The S&P/ASX 200 Information Technology Index closed lower by 1.56% to the current value of 1,330.6 on 28 June 2019. Letâs look at the following four Australian IT sector stocks with huge market capitalisation.

Technology One Limited

Technology One Limited (ASX:TNE), established in 1987 and based in Fortitude Valley, Australia, is engaged in the development, marketing, sales, implementation, support, and distribution of financial management and enterprise software solutions (SaaS-based). The company has operations in the United Kingdom, Australia, New Zealand, the South Pacific and Malaysia with 14 international offices.

With a market capitalisation of AUD 2.53 billion and around 317.13 million shares outstanding, the TNE stock price closed the dayâs trading at AUD 7.880 on 28 June 2019, down 1.129% by AUD 0.090, with approximately 967,660 shares traded. The company also paid out an ordinary fully paid dividend of AUD 0.0315 on 14 June 2019 to its shareholders related to a period of six months ended 31 March 2019.

On 24 June 2019, Technology Oneâs Director Sharon Doyle acquired an indirect interest in the company upon purchase of 12,375 fully paid ordinary shares on-market through Sharon Louise Doyle ATF Sharon Doyle Family Trust at a cash consideration of AUD 100,397.46.

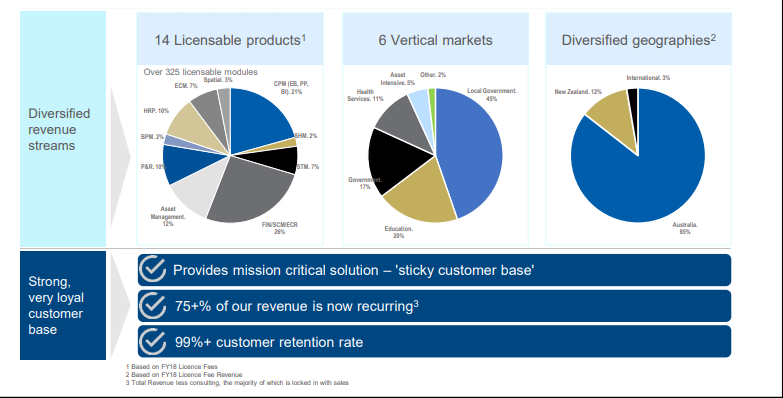

The company recently presented at the Macquarie Emerging Leaders Forum and disclosed the presentation for the same. According to the information provided, Technology One has been profitable over the past 27 years. Its research & development centre is also one of the largest in Australia with over 315 developers.

With its business so far and market penetration, the company is strongly positioned to deliver long-term growth.

Foundation for long-term growth (Source: TNE Macquarie Presentation)

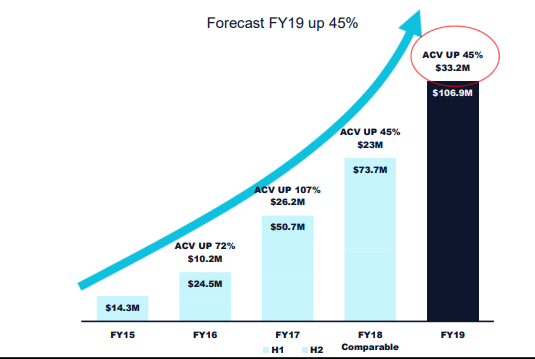

Financial Results- On 21 May 2019, the company released its half-year results for the six months to 31 March 2019, reporting that its SaaS business continued to flourish with 42% growth registered by the SaaS Fees Recognised to $ 37.5 million. SaaS Annual Contract Value (ACV) stood at $ 85.8 million in H1 FY19, also up 45% as compared to the prior corresponding period (pcp).

TNEâs SaaS ACV Growth Trend (Source: TNE Macquarie Presentation)

As the companyâs revenue increased by 5% to $ 129.3 million and expenses reduced by 7% to $ 104.8 million, there was a stupendous rise of 130% in net profit before tax to $ 24.5 million in the first half of FY19. The operating cashflow improved by more than 100% to $ 7.8 million, while net cash balance stood at $ 68.2 million (up 19%).

Afterpay Touch Group Limited

Melbourne-based Afterpay Touch Group Limited (ASX:APT) provides innovative technology-based payment solutions to customers, globally, ensuring a great buying experience for them.

Business- Its solutions are used for purchasing apparel, automotive parts, personal care products, shoes, watches, food items, beverages, and many other varieties of products. The company enables leading retailers to offer a âbuy now, receive now, pay laterâ service under the name Afterpay, while its Touch business offers digital payment solutions to consumer-facing organisations in the telecom, health and convenience retail sectors, internationally. The company serves an active base of more than 4.3 million customers and nearly 30,600 retail merchants.

With a market capitalisation of AUD 7.03 billion and approximately 252.64 million shares outstanding, the APT stock price settled the dayâs (28 June 2019) trading at AUD 25.070, down 9.917% by AUD 2.760. In addition, the stock has delivered outstanding return yields of 38.47% in the last three months, 118.52% in the last six months, and 126.17% YTD.

On 26 June 2019, Afterpay Touch Group released an update concerning three subjects discussed below-

Approach to the external audit notice issued by AUSTRAC on 12 June 2019- Afterpay provided a list of three candidates to AUSTRAC for conducting the external audit as per the AUSTRAC Notice. Besides, the company has created a sub-committee led by independent Non-Executive Director Elana Rubi, to report on the progress of the external audit process to the companyâs board.

Share Purchase Plan (SPP) announced on 11 June 2019- Afterpay Board has informed the stakeholders that it would not progress with the SPP, as it believes it to be in the best interest of the shareholders until the company studies the final audit report and considers its recommendations thoroughly.

Regardless, the SPPâs record date would remain 7 June 2019 (7:00pm (Sydney time)) with a cap of $ 30 million. Under the SPP, Afterpay intends to issue shares at the lower of $ 23.00, being the placement price, and the five-day VWAP of Afterpay shares up to the SPP closing date. Further update would be provided shortly.

The third update was that the co-founders Anthony Eisen and Nick Molnar have declared that the company would not sell any shares during the next financial year 2020 (FY20).

Financials- As per the companyâs recently released Investor Presentation, there has been a growth of ~143% in underlying sales to $ 4.7 billion with over 4.3 million active customers as of the 11 months to 31 May 2019. A snapshot of the key business metrics for the concerned period is as follows-

Source: Investor Presentation

WiseTech Global Limited

WiseTech Global Limited (ASX:WTC), based in Alexandria, Australia, is engaged in developing and providing cloud-based software solutions to the global logistics industry, as it simplifies the movement and storage of goods and information for clients including multinationals and medium and small-sized regional and domestic enterprises. Its flagship product is the single-platform CargoWise One.

WTC Snapshot (Source: Investor Presentation)

With a market capitalisation of AUD 8.9 billion and around 318.16 million outstanding shares, the WTC stock price closed the trading today (28 June 2019), at AUD 27.710, down 0.894% from its previous close. Besides, the WTC stock has delivered positive and high return yields of 68.84% for the last six months and 64.18% YTD.

Recently on 6 June 2019, WiseTech Global released its Investor Presentation, extensively demonstrating its global business landscape and outlook ahead.

Xware acquisition- On 30 April 2019, WiseTech Global announced to have acquired Xware, a Sweden-based leading messaging integration solutions company at a value consideration of ~ $12.0 million upfront, with a further expected multi-year earn-out potential of ~$11.2 million concerning business integration, strategic objectives and revenue performance. Xwareâs key product, xTrade, an interoperable messaging solution, connects companies to their suppliers and partners. In addition, Xwareâs other products are supplied to complex sectors like defence.

The transaction follows WiseTechâs other recent acquisitions of logistics solutions in Belgium, North America, Australasia, Argentina, Brazil, Germany, Canada, France and other regions worldwide.

Share Purchase Plan â The company has completed its share purchase plan (SPP), as reported on 15 April 2019, raising ~ $ 35.9 million, with approximately 1.7 million new fully paid ordinary shares to be issued to successful SPP applicants at $ 20.90 per share.

During 2019 so far, WiseTech Global has raised a total of $ 335.9 million, comprising $ 300 million from the institutional placement completed on 19 March 2019 and the SPP.

Catapult Group International Ltd

Catapult Group International Ltd (ASX:CAT), established in 2006 and headquartered in Prahran, Australia, is engaged in the development and commercialisation of wearable athlete tracking and analytics solutions to customers like sports teams, institutes and universities worldwide. With a market capitalisation of AUD 210.04 million and approximately 190.9 million shares outstanding, the CAT stock price settled the dayâs trading at AUD 1.095 on 28 June 2019, down 0.905% by AUD 0.010, with ~ 227,962 shares traded. In addition, the stock has delivered positive return yields of 43.51% for the last six months.

Vector Soft Launch- Recently on 5 June 2019, Catapult Group International provided a progress update on the limited âsoft launchâ of its next-generation wearable technology, Vector, which is based on Catapultâs proprietary ClearSky technology. The launch was initiated in May 2019 to a small number of Australian teams, which shared an affirmative feedback. As a result, the company is expanding the soft launch in the markets of United Kingdom and the United States.

Board Governance Update- The Board of Catapult Group International announced an update on 30 May 2019 with respect to its ongoing process to ensure the governance structure of the company is consistent with its much larger aspirations. In line with the objective, the Board has expressed its intention to appoint an additional Independent, Non-Executive Director prior to the end of calendar year 2019, subject to identifying and recruiting a suitable candidate.

On 10 April 2019, the company informed that the National Rugby League (NRL) has awarded it with an aggregated contract. With this new win, the company has positioned itself as a technology supplier to NRLW Clubs, NRL Clubs, representative teams in Australia and match officials.

The three-season term contract has a performance-based option, which might result in the extension of the contact by further two years. It follows similar past deals of the company with the AFL Womenâs (AFLW), Australian Football League (AFL), National Basketball League and other Australian leagues.

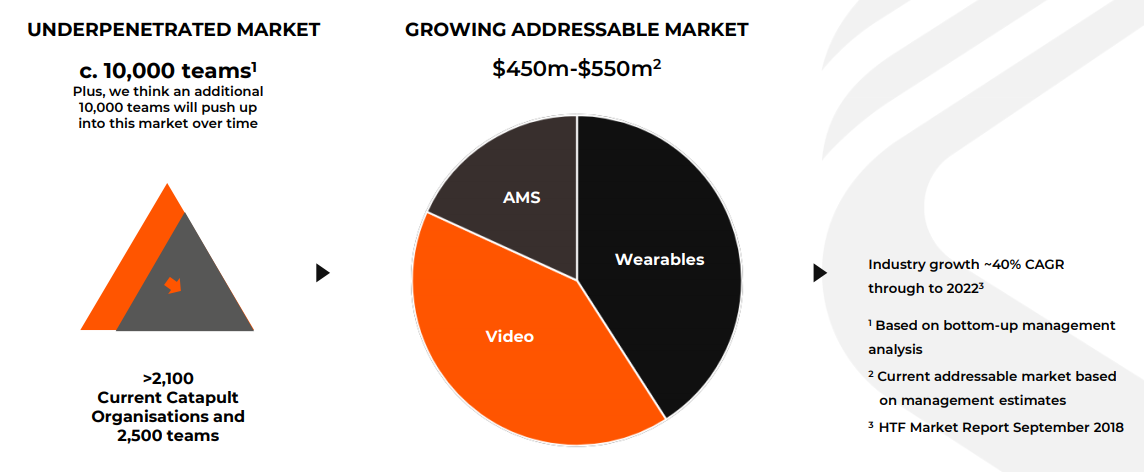

Catapult Group Internationalâ business has a large addressable market as depicted below.

Source: H1 FY19 Results Presentation

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.