Investing in Stocks at Bargain Level

Investors tend to catch falling knives; however, the falling stock price of a company could be for various reasons such as weakness in its business fundamentals, change in macroeconomic conditions and corporate management. The biggest mistake of the investors is to consider âa lower price stock as a cheap stockâ.

Bargain buys are the stocks trading below their fundamental value as compared to the current price in the market. Investors must ensure that the value of the stock has decreased due to an overall market correction, and not due to the persisting structural problems in a company.

While there are many factors to consider in bargain hunting, the fundamentals revolve around revenue growth and profit growth, which should be consistent. Secondly, the transparency and disclosure come into the picture, as an old saying goes âa lie travels much faster than a truthâ.

When looking at stocks for investments, the ones that seem to be trading at low levels can give an immense upside in months to come, preferring companies with less debt gives a substantial edge, as there is less financial risk to the business.

Below discussed are three stocks that are trading near their 52-week lows.

Rural Funds Group

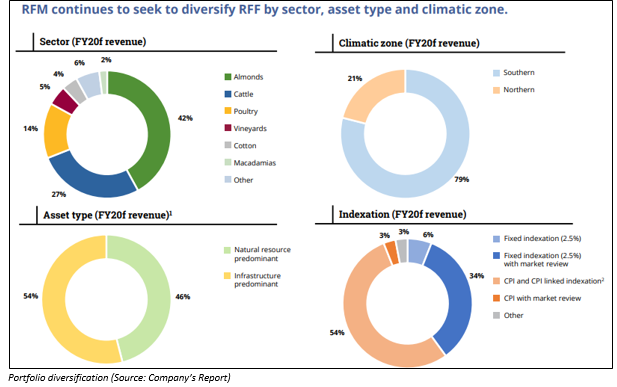

Rural Funds Group (ASX: RFF) is an agricultural REIT managed by Rural Funds Management Limited (RFM). The group, which generates revenues from long-term leases across 6 sectors, is the first listed diversified agricultural property trust in Australia.

RFM Response to Bucephalus Document

On 23 September 2019, RFM made an announcement referring to a document selectively released by Bucephalus Research Partnership Limited that is critical of the Rural Funds Group. In the announcement, RFM mentioned that in its opinion the claims made in the document were considerably same to criticisms made in the recent documents that were selectively released by Bonitas (short-seller).

Meanwhile, RFM again rejected the claims made in the document by Bucephalus. More on the document can be READ here.

Substantial Holder/Interest Change

On 10 September 2019, the group announced that Sumitomo Mitsui Financial Group, Inc. became a substantial holder of RFF with 16,808,337 ordinary shares, translating into a 5.02 per cent voting right.

In another market update on 9 September 2019, the group announced a change in the indirect interest held by director (Leslie Guy Julian Paynter) in RFF following the acquisition of 100,000 shares. The number of shares held by the director after the change is 1,559,104 units.

Financial and Operating Highlights - FY2019

On 27 August 2019, the group released a full-year report for FY2019 (12 months to 30 June 2019, unveiling

- Property revenue increased by 30 per cent to A$66.39 million compared to the same period of the previous year

- Total comprehensive income and earnings per unit were lower due to A$18 million non-cash revaluation decrements on interest rate swaps

- Adjusted funds from operations (AFFO) stood at A$43.25 million in FY2019, up from A$32.32 million in FY2018

- AFFO per unit grew by 4.7 per cent

- Adjusted total assets increased by A$ 222.2 million, due to acquisitions, capex and revaluations of almond orchards, vineyards and water entitlement.

FY2020 Outlook

The group has forecast AFFO per unit of A$0.14 for FY2020, representing a 5.3 per cent increase to FY2019, while distributions per unit (DPU) is expected to be A$0.1085 in FY2020, compared with A$0.1043 in FY2019. Additionally, the group has forecast an AFFO yield of 7.0 per cent and payout ratio of 78 per cent.

Stock Performance

The stock of RFF closed the dayâs trading at A$1.725 on ASX on 25 September 2019, down by 1.429 per cent from its previous closing price. The market capitalisation of the company stands at A$586.12 million, while it has approx. 334.93 million outstanding shares. The 52-week high and low value of the stock is at A$2.420 and A$1.360, respectively. The stock has generated a negative return of 25.76 per cent in the last six months and a negative return of 22.37 per cent on a year-to-date basis. While its annual dividend yield is 6.02 per cent and PE multiple is 17.11x.

Challenger Limited

Challenger Limited (ASX: CGF) is an Australia-headquartered investment management firm, which is engaged in providing solutions catered towards financial security for retirement. The company was listed on the ASX in 2003. Some of its offerings are annuities, aged care solutions, superannuation and guaranteed allocated pension. CGF, which is the largest provider of annuities in the country, has two divisions- Fiduciary Funds Management and APRA-regulated Life.

The company is scheduled to hold its annual general meeting on 31 October 2019

Vision and Strategy (Source: Companyâs Report)

DRP/Dividend Update

On 20 September 2019, the company announced that issue price under the Dividend Reinvestment Plan (DRP) for the final 2019 dividend is A$7.032 per share. The participation rate is approximately 2 per cent of all issued shares. To satisfy the DRP requirements, the company issued 364,482 Challenger ordinary shares on 25 September 2019.

On 18 September 2019, the company gave an update to an announcement on 13 August 2019 related to a fully franked final dividend distribution of A$0.18 per ordinary fully paid security, due to update to DRP Price. The dividend for the six-month period to 30 June 2019 is scheduled for payment on 25 September 2019.

New Chief Executive Funds Management Appointment

CGF updated the market on 17 September 2019 that the company has appointed Nick Hamilton as Chief Executive, Funds Management. The new appointment, effective from 23 September 2019, was made after an extensive search (internal and external).

Substantial Holder/Interest Change

On 9 September 2019, the company announced a change in the interest of substantial holding of MOQ Limited to a 5.29 per cent voting right from an earlier voting right of 6.48 per cent. Moreover, Richard Howes, a company director, made changes in its direct and indirect interest in CGF.

Stock Performance

The stock of CGF settled at A$7.450 on ASX on 25 September 2019, down 1.845 per cent from its previous closing price. The market cap of the company is A$4.64 billion, while it has approx. 611.6 million outstanding shares. The 52-week high and low value of the stock is at A$11.620 and A$6.220, respectively. The stock has generated a positive return of 4.26 per cent in the last six months and a negative return of 16.87 per cent on a year-to-date basis. While its annual dividend yield is 4.68 per cent and PE multiple is 14.91x.

Washington H. Soul Pattinson and Company Limited

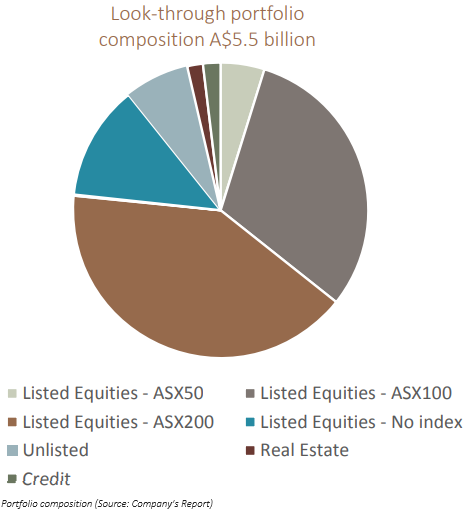

Washington H. Soul Pattinson and Company Limited (ASX: SOL) is an Australia based company, whose principal activities include investments in a portfolio of assets in several industries like building materials, retail, equity, natural resources, telecommunications, agriculture and corporate advisory.

Substantial Holding Updates

- On 23 September 2019, the company announced that Washington Soul Pattinson and Co. Ltd ceased to be a substantial holder of Quickstep Holdings Limited.

- On the same day, SOL made another announcement, unveiling a change in the interest of its substantial holding in Clover Corporation Limited from a 25.87 per cent to a 24.05 per cent.

Financial Highlights for FY2019

For the year ended 31 July 2019, the company unveiled

- Group regular net profit after tax dipped by 7.2 per cent to A$307 million compared to the same period of the previous year

- Cash flow from operations increased by 18 per cent from the year-ago period

- Pre-tax value of portfolio went up by 0.6 per cent to A$5,469 million

More on FY2019 results can be READ here.

Stock Performance

The stock of SOL settled at A$20.950 on ASX on 25 September 2019, down 3.054 per cent from its previous closing price. The market cap of the company is A$5.17 billion, while it has approx. 239.4 million outstanding shares. The 52-week high and low value of the stock is at A$31.870 and A$19.700, respectively. The stock has generated a negative return of 23.48 per cent in the last six months and a negative return of 11.22 per cent on a year-to-date basis. While its annual dividend yield is 2.68 per cent and PE multiple is 20.87x.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.