All the three stocks, JB Hi-Fi, Dominoâs and Flight Centre, are consumer centric that gets affected due to the state of the economy, unemployment rate etc. as it depends upon how much disposable income are there in peopleâs hands.

JB Hi-Fi Limited (ASX: JBH)

Reaffirmed 2020 Outlook Despite weakening sales growth in 1Q 2020:

Australiaâs leading company JB Hi-Fi Limited is into retailing of home consumer products. It has in its portfolio top consumer products that has best & most valued brands.

JBH stock has risen 9.46% in three months as on December 13th, 2019 after the company reaffirmed the outlook for fiscal 2020 and expects the FY20 guidance of total sales to be of circa $7.25 billion. This has taken into account the projected sales of JB HI-FI Australia to be of $4.84 billion, sales from JB HI FI New Zealand (NZD) is to be of $0.24 billion and sales from The Good Guys is to be of $2.18 billion.

For the first quarter of 2020, the company has reported 4.7% rise in the total sales for JB HI-FI Australia compared to 5.3% growth in pcp with 3.7% increase in the comparable sales compared to 3.4% increase in the pcp. During 1Q 2020, there was 3.8% rise in total sales for JB HI-FI New Zealand compared to 4.0% in pcp with 3.8% increase in the comparable sales compared to 9.8% increase in the pcp. Total sales for The Good Guys posted the negative growth of 0.5% versus 2.3% growth in pcp with comparable sales negative growth of 1.8% compared to 1% growth in pcp.

On 16 December 2019, the stock last traded at a price of level of $38.6, moving up by 2.988 percent from its last close.

Domino's Pizza Enterprises Ltd (ASX: DMP)

Changes to its financial reporting for FY 20:

Domino's Pizza Enterprises Ltd that operates one of the biggest pizza chains in Australia, on 6 December 2019 announced that it would be making a few changes in its financial reporting from this Financial Year effective from 01 July 2019.

Due to this, there will be a change to the food warehouse and distribution arrangements in Australia/New Zealand (ANZ region), that is expected to have greater control and visibility of the supply chain, which is projected to bring ANZ in line with other regions.

The change will lead to the segmentation of costs related to Global Functions and corporate overheads. However, the company has assured that the changes will bring no effect to the previous FY20 Leasing Guidance, or the 3-5-year outlook.

Moreover, on the back of this change, revenue is projected to increase by the range between approximately $260m - $300m in ANZ for fiscal 2020 and the Cost of Goods is projected to increase by an amount equal to the increase in revenue but there will be no change to EBITDA.

In addition, more than 80% of the new stores will open in Japan and Europe over the next ten years and due to expansion of international portfolio of businesses, it is expected that more Global Functions will be situated outside of Australia.

On the other hand, for the period of 3 to 5 years, the company expects annual sales growth to be 3% to 6%, annual store growth to be 7% to 9% and annual net capex to be in the range of $60-$100 million.

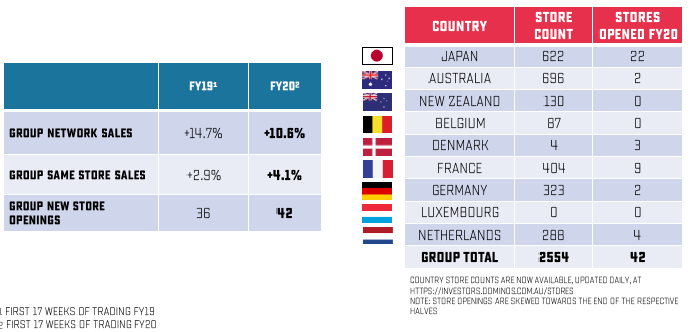

Trading Update of FY 20 (source: Companyâs Report)

Meanwhile DMP stock has risen 12.29% in three months as on December 13th, 2019. On 16 December 2019, the stock last traded at a price of level $53.420, up by 2.239 percent from its last close.

Flight Centre Travel Group Ltd (ASX: FLT)

Weak Outlook & Profit Guidance for FY 20:

Flight Centre Travel Group Ltd is a leading Australian company that operates travel retailing in the segments like leisure & corporate travel sector, and wholesaling. Recently, the company updated the market that it has expanded its global leadership team for increasing the focus on the growth of both leisure and corporate travel.

The companyâs top executives, Chris Galanty and Melanie Waters-Ryan have of late been shifted to the newly created CEO or chief executive roles for FLTâs corporate and leisure businesses.

On the other hand, for the first half 2020, the company expects underlying PBT to be in the range of $90 million and $110 million, which is below the underlying $140.4 million first half of FY 19. The company is expecting underlying PBT to be in the range of $310 million and $350 million for the full year. The midpoint of this range $330million, reflects a 3.8% decline on the $343.1million underlying FY19 result.

The performance for the first half is expected to weak due to reduced net interest income, increase in consultancy costs and poor trading results in the Global Touring businesses. The guidance reflects that the company will heavily depend upon the second half of the year. This can be achieved if the company faces like-for-like trading conditions from late in the second quarter, the recently increased ownership of both 3Mundi and LDV, and the Casto business, starts giving more profit to the group, some world problems like Brexit resolves.

In the last 6 months period, FLT stock has given a return of 5.94 percent. On 16 December 2019, FLT last traded at $44.85, up by 1.839 percent compared to its last close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.