Introduction

Considering that grapes are the most planted fruit crop worldwide, wine is one of the most produced and famous alcoholic drinks. A visit to Australia would be incomplete without tasting the exquisite wine varieties that the country proudly offers. Australians are amongst the worldâs biggest wine drinkers and the country possesses some of the oldest grape vines in the world.

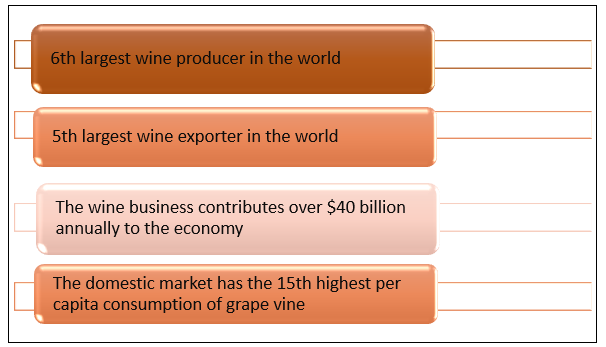

Let us begin our article by screening through some wine facts from Australia (as of 2018):

The Australian Wine Sector

Wines have been around for over 6,000 years, but Australia had not produced a few of its own until a couple of centuries ago. The first Australian grape vines were planted in 1788 at Sydney's Farm Cove, and at present, the total vineyard area in Australia is 135,133 hectares, according to Wine Australia, an Australian Government authority that promotes and regulates the Australian wine industry.

The total wine grape crush in 2018 was 1.79 million tonnes and there were approximately 2,468 wineries and 6,251 cultivators of grape, providing jobs to 172,736 (both, full and part-time) throughout the sixty five wine producing areas in the country. tres of wine â giving an average extraction rate of 716 litres/tonne. There are estimated to be 2468 wineries and 6251 grapegrowers employing 172,736 full and part-time employees across 65 winegrowing regions in Australia, contr

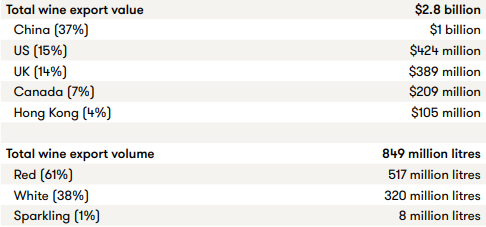

In the 12 months to June 2019 the value of Australian wine exports was up by 4 per cent to $2.9 billion, though the volume decreased by 6 per cent to 801 million litres, driven by increased competition and premiumisation in the market, as per Australian Vintage Limited (ASX: AVG). China continues to lead the market for wine exports, with sales up by 8 per cent to $1.1 billion.

The below image depicts Australiaâs wine exports details of 2017-2018:

(Source: Wine Australia)

Latest in the Australian Wine Sector

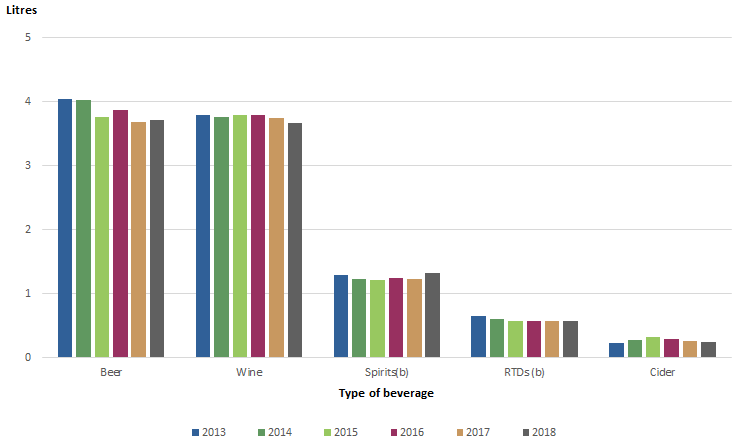

According to the recent Apparent Consumption of Alcohol, Australia, 2017-18 data provided by the Australian Bureau of Statistics (ABS)- there was an increase in availability of pure alcoholic beverages in Australia, for consumption, from 187.6 million litres (2016-2017) to 191.2 million litres (2017-2018). Of this, wine amounts for 38.6 per cent or 73.9 million litres. The ABS trend suggests that over the last 5 years, the wine consumption increased by 5 per cent each.

Apparent consumption of pure alcohol, Per capita(a) â Year ended 30 June 2013 to 2018 (Source: ABS)

Based on the population who consumed alcohol within the last 12 months, there was an average daily consumption of 2.08 standard drinks of wine per day among wine drinkers. In a typical week in 2017-18, around 52.8 per cent or 10.3 million of the Aussie population consumed alcohol, wherein 26.7 per cent consumed wine, and the beverage was more often consumed by females (31.3 per cent over the male consumption which accounted for 22 per cent).

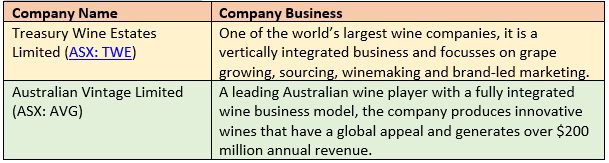

Given this backdrop, let us look at the two wine companies, which are from the consumer staples sector, listed and trading on the Australian Securities Exchange, and understand the recent developments in their businesses:

Companies under discussion

Treasury Wine Estatesâ Investor Day

On 24 September 2019, TWE conducted an Investor Day and released a presentation, notifying that the company was the most self-distributed wine company on a global level, driving sustainability in everything that it does. The companyâs vision is to become the worldâs most celebrated wine company, by efficiently utilising its strategic imperatives (people, brands, markets, partners and model). Presently, the company is building a brand portfolio and would be launching a French portfolio. Besides this, it would shift its focus from Fixing to Growth in the US wherein the EBITS margin would drive the Group margin.

TWEâs three phased approach (Source: Investor Presentation)

In FY19 period, TWE achievements consist of the establishment of Global Business Services, Expansion of distribution in China and Investment in French production assets. For the year, TWEâs NSR stood at $2,832 million, EBITS was at $663 million whereas the ROCE was of 14.9 per cent. The companyâs five-year EBITS CAGR is over 30 per cent.

In the Australian context, the company has more than double the share of the next largest supplier, excluding private label, and premiumisation continues, as the company would target 25 per cent market share in Australia.

TWEâs Competitive edge in Australia (Source: Investor Presentation)

TWEâs Dividend Distribution

On 23 September 2019, the company announced that it would pay ordinary and fully franked dividend to shareholders, relating to a period of six months ending 30 June 2019, on 4 October 2019. The declared dividend amount was of $0.20, and the DRP would be applicable in the distribution.

Australian Vintage Limitedâs Results

On 28 August 2019, AVG pleasingly released its full year ending 30 June 2019 results, highlighting the below points:

- EBITS up by 30 per cent to $21.7 million;

- NPAT and before SGARA enhanced by 48 per cent to $11.9 million;

- NPAT up by 6 per cent to $8.1 million;

- Revenue up by $19.7 million to $269.2 million;

- Cash Flow from Operating Activities positive at $23.6 million;

- Reduced net debt of $72.4 million compared to $77.2 million of pcp;

- Sales of McGuigan, Tempus Two and Nepenthe were up by 10 per cent.

As part of the result, the company declared a 2 cent per share fully franked final dividend, up by 33 per cent on pcp, marking the highest payout ratio since the companyâs formation. AVGâs CEO, Mr Neil McGuigan believes that the notable improvements in AVGâs underlying business result were proof that the companyâs key, long-term strategies are correct. Besides this, the company has extended the existing banking facility to September 2022.

AVGâs Financial Summary (Source: Investorâs Presentation)

On the outlook front, the company would focus on growing its export business, increasing branded sales and concentrate on cost control. AVG is aware of the challenges that the much-anticipated Brexit, the drought and the increasing cost of grapes and wine processing may cause in the coming times.

Market enthusiasts are looking forward to AVGâs Annual General meeting in November 2019, for gaining more insights on the future of the company.

Share Price Information

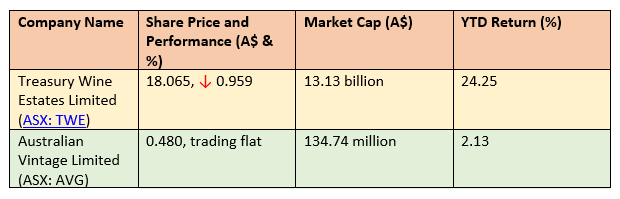

Let us look at the stock price performance of the companies discussed, along with their returns, on 25 September 2019 (at AEST 1:07 PM):

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice