rented mining and ancillary equipment to Peabodyâs coal mines located in the Hunter Valley & Bowen Basin. Besides, the commencement of the contract dates back to April 2015, and the current extension was initiated on 1 April 2019.

On 2 August 2019, ASL closed the trading down at A$1.900, down by 2.314% from the previous close. Over the past one year, the return of the stock has been +11.28%. Also, the year-to-date and three-months returns have been +72.12% and +16.12%, respectively. The market capitalisation of the stock is ~A$1.33 billion, with approximately 685.71 million shares outstanding.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.