A report from the Department of Industry, Innovation and Science suggests that the resource sector provides tax revenues, economic wealth, high wages, job and investments to Australians. The sector accounts for more than 8% of Australiaâs economy. This year, it is anticipated to deliver a record exports amounting to $264 Bn, which will account for more than 70% of the countryâs export. Four important companies of this sector are Independence Group NL, Ausdrill Limited, Perseus Mining Limited and OZ Minerals Limited. Letâs see how the recent developments are affecting the stock performance of these four players.

Independence Group NL (ASX:IGO)

Independence Group NL (ASX:IGO) has an engagement in the (A) Mining and processing of Copper and Nickel at the Nova operation, (B) Non-operator gold mining from the companyâs 30% interest in the Tropicana Operation, (C) Nickel mining at the Long operation, (D) Zinc, Copper and Silver mining at the Jaguar Operation and ongoing mineral exploration. The company recently announced the intersection of additional Copper and Cobalt at Lake Mackay Project (IGO 70%; PRX 30%) in the Northern Territory. The reverse circulation (RC) drill holes have identified a new prospect at Phreaker with multiple interceptions (>10 meters wide). After the successful interceptions of sulphide prospects in the 1st hole, drilling was done at another two holes in the same section.

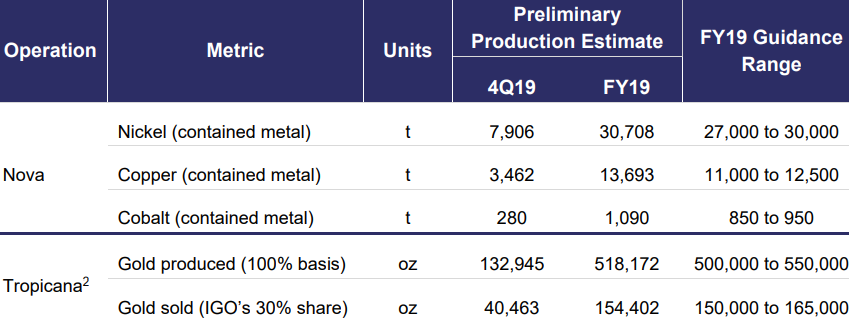

In another update, IGO announced that the metal production for June â19 quarter at Nova exceeded FY19 production guidance, whereas the metal production for June â19 quarter at Tropicana was well within the FY19 production guidance range. In Nova, FY19 production guidance for Nickel (contained metal), Copper (contained metal) and Cobalt (contained metal) was stated to be in the range of 27,000 to 30,000 tonnes, 11,000 to 12,500 tonnes and 850 to 950 tonnes, respectively. As per the June â19 quarter results, Nickel (contained metal), Copper (contained metal) and Cobalt (contained metal) production for FY19 stood at 30,708 tonnes, 13,693 tonnes and 1,090 tonnes, respectively. In Tropicana, gold produced (100% basis) and gold sold (IGOâs 30% share) for FY19 amounted to 518,172 oz and 154,402 oz, which was well within the stated FY19 production guidance of 500,000 to 550,000 oz and 150,000 to 165,000 oz, respectively.

June â19 Quarter Data (Source: Company Reports)

June â19 Quarter Data (Source: Company Reports)

On the stock information front, at the time of writing (on July 19, 2019, AEST 4 PM) the stock of Independence Group was trading at $5.390 up 2.083% with the market capitalisation of ~$3.12 Bn. Its current PE multiple is at 61.470x and its last EPS was noted at 0.086 AUD. Its annual dividend yield has been noted at 0.76%. Today, it made dayâs high at $5.445 and dayâs low at $5.300 with an average daily volume of 2,392,749. Its 52 weeks high was at $5.445 and 52 weeks low at $3.560 with an average volume of 2,066,464 (yearly). Its absolute return for the past 1 year, 6 months, and 3 months are 10.69%, 31.67%, and 10.69%, respectively.

Ausdrill Limited (ASX:ASL)

Ausdrill Limited (ASX:ASL) has an engagement in drilling and blasting, grade control, water well drilling, exploration drilling, mineral analytics, equipment sales and hire, etc., in Australia. In Africa, ASL offers load and haul and crusher feed services in addition to all the production-related services.

The company recently announced about its substantial holders, IOOF Holdings Limited and Norges Bank, who have disposed all of their stakes in the company, effective from July 10, 2019 and July 4, 2019, respectively. In another update, ASL informed the market that its wholly-owned subsidiary, Barminco Finance Pty Limited has released its Q3 FY2019 Business Update and unaudited condensed interim consolidated financial statements for Barminco Holdings Pty Ltd to the Singapore Exchange (SGX-ST) according to the terms of its outstanding 6.625% Senior Notes, which are due in 2022.

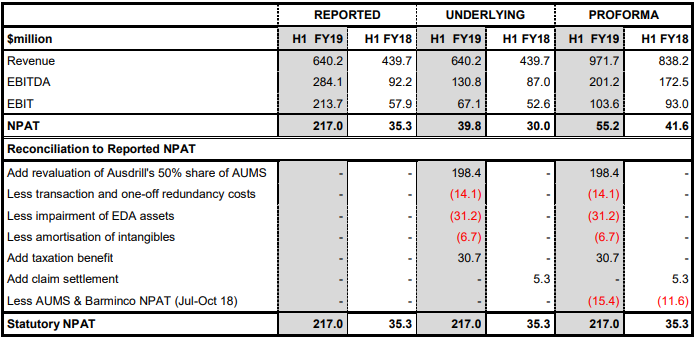

H1 FY19 (ended on December 31, 2018) Key Highlights: Revenues (reported) from operations increased from $439.7 Mn in H1 FY18 to $640.2 Mn in H1 FY19. This can be attributed to two months of contribution from Barminco and its additional 50% shares in AUMS (which was acquired on October 31, 2018). The EBITDA (reported) (earnings before interest, tax, depreciation and amortization) increased from $92.2 Mn in H1 FY18 to $284.1 Mn in H1 FY19. The EBIT (reported) (earnings before interest and tax) increased from $57.9 Mn in H1 FY18 to $213.7 Mn in H1 FY19. The NPAT (reported) (Net profit after tax) increased from $35.3 Mn in H1 FY18 to $217 Mn in H1 FY19. This can be attributed to a significant uplift from one-off, non-cash items related to the accounting treatment of the acquisition.

H1FY19 Key Financial Metrics (Source: Company Reports)

H1FY19 Key Financial Metrics (Source: Company Reports)

Outlook: Under the newly appointed Managing Director, Mark Norwell, ASL is expected to invest more on its staff and people, embrace innovation and technology and ensure focus on value adding systems and business discipline. ASL further aims to transform its ground operations in Africa and divest businesses, which strategically do not fit into their core operations.

On the stock information front

At the time of writing (on July 19, 2019, AEST 4 PM) the stock of Ausdrill was trading at $1.965 down 1.008% with the market capitalisation of ~$1.36 Bn. Its current PE multiple is at 4.120x and its last EPS was noted at 0.482 AUD. Its annual dividend yield has been noted at 2.52%. Today, it made dayâs high at $2.020 and dayâs low at $1.942 with an average daily volume of 2,188,985. Its 52 weeks high was at $2.020 and 52 weeks low at $1.042 with an average volume of 3,385,385 (yearly). Its absolute return for the past 1 year, 6 months, and 3 months are 24.32%, 52.69%, and 16.42%, respectively.

Perseus Mining Limited (ASX:PRU)

Perseus Mining Limited (ASX:PRU) has an engagement in gold production and mineral exploration along with gold project development in the Republic of Ghana and the Republic of Cote dâIvoire, both of which are located in West Africa. The company recently announced that it had achieved its gold production guidance, with gold production amounted to 131.27k ounces at US$918 per ounce and 271.82k ounces at US$960 per ounce for the June 2019 half year and financial year 2019, respectively. The gold production in June â19 quarter at Edikan and Sissingue mines stood at 42,555 oz and 21,570 oz, respectively. The All-In Sustainable cost (AISC) at Edikan and Sissingue mines amounted to US$1,090 per ounce and US$791 per ounce for the June Quarter, respectively. The gold sales for the quarter for Edikan and Sissingue mines were 41,110 oz and 19,374 oz, respectively.

June â19 Quarter Key Metrics (Source: Company Reports)

The groupâs gold production and All-In Site Cost for FY20 have been estimated at 260K to 300K oz and US$800 to US$975 per oz, respectively.

As per the companyâs balance sheet, PRU reported cash and bullion on hand of around US$119.3 Mn, which was an increase of US$38.5 Mn during the quarter. Outstanding bank debt reduced to US$31.5 Mn, reflecting a decline of US$13 Mn. Notional cashflow generated from operations was reported at US$19.2 million, and the amount received from the exercise of warrants and associated underwriting, net of fees was reported at US$37.8 Mn. During the period, PRU also inked a new US$150 million corporate debt facility, and the first drawdown to refinance the existing debt has been planned for the September â19 quarter.

On the stock information front

At the time of writing (on July 19, 2019, AEST 4 PM) the stock of Perseus Mining was trading at $0.710 up 6.767% with the market capitalisation of ~$776.35 Mn. Today, it made dayâs high at $0.722 and dayâs low at $0.685 with an average daily volume of 12,472,700. Its 52 weeks high was at $0.722 and 52 weeks low at $0.327 with an average volume of 5,363,424 (yearly). Its absolute return for the past 1 year, 6 months, and 3 months are 64.20%, 68.35%, and 47.78%, respectively.

OZ Minerals Limited (ASX:OZL)

OZ Minerals Limited (ASX:OZL) has an engagement in the mining and processing of ore contained copper, gold and silver; sales of concentrate; exploration activities; and the development of mining projects. The company recently announced the issuance of 543,743 performance rights issued under the OZ Minerals 2019 General Performance Rights Plan. The performance rights will be measured over the performance period, 1st January 2019 to 31st December 2019 and may vest upon the satisfaction of performance and service conditions. Performance rights that have vested may be exercised without payment of an exercise price. The number of performance rights granted was calculated based on the Volume Weighted Average Price (VWAP) for OZ Mineralsâ shares traded over the 20 trading days commencing 2nd January 2019, which was the effective date used as the basis for determining the value of the rights. The VWAP was $9.2211 per share.

In another update, OZL will spend around $10 Mn in three-stage exploration program over five years, whereby OZ Minerals Limited may earn up to 70% of Maslins Iron Oxide Copper-Gold Project.

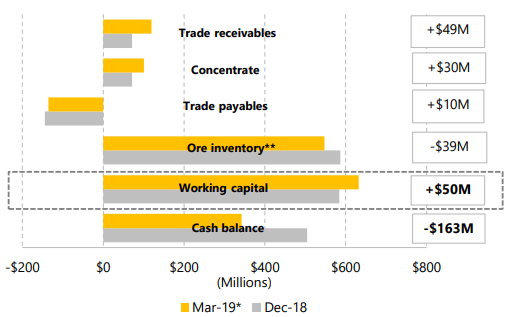

Q1FY19 Key Highlights: The company reported a cash balance of $342 million at 31st March 2019, with revolver cash advance facility extended to $300 million. Trade receivables for the period increased by $49 million due to the shipment timing late in the quarter. Concentrate inventory increased by $30 million in readiness for early Q2 shipment. Net ore inventory during the period witnessed a reduction of $39 million, following the open pit stockpile processing. The company made a cash investment of $116 million ($128 million of capital expenditure) for the Carrapateena project.

March â19 Working Capital Movement Data (Source: Company Reports)

On the stock information front

At the time of writing (on July 19, 2019, AEST 4 PM) the stock of OZ Minerals was trading at $9.970 up 1.943% with the market capitalisation of ~$3.17 Bn. Its current PE multiple is at 13.680x and its last EPS was noted at 0.715 AUD. Its annual dividend yield has been noted at 2.35%. Today, it made dayâs high at $10.030 and dayâs low at $9.820 with an average daily volume of 1,748,095. Its 52 weeks high was at $11.040 and 52 weeks low at $8.080 with an average volume of 1,796,978 (yearly). Its absolute return for the past 1 year, 6 months, and 3 months are 8.67%, 5.96%, and -7.12%, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.