Gold prices are making new highs on the back of fears of global economic slowdown and US-China trade talks, which will further be governed in the future by the development on Brexit, currency fluctuation and US Federal Reserve's stand on rate cuts.

On the other hand, the metal price after the fall is consolidating and the investors are looking at what effects would come through post the US tariff increases on Chinese goods effective September 1, 2019.

Further, about half of the global demand for base metals comes from China which is dependent upon the industrial production there. Industrial production in China has just grown 4.8% year on year during July, which reflects the slowest growth in the last 17 years. Among the base metals, nickel has been the outperformer.

Let us go through the updates from the metals and mining stocks:

Talisman Mining Ltd

Signed a farm-in agreement with Lucknow gold project:

Talisman Mining Ltd. (ASX: TLM) is into the exploration of the precious and base metals like copper, gold and nickel and is situated in the Northern Murchison Region of Western Australia.

In the Investor Presentation released on 30 July 2019, the company mentioned that at the end of June 2019, had cash balance of $10.6 million and had no debt in the books.

Also, on 26 August 2019, the companyâs wholly owned subsidiary, Talisman B Pty Ltd has signed a farm-in agreement with Lucknow gold project in New South Wales, where the production has been of more than 400,000oz of gold at grades of between 100 and 200 grams per tonne (g/t). This project is located in Macquarie Arc, that holds substantial gold and copper mineralisation. The place consists of highest-grade gold mines, including the substantial Cadia-Ridgway (Cu-Au) and McPhillamys (Au) deposits and a few more deposits. TLM has planned to start ground exploration works at Lucknow, which is being anticipated to start late in the existing quarter period. Talisman B can earn up to a seventy percent stake in the Project. It will be spending a minimum of $1.5million for the exploration over the time frame of four years and will issue TLM shares of total value of $250k.

Lucknow Project and surrounding gold deposits (Source: Companyâs Report)

On 2 September 2019, TLMâs stock last traded flat at A$0.110. The company has a market cap of A$20.43 million and ~185.7 million shares outstanding. The YTD return of the stock is of 55.91 percent.

Kalamazoo Resources Limited

Applied for Exploration Licence EL7021:

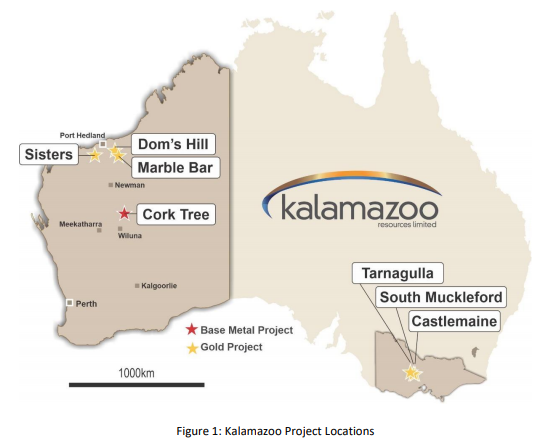

Kalamazoo Resources Limited (ASX: KZR) is into gold and copper exploration work and is currently developing two gold-copper projects in Pilbara, WA and the Wattle Gully Gold Project in Victoria.

Source: Companyâs Report

On 28 August 2019, KZR notified that it had applied for Exploration Licence - EL7021 for additional expansion of the tenure for its freshly procured South Muckleford Gold Project. Also, South Muckleford has two tenures in which EL6959 (~84km2) has already been granted in July 2019 and then a new licence application for EL7021 (68km2). The company plans to start shortly, the ground geophysical surveys at South Muckleford. It would help the company to map potential gold mineralised structures.

On the other hand, in the June 2019 quarterâs activities report, the company mentioned that by the end of June 2019, it had cash and cash equivalents of $0.8million. Also, the company had raised $1.2 million (before costs) via the placement of 10 million shares at $0.12 cps in July 2019. There was one for two option attached, which will be exercisable at $0.25cps and will be expiring on 10 July 2020.

On 2 September 2019, KZRâs stock last traded flat at A$0.230. The company has a market cap of A$24.37 million and ~99.49 million shares outstanding. The YTD return of the stock is of 147.47 percent.

Azure Minerals Limited

Regains 100% ownership of the Alacrán Project:

Azure Minerals Limited (ASX: AZS) is developing its portfolio of projects related to precious metal and base metals in Mexico.

On 28 August 2019, AZS notified that it had signed an agreement with Minera Teck S.A. de C.V. for AZSâ acquisition of all of Teck S.A. de C.V.âs rights and interests and has taken full control in the Alacrán Project. Teck S.A. de C.V. is a subsidiary of Canadaâs Teck Resources Limited (100% ownership). Therefore, for this purpose AZS has issued 27,545,566 common shares of the company to Teck and now Teck Resources holds 19.9% stakes in AZS.

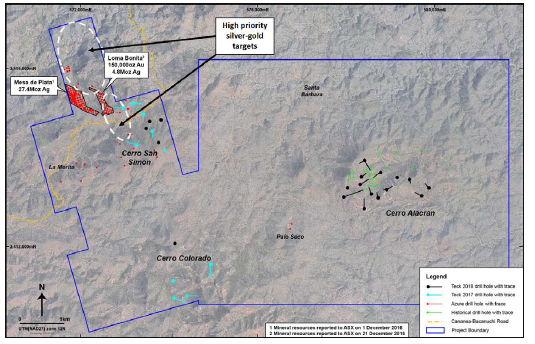

From the previous exploration of the Alacrán project, AZS had discovered two precious metal deposits; comprising of high-grade Mesa de Plata silver deposit (resource of 10.5Mt at 82g/t silver for 27.4Moz of Ag) at near surface and Loma Bonita gold-silver deposit (resource of 5.4Mt at 0.9g/t gold and 28g/t silver for 150,000oz gold and 4.8Moz silver) adjacent to it. The deposits have 32.2Moz of silver & 150,000oz of gold resources and the company is planning for potential upside for both the metals. For this purpose, the company has scheduled to carry on drilling in the fourth quarter of 2019.

Further, in June quarter report AZS mentioned that Alacrán has the potential for having large porphyry copper deposits as the Alacrán property is close to giant Cananea / Buena Vista del Cobre copper mine and others.

Locations of Mesa de Plata and Loma Bonita deposits, Source: Companyâs Report

On 2 September 2019, AZS stock last traded at A$0.165. The company has a market cap of A$20.78 million and ~138.55 million shares outstanding. The YTD return of the stock is of 15.38 percent.

Echo Resources Ltd

Getting Acquired by Northern Star Resources Limited:

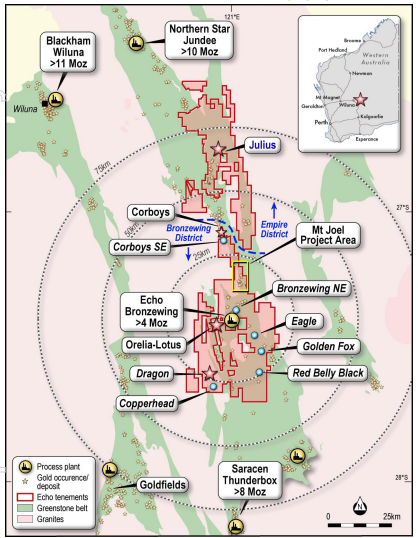

Echo Resources Limited (ASX:EAR), is into the exploration of gold, copper and nickel. The companyâs key project is Yandal Gold Project, which is located in Western Australia.

Echo Resources Project Locality Map, Source: Companyâs Report

On 26 August 2019, EAR and Northern Star Resources Limited (ASX: NST) notified that they have inked a deal, wherein NST would offer to acquire all of the issued and outstanding ordinary shares in EAR through an off-market takeover bid.

Both the companies have signed Bid Implementation Agreement, under which the shareholders of EAR will get the cash offer of A$0.33 for every Echoâs share they were holding. This offer price represents 39.4 percent to EARâs VWAP or Volume Weighted Average Price standing at A$0.237 on 19 August this year.

Moreover, the offer price reflects 154 percent premium to the A$0.130 a share issue price at which EAR has of late, on 6 May this year had raised capital. The offer price also reflects that EAR has valuation of approximately A$242.6 million. The details of the offer are expected to be given to the shareholders, though it consists of limited number of conditions including âno shopâ, âno talkâ and âno due diligenceâ restrictions.

On the other hand, the company at the end of June 2019, had cash and cash equivalents of $17.3 million, which underpinned EARâs upcoming exploration and growth activities.

On 2 September 2019, EARâs stock last traded flat at A$0.325. The company has a market cap of A$224.61 million and ~691.09 million shares outstanding. The YTD return of the stock is of 96.97 percent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.