The economy section made up of firms and entities that are engaged in delivering financial solutions and services to retail as well as commercial customer base is known as the financial sector. A large part of revenue of this sector comes from mortgages and loans. The financial sector of any economy depicts the health of the economy, stronger the financial sector is, healthier the economy and vice versa.

The Australian financial sector is a vital component of the economy and is characterised by a sophisticated environment. Below are some of the factors that give a boost to the Australian financial sector.

- A strong regulatory system;

- Adoption of new technologies in Australia is growing and leading to developments in the financial sector;

- Australia has the fourth-largest pool of investment fund assets, globally and the largest in the Asian region.

Let’s have a look at three financial stocks listed on ASX.

Steadfast Group Limited (ASX: SDF)

ANZ focused general insurance broker network, Steadfast Group Limited is in the business of providing services to Steadfast Network Brokers. Additionally, the company is engaged in the insurance policy distribution with the help of insurance brokerages and underwriting agencies.

The company, which was established in 1996, is also the largest underwriting agency group in Australasia, with growing operations in regions including Asia and Europe. The company has grown Steadfast Network to 398 brokerages, of which Steadfast Group holds equity in 65. Additionally, SDF has built a portfolio of 26 underwriting agencies and has a 40% interest in the unisonSteadfast network of 267 brokerages.

2019 AGM Highlights

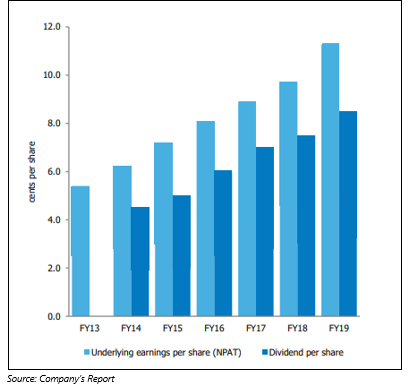

The company continues to perform since its listing in 2013. The total shareholder return for FY19 was 28% and since the listing the total return has been 239%, as of 30th June 2019. FY19 was a remarkable year for the company as it delivered strong revenue and profit growth.

- Underlying revenue was up 21.4% year-on-year to $688.3 million;

- Underlying EBITA was up 17.8% to $193.3 million;

- Underlying net profit after tax (NPAT) was up 19% to $89.2 million;

- Underlying diluted earnings per share (NPAT) was up 16% to 11.27 cents per share;

- Statutory NPAT, which includes net non-trading gains, was up 36.9% to $103.8 million.

The company declared a final fully franked dividend of 5.3 cents per share, which is up by 13% from the last year. The full year dividend stands at 8.5 cents per share, representing a payout ratio of 76%, balancing a healthy return for shareholders with ongoing investment in the business.

Guidance for FY20

- The company has given EBITA guidance of $215 million to $225 million and underlying NPAT of $100 million to $110 million for FY20;

- With the increased shares on issue, this translates to 5% to 10% growth in underlying diluted EPS (NPAT);

- This guidance is the underlying forecast result and excludes expensing the costs of the IBNA acquisition and Steadfast PSF Rebate offer.

Stock Performance

The stock of SDF closed the day’s trading at $3.660 per share on 18th October 2019, up by 1.667% from its previous closing price, with a market capitalisation of $3.06 billion. Its 52-week low and high is $2.490 and $3.890, respectively, while the total outstanding shares of the stock stood at 850.99 million. The company has given a total return of 1.41% and 13.92% in the time period of 3 months and 6 months, respectively.

Insurance Australia Group Limited (ASX: IAG)

Insurance Australia Group Limited is engaged in the underwriting of general insurance and related corporate services and investing activities and the company's segments include:

- Consumer Division (Australia), which provides general insurance products to individuals and families throughout Australia;

- Business division (Australia), which provides commercial insurance to businesses of all sizes throughout Australia under brands such as CGU and WFI;

- New Zealand, which provides general insurance business underwritten in New Zealand;

- Corporate and other, which comprises other activities, including corporate services, capital management activity and others.

Deals to Divest 26% Interest in SBI General

IAG has reached deals to divest the whole of its 26% interest in SBI General Insurance Company, which is its JV with the State Bank of India.

One of the two transactions being carried out is with Napean Opportunities LLP. Under this deal, Napean (part of Premji Invest) would acquire an interest of 16.01%. The other deal is with an affiliate of Warburg Pincus LLC for the acquisition of the remaining 9.99% interest.

Details of the transactions:

- The two deals are valued at more than $640 million; however, the amount is based on the current exchange rate;

- Following the completion of the two transactions, IAG’s regulatory capital position is expected to get a boost of over $400 million, in addition to an increase in net profit after tax of over $300 million. These additions would be recognised in the company’s FY20 results.

Stock Performance

The stock of IAG settled at $8.050 per share on 18th October 2019, up 1.258% from its previous closing price, with a market capitalisation of $18.37 billion. Its 52-week low and high is $6.530 and $8.740, respectively, while the total outstanding shares of the stock stood at 2.31 billion. The company has given a total return of -6.25% and 3.92% in the time period of 3 months and 6 months, respectively.

Challenger Limited (ASX: CGF)

Challenger Limited is engaged in primary activities through its two segments: Life and Fund Management.

- Life: The Life segment comprises Challenger Life Company Limited (CLC), Australia’s leading provider of annuities and guaranteed retirement income products and Accurium Pty Limited, which is a provider of self-managed superannuation fund actuarial certificates;

- Fund Management: The Fund Management segment focuses predominantly on the retirement saving phase of Australia’s superannuation system by providing products seeking to deliver superior investment returns, and it is also expanding its reach to international markets.

Quarterly Performance

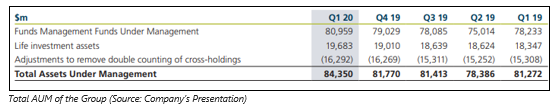

Challenger Limited’s total Assets Under Management (AUM) increased by 3% to $84 billion for the first quarter of FY20 ended 30 September 2019, which was driven by strong net flows across the business and positive investment markets.

- Life netbook growth reported at $766 million, or 5.2% for the quarter;

- Total annuity sales stood at $842 million for the quarter, up 14% on Q419;

- Australian annuity sales reached $624 million, down 11% on Q419;

- Japanese annuity sales were 26% of total annuity sales, up $180 million on Q419;

- Other Life sales reported at $936 million, up $737 million on Q419;

- Funds Management net flows $437 million and FUM up 2% for the quarter.

Stock Performance

The stock of CGF closed the day’s trading at $7.770 per share on 18th October 2019, up by 2.914% from its previous closing price, with a market capitalisation of $4.62 billion. Its 52-week low and high is $6.220 and $11.620, respectively, while the total outstanding shares of the stock stood at 611.96 million. The company has given a total return of 10.87% and -2.83% in the time period of 3 months and 6 months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_01_09_2025_07_01_12_631371.jpg)