At the time of writing on 17th October 2019, the benchmark index S&P/ ASX200 is placed at 6,684.7 points, down 0.77% with respect to the previous close. Some stocks have experienced a decent price movement in the recent past. In the article below we will be having a greater discussion on a few such companies.

WorleyParsons Limited

WorleyParsons Limited (ASX:WOR) provides engineering design and project delivery services. These include maintenance, reliability support services and advisory services. These are offered to energy, chemical and resources industries.

Acknowledgement in an Edition of Australian Financial Review

The company through a release dated 16th October 2019 has noted a report on WOR in Australian Financial Reviewâs edition:

- The company affirmed that the information related to its operations to the Foreign Investment Review Board, regarding possible creeping acquisitions by its leading shareholder, Dar Group (Dar) has been provided.

- WOR also made a confirmation that it has engaged with leading shareholder, Dar Group, in relation to further similar share acquisitions as well as requests by Dar for the companyâs Board representation. It has also engaged with Dar for a comprehensive business cooperation agreement.

Issue of Securities

- On 1st October 2019, the company has issued 1,350,243 fully paid ordinary shares and 6,431 share price performance rights.

- The securities have been issued to fulfil the terms of its Performance Rights Plan.

In another update, the company announced that Director Andrew Peter Wood has acquired 135,854 ordinary shares on 1st October 2019, which has led to change in his holdings in the company.

The stock of WOR closed at $13.640, up 0.147% as on 17th October 2019. The stock has produced a return of 20.11% during the year to date.

Phoslock Environmental Technologies Limited

Phoslock Environmental Technologies Limited (ASX: PET) provides solutions related to design, engineering and project implementation for water-related projects as well as water treatment products in order to clean up lakes, rivers, canals and drinking water reservoirs.

A look at Business Update

- The company through a release dated 16th October 2019 stated that the modifications at the Changxing Factory have been wrapped up successfully on time as well as within budget.

- It added that the daily production is currently more than 50 tons and the current production record stood at 58.5 tons/day.

- It brings the annual production capacity to 20,000 tons for the first production line.

- As of 30 September 2019, Phoslock happens to be debt-free, and the cash balance of the company stood at $14.6 million.

Future Guidance

- The company reiterated its guidance for revenue in the range of $27 million-30 million for the financial year 2019. It added that the global project pipeline is currently valued more than $330 million.

- It was mentioned in the release that the plans for a second production line at the Changxing Factory of similar size are being finalised. The purpose is to have it completed by May 2020.

The stock of PET closed at $0.980, down 10% as on 17th October 2019. The stock has produced return of 217.53% during the last six months.

Steadfast Group Limited

Steadfast Group Limited (ASX: SDF) provides services to Steadfast Network brokers and is into distribution of insurance policies through insurance brokerages as well as underwriting agencies.

An Update on Takeover Bid for IBNA

- As per the release dated 24th September 2019, the company advised the market participant that it has closed its takeover offer for IBNA Limited.

- It added that the takeover offer has been accepted by all the shareholders of IBNA Limited.

- The company has issued 21,382,569 fully paid ordinary shares at the price of $3.28 per share in lieu of consideration for IBNA takeover offer on 14th October 2019.

In another release, the company mentioned that 1,344,020 fully paid ordinary shares have been issued at the $3.7733 per share on 20th September 2019 pursuant to a dividend reinvestment plan.

Share Purchase Plan

- The company recently through a release stated that it has closed its share purchase plan, which was announced on 21st August 2019.

- SDF raised an amount of $19 million with 1,234 eligible shareholders as participants.

- With respect to SPP, 5,641,279 fully paid ordinary shares have been issued at the consideration of $3.38 per share on 19th September 2019.

Key Financial Highlights for FY 2019

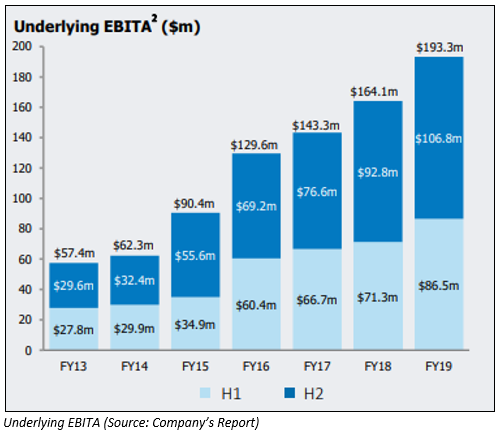

- The company reported underlying revenue, EBITA and NPAT with growth of 21.4%, 17.8% and 19.0% respectively over prior corresponding period in FY2019 and the respective figures stood at $688.3 million, $193.3 million and $89.2 million.

- Moreover, the statutory NPAT of the company for FY 2019 amounted to $103.8 million, which was higher 36.9% in comparison to underlying NPAT because of net non-trading gains.

The stock of SDF closed at $3.600, up 0.559% as on 17th October 2019. The stock has produced return of 34.08% during the year to date.

Austal Limited

Austal Limited (ASX: ASB) is engaged into the design, manufacture as well as support of high-performance vessels for commercial and defence customers globally.

Notice and Agenda of 2019 Annual General Meeting

The company recently announced that it would be holding its 2019 Annual General Meeting on 1st November 2019 and following will be the key agendas for discussion:

- Non-binding resolution to adopt the Remuneration Report.

- Board Spill Meeting.

- To consider Re-election of Ms Sarah Adam-Gedge.

- For taking in account a Rights Plan for incentivizing Long- and Short-Term performance.

- For taking approval for issuing Share Rights to Ms Sarah Adam-Gedge and Mr Chris Indermaur.

- For the approval of issuing Rights for LTI and STI to Mr David Singleton.

In another update, the company advised the market participants with the price of ordinary shares will be $4.19 per share, which are to be issued under dividend reinvestment plan for FY19 final dividend.

Change in Substantial Holdings and Directors Interests

- Austal in one of its release mentioned that Mitsubishi UFJ Financial Group, Inc. has made a change to their substantial holdings in the company on 17th September 2019 and the current voting power stands at 6.12% in comparison to the previous voting power of 5.11%.

- When it comes to change in holdings by directors, the company announced that Christopher Charles Indermaur has acquired 11,900 share rights at the consideration of $49,623.

- Accordingly, Sarah Adam-Gedge acquired 12,292 share rights, which led to a change in her holdings in the company. Post-change, Sarah Adam-Gedge possesses 10,000 ordinary shares and 25,876 share rights.

The stock of ASB closed at $4.270, up 0.235% as on 17th October 2019. The stock has produced return of 123.04% during the year to date.

To know more also read: https://kalkinemedia.com/au/news/austal-limited-increases-revenue-guidance-for-fy-2019-what-market-players-need-to-know

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.