Global technological advancement has compelled the turnaround across many business sectors. The rare earth elements sector is currently witnessing an accelerating demand for its minerals due to increased utility in technologically advanced products. As an effect of this lucrative opportunity, ASX Listed Rare Earth Stocks have made their way into the investorsâ watchlist.

Letâs discuss some of the rare earth stocks in Australia and assess their potential in the light of various forecasts and expectations in the near future.

Let us begin with strengthening the understanding of rare earth elements.

According to Geoscience Australia, rare earth elements (REE) are formed by a group of 15 lanthanide elements plus yttrium and sometimes scandium, that show similar physical and chemical properties to the lanthanides. These include elements like lanthanum (La), cerium (Ce), europium (Eu), gadolinium (Gd), terbium (Tb), dysprosium (Dy), holmium (Ho), praseodymium (Pr), neodymium (Nd), promethium (Pm), samarium (Sm),erbium (Er), thulium (Tm), ytterbium (Yb) and lutetium (Lu) in addition to scandium (Sc) and yttrium (Y).

Although these elements are referred to as rare, they are not mainly rare in the earthâs crust; rather are a relatively abundant group of elements with unique catalytic, metallurgical, nuclear, electrical, magnetic and luminescent properties which makes them strategically important due to their use in emerging and diverse technologies that are becoming acceleratingly significant in contemporary civilisation.

Over the past two decades, the REEs have witnessed a significant increase in their global demand as an effect of their expansion into high-end technological, environmental and economic environments.

[New to Stock Market Investment? Get Tips On Investing in ASX Stocks]JORC Reserves

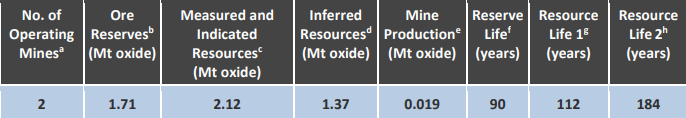

As at December 2018,

- Proved and Probable Ore Reserves of REO+Y2O3 reported in compliance with the JORC Code amounted to 2.84 Mt, an increase of 36% over 2017;

- These Ore Reserves do not include the approximately 17 kt of REO+ Y2O3 that have been reported within Proved and Probable Reserves of heavy mineral sands that are not expected to be recovered;

- Ore Reserves of REO+ Y2O3 at Australiaâs two operating mines, Mount Weld and Browns Range (Table 2), accounted for 60% of all Ore Reserves, which in turn account for 69% of Australiaâs Economic Demonstrated Resources (EDR);

Figure 1 Ore Reserves and Mineral Resources of REO+ Y2O3 (Source: Geoscience Australia)

Interestingly, further exploration of the resources has shown the following results:

- Economic Demonstrated Resources (EDR) of REO+ Y2O3 were 4.12 Mt at the end of December 2018, up by 26% from 3.27 Mt at the end of 2017;

- Australia had 33.99 Mt of REO+ Y2O3 resources considered to be sub-economic at the end of 2018, an increase of 11% from the 30.56 Mt at the end of 2017;

- Inferred Resources of REO+ Y2O3 in 2018 were 26.15 Mt, 5% higher than the 24.81 Mt at the end of 2017;

Production

In the production front,

- World production of rare earths, based on USGS data and modified for Australian production, was estimated to be 170 000 t of REO in 2018;

- According to Geoscience Australia, world economic resources of rare earths in 2018 totalled 120,000 kt of REO;

- The Australian production of rare earths in 2018 was almost 0.019 Mt which came predominantly from Lynas Corporationâs Mount Weld mine in Western Australia with output in 2018 reported as 18 556 t of REO;

- Australia was the worldâs second-largest producer due to output from Lynas Corporationâs Mount Weld mine in Western Australia;

- Concentrates from Mount Weld are processed at the Lynas Advanced Materials Plant in Malaysia to produce REO products;

- 6 t of rare earth carbonate was produced and exported to China by Northern Minerals Ltd from its pilot mining and processing operation at the Browns Range project in the Kimberley region of Western Australia;

Demand, Supply and Price Outlook

The growing strategic importance of REE and scandium was reflected in the inclusion of 35 critical minerals in the US Governmentâs 2018 list, signifying reliable and secure supplies of minerals that are critical to the US economy and military.

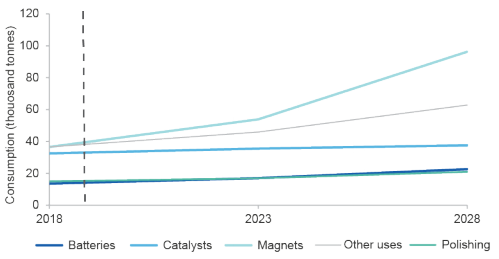

The Department of Industry, Innovation and Science expects the following:

- oversupply in some rare earth element markets like lanthanum;

- the market for neodymium to remain tight;

- consumption is expected to increase, particularly in magnet and battery end-use markets;

- prices for rare earths used in magnets and batteries are expected to grow substantially over the medium term;

Figure 2 Forecast rare earth consumption (Source: Australian Government)

- Praseodymium and neodymium prices are forecast to increase by 5-10 per cent over the next five years;

- Prices for heavy rare earths are expected to increase;

- Consumption is expected to grow and

- Near term price increases are expected to be maintained over the outlook period.

Let us now look at some of the ASX listed rare earth stocks.

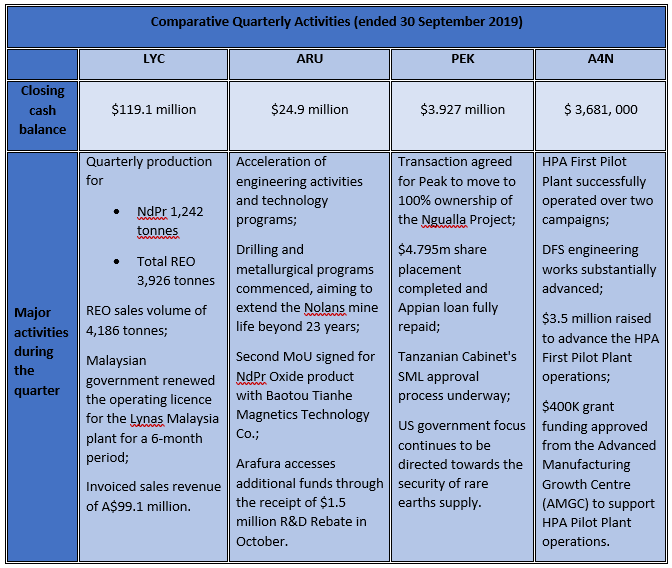

A glimpse of the quarterly activities of Lynas Corporation Limited (ASX: LYC), Arafura Resources Limited (ASX: ARU), Peak Resources Limited (ASX: PEK) and Alpha HPA Limited (ASX:A4N) is given in the table below:

The stock price of the above-discussed stocks, during the trading session on 29 November 2019 (at AEST 2:07 PM) are as follows:

- LYC $ 2.210, up 0.452%;

- ARU $0.090, up 1.124%;

- PEK $ 0.046, down 2.128% and

- A4N $ 0.200, up 5.263%, close to its 52-week high price of $0.205.

Bottomline

Australian Governmentâs plan to refine the settings in Australiaâs resources sector, Australiaâs Critical Minerals Strategy 2019 aims to promote investment into Australiaâs critical minerals sector and downstream processing activities, provide incentives for innovation to lower costs and increase competitiveness, and connect current and pipeline critical minerals projects with infrastructure development.

Based on the Austradeâs estimate about Australia to be well placed to capitalise on rising global demand for securing supplies of critical minerals, there is a huge opportunity for the rare earth companies to capitalise upon and we may witness a further increase in their stock prices.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.