Tesla Inc. is named after the great inventor Nikola Tesla, who was one of the main rivals of the renowned Thomas Alva Edison. The world, however, barely knows Mr Tesla and his innumerable contributions made to the electric world. Mr Elon Musk, the CEO and a co-founder of Tesla, might have thought of paying tribute to one of the most underrated genius scientists the world has ever seen while the company after him.

Tesla Inc. (NASDAQ:TSLA) is probably the hottest stock in the world right now, soaring up around 70 per cent in the YTD period to 05 February 2020, and up by around 218 per cent in the six months to 05 February 2020.

According to NASDAQ, the short interest in the company has come down to just under 25 million shares as of mid-January 2020, which was around 40 million shares in mid-August 2019.

On 05 February 2020, TSLA last traded at US$ 734.70, a decline of 17.18% or US$ 152.36 per cent compared to the previous day’s close.

It appears that the momentum traders have carried the stock to extremely high levels, which could be unsustainable on fundamental grounds.

On 05 February 2020 in the US, the stock lost US$ 152.36 during the day indicating that its momentum might have run out of fodder.

Moreover, the short-covering rally might see an end now, and it could be expected that the stock will be back at the level where its price is closer to the fundamental conviction of the market.

This unprecedented run sparked when the company released its Q3 results back in late October 2019, and since then it has become a kind of an obsession to own TSLA and make money in a short span.

Read: Tesla Triumph Continues, Rising Share Price Pushes Market Valuation to Over US$ 100 Billion

However, an investor needs to be mindful of the underlying fundamentals, and Tesla may have to depict remarkable numbers to sustain the given valuations, a scenario which seems unlikely.

While Tesla could deliver the numbers given that the company has been at the forefront of electric vehicles, and battery storages, among others, it would still need more time to achieve those figures.

With gigantic supply chain capabilities, the company could have an optimistic future, but it would require flawless execution and smart decisions at every turn, among other essential requirements.

Meanwhile, Elon Musk has made trips to China, penning the Giga Shanghai factory in the process, while flaunting his dance moves as well. Of late, it appears that the stock has been dancing too.

TESLA is not just an automobiles company, but a budding and disruptive green energy company

The mission of the company is to accelerate the globe’s transition to sustainable energy via affordable electric vehicles, storage systems, renewable energy generation and batteries continues to be at the core of the mission.

So, what does Tesla do other than manufacturing electric vehicles?

The business owns the world’s largest-volume battery plant. Located in Nevada, Gigabyte 1 has reached an annualised battery production of 20 GWh.

Tesla notes that a ramp-up in production volumes at gigabyte factory would lower the cost of battery cells significantly, and deliver economies of scale, innovative manufacturing, reduction of waste, and optimisation of assembling most manufacturing processes at one place.

In 2016, Tesla launched the 2nd generation Powerwall, which is a rechargeable lithium-ion battery for self-consumption of solar power, emergency backup, grid-service applications. The company had launched the first generation of Powerwall in H1 2015.

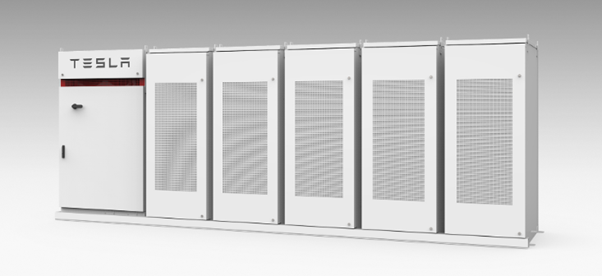

The company’s Powerpack is a collective solution that integrates batteries, power electronics, thermal management and controls for businesses and utilities. Powerpack presents a great value proposition for organisations/companies looking to go carbon negative as it is an alternative solution to diesel-powered generators.

Powerpack (Source: Tesla Website)

The company believes that the inverter is a lower cost, highest power density with the highest efficiency utility-scale inverter in the market. Also, it is scalable from 200 KWh to 100+ MWh, setting a new benchmark for business and utility-scale battery solutions.

In 2017, the company came to the rescue of South Australians to build the world’s largest lithium-ion battery in the region. In mid-2019, the company noted that the facility had saved around US$ 40 million in the first year alone.

Read: The Tesla Story- Records, Growth Triggers and Challenges

In July 2019, the company came up with Megapack in the wake of increasing requirements of battery storage as an electric grid, which would be crucial for the transition to sustainable energy.

Megapack has been specially designed to cater to large-scale utility projects. Tesla believes that it would take less than three months to assemble an emission-free Megapack with a capacity of 250 MW, 1 GWh covering an area around 3 acres.

The company’s Solarglass Roof intends to provide renewable electricity at any time, and it was designed with a goal to create a roof that would improve the look of the home while saving utility bills.

Solarglass roof is customisable for a range of houses, and it is engineered in a way that photovoltaic cells are invisible. It mobilises renewable energy to homes, battery storage systems as well as grids, proposing savings to customers.

In August 2019, Tesla Insurance was launched, offering comprehensive coverage and claims management to augment the proposition for its customer in California.

Tesla reckons that the insurance products are priced competitively with around 20 per cent to 30 per cent lower rates. It was also noted that the company has plans to launch insurance across the United States.

2019 was a good year for Tesla

Tesla has highlighted that its revenue growth was impacted favourably through an increase in vehicle deliveries and that the growth was offset by a larger lease mix.

As a result of a few changes in Model 3, a reduction in the average selling price was recorded as compared to 2018 prices. Also, model 3 has emerged as a more significant constituent in the revenue mix.

The company reckons that it could accelerate the revenue growth by improving build rates across Giga Shanghai and Model Y production line in Fremont, enabling the business to clock better deliveries, and thus revenues.

According to the unaudited financials, the company clocked a total revenue of US$ 24.57 billion in the year ended 31 December 2019 (FY 2019). Tesla achieved a gross profit of US$ 4.06 billion. Also, the company incurred a net loss of US$ 775 million as against a loss of US$ 1.06 billion in the previous year.

Tesla expects to deliver vehicles in excess of 500k units in FY 2020, solar and storage deployments should increase by at least 50 per cent, and production would outpace deliveries due to additional capacity from new plants.

With an exception for periods when the company would launch a new product or ramp-up production, Tesla expects to report positive quarterly free cash flow going forward. The company also believes that the business is in a position of self-funding capability.

Bottomline

If you are short Tesla, you should think thrice, not even twice, before going against the guy who can make rockets better than NASA.