Gold prices are ablaze over the speculation of a possible rate cut from the Federal Reserve of the United States. The market expectation is dragging the dollar prices down in the international market, which, in turn, is supporting gold.

Gold prices rose to mark a high of US$1358.13 on 14th June 2019 and is currently trading around US$1341.71 (as on 18th June 12:08 PM AEST).

A high gold price in the market is supportive for gold miners as it supports the balance sheet in terms of high sales proceed, with gold prices inching up in the market. Let us have a look over few ASX-listed gold miners, who recently progressed over their prospects.

ASX-listed Gold Miners:

Silver Lake Resources Limited (ASX: SLR)

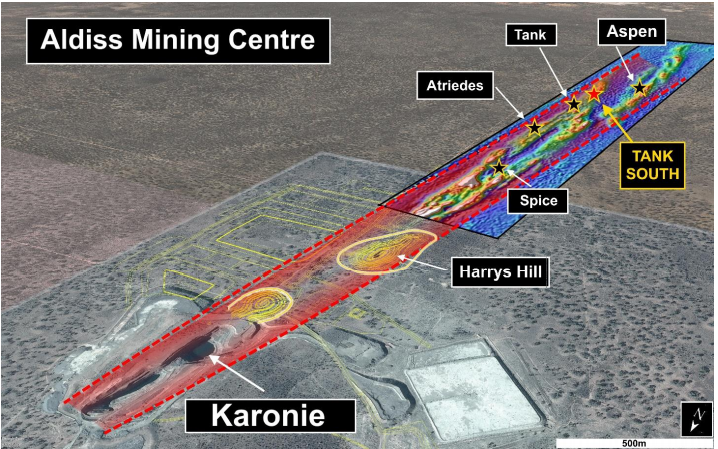

SLR announced on 18th June 2019, that the company received thick high-grade intersections from Aldiss Mining Centre, which is near the SAT Trend, where all the gold occurrences are within a granted Mining Lease.

SLR previously encountered the gold occurrences at three gold deposit over the SAT Trend, which includes, Spice, Atriedes, and Tank deposit. The company further conducted a detailed ground magnetic survey in the first quarter of the year 2019.

SAT Trend and respective deposits (Source: Companyâs Report)

The survey improved the geophysical resolution and exploration target over the SAT Trend, and the company completed a preliminary phase of reverse circulation drilling over it in September 2018.

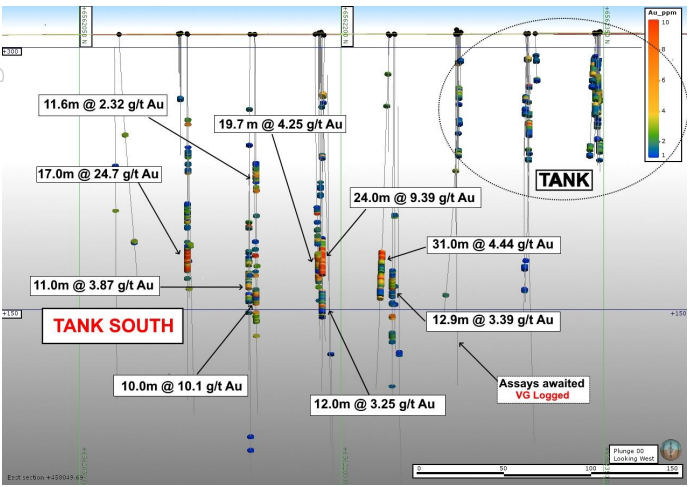

Post completing the preliminary phase, SLR completed a follow-up RC and diamond drilling phase in December 2018, which targeted direct extensions to mineralisation at the SAT Trend deposits. The follow-up phase intersected the widest and highest grade, along the south of the Harrys Hill as compared to the previous intersections received by the company.

The drill hole identified as 18STRC017D intersected 24.0m @ 9.39g/t of gold and 12.0m @ 3.25g/t of gold. However, the company identified that the plunge direction of the intersection is different from the existing Mineral Resources at Tank and hosts different style of mineralisation, which in turn, further indicates that the discovery is potentially a part of a new mineralised system, situated near to the existing shallow Tank deposit.

9.39g/t of gold intersections and South extensions (Source: Companyâs Report)

SLR further tested this new mineralised system through a follow-up RC and DD, which included a scissor hole at Tank South, which further confirmed the local extensions over 160m strike around the original intersections in 18STRC017D.

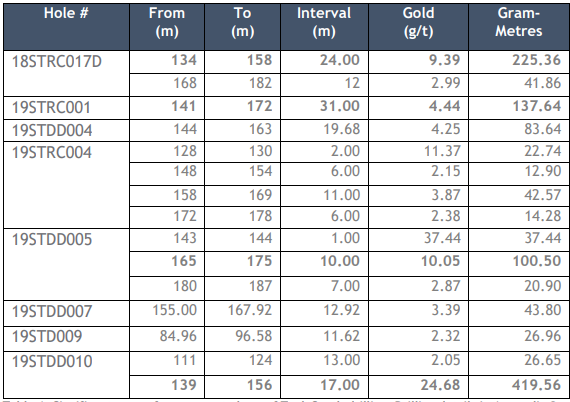

The results of the follow-up and initial drilling are as follows:

The drill hole identified as 19STDD010 intersected 17.00m @ 24.68g/t of gold, which was more significant than the previous widest and highest-grade intersection.Â

Apart from such intersections, the company tested continuity and extensions of lodes in the Upper Easter Hollows area at the Daisy Complex and discovered further Daisy Style mineralisation. The results gave grade ranging from 108g/t to 8.79g/t over different lengths.

The first-half year (1HFY19) revenue of the company inched up by 4 percent, and the company recently updated its quarterly activities as well.

The stock of the company, last traded at A$1.055 (as on 18 June 2019), up by 12.234% from its previous close.

Apollo Consolidated Limited (ASX: AOP)

AOP announced on 18th June 2019 that the ongoing drilling campaign comprising of 20,000m Reverse Circulation and 2,000m diamond drilling at the Lake Rebecca Gold Project discovered new zones of gold mineralisation around the Jennifer Lode.

Drilling Activity:

The company reported a total of 28 RC drill holes which accounted for 5,600m drilling at the Rebecca corridor area. The ongoing drilling program aims to extend and boost the confidence in the companyâs prospects namely Jennifer Lode & NE, Laura Lodes. Apart from the extension, the drilling also aims to explore for parallel lodes and strike extensions.

New Identifications: Â

AOP identified new mineralisation to the south of Jennifer, which resulted in a grade of 16.92g/t of gold from 93m with a 2m continuity, which also included a grade of 27.80g/t with a 1m continuity. The drill hole which intersected the grades was identified as RCLR0354 and was on the southernmost line of the drilling, which was around 700m to the south of the Jennifer Lode. The new intersection was supported by the widespread anomalism in the same hole and by a further gold zone of 0.91g/t grade, identified by RCLR0358 on the next exploration traverse 100m to the north.

The new identification extended the Rebecca gold system by more than 1.4km, and as per the company, the trend is open in the southward direction. AOP discovered a new gold zone at the Lake Rebecca prospect previously as well.

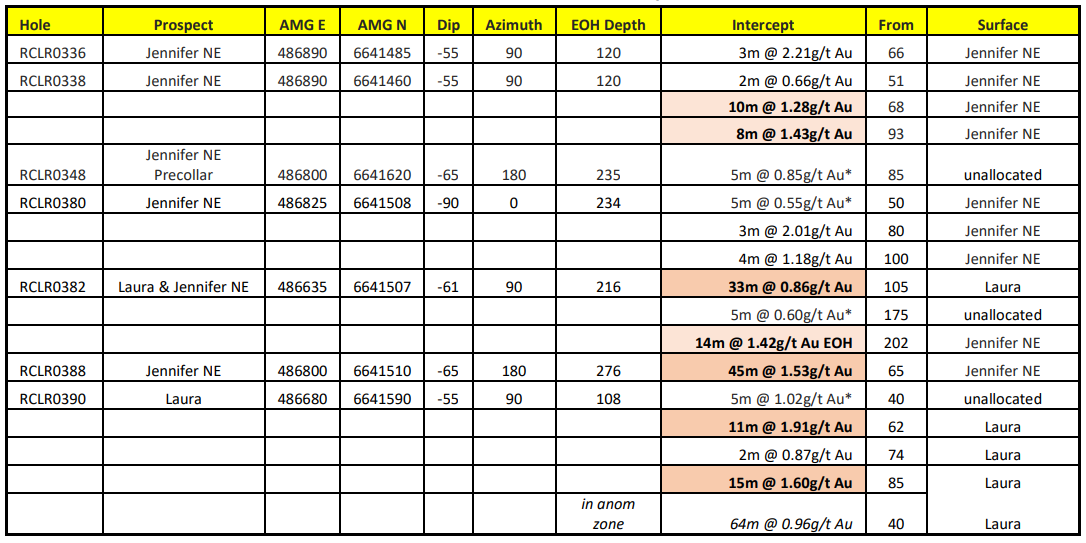

Apollo also conducted exploration drilling at the Laura and Jennifer NE, and the results of the activity are as:

Source: Companyâs Report

The significant results from the extension holes of the Jennifer Lode and Jennifer Hangingwall Surfaces are as:

| Drill Identity | Grade | Continuity | Prospect |

| RCLR0388 | 8.06g/t of gold including 32.55g/t | 9m and 2m | Jennifer Lode |

| RCLR0388 | 2.93g/t Au of gold Including 24.4g/t | 19m and 1m | Jennifer Lode |

| RCLR0386 | 3.66g/t of gold including 16.00g/t | 19m and 1m | Jennifer Lode |

| RCLR0386 | 6.33g/t of gold including 17.3g/t | 7m and 1m | Jennifer Lode |

| RCDLR0344 | 2.14g/t of gold and 1.81g/t | 11m and 10m | Jennifer Hangingwall Surfaces |

| RCLR0350 | 1.08g/t of gold | 22m | Jennifer Hangingwall Surfaces |

| RCDLR0378 | 2.15g/t of gold | 10m | Jennifer Hangingwall Surfaces |

As per the company, the results indicate that the Jennifer Lode is picking up strength and width at depth to the north.

By the closure of the trading session, the stock of the company was at A$0.205 (as on 18 June 2019), up by 17.143% from its previous closing price.

Kalamazoo Resources Limited (ASX: KZR)

KZR announced on 18th June 2019, that the company secured the services of Planetary Geophysics to complete the Induced Polarisation and ground magnetic surveys over the Castlemaine Gold Project in Victoria, Australia. The company plans to conduct these surveys over the top ten prospects located within the Exploration Licence EL006679 at the gold project.

The proposed survey would include about 40-line km of Induced Polarisation survey lines and 360-line km of ground magnetic survey lines spread across the top-ranked prospects, with an aim to identify the potential gold mineralised fault/ fold structures for follow-up DD test planned for late 2019.

As per the company, no geophysical surveys have been conducted on the Castlemaine since the 1960s, and the data available for the area is of aeromagnetic and ground gravity surveys.

The companyâs exploration strategy includes the application of modern ground geophysical survey over the high ranking prospects at the Castlemaine Gold Project, and as per the company, the absence of young sedimentary cover is a positive feature which would help the geophysical survey to identify the geological features at greater depths better.

KZR acquired the project in June 2018 which included the entire Castlemaine Goldfield and historic Wattle Gully gold mine along with the 288km2 surrounding. The gold project of the company is one of the most productive gold fields in Australia and produced 5.6 million ounces of gold across its life. As per the company, the drilling at the project is limited below 400m, and only minor exploration activities have been conducted over the past decade.

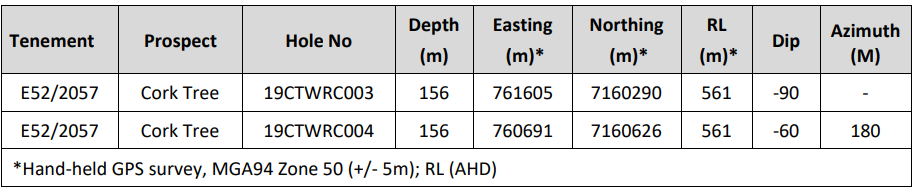

Kalamazoo also provided its Cork Tree Project resampling results, for which the company collected the samples from two RC holes at the Cork Tree prospect in order to test for copper anomalous intervals identified by the RC holes.

The Results of the resampling are as:

Source: Companyâs Report

Independence Group NL (ASX: IGO)

IGO announced on 17th June 2019, that the company through its wholly owned subsidiary- Independence Newsearch Pty Ltd entered into an Earn-in and Joint Venture Agreement with Classic Mineral Ltd (ASX:CLZ)

Classic Minerals signed the agreement for the development of its Fraser Range tenements, and Classic mentioned, that it had received significant funds for the highly regarded exploration work for the advancement of the project.

As per the agreement, IGO would continue to advance the Fraser Range Project, which in turn, would allow Classic Minerals to focus on the exploration of its emerging Kat Gap Gold Project in the Forrestania area.

The terms of the agreement are as:

- A conditional initial cash payment of A$300,000 to Classic within five days of the completion of the conditions mentioned below.

- IGO can elect to earn a 51 percent interest in the project by expending A$1,500,000 on the exploration activities over the tenure of two years, which would also mark the first earn in the period.

- A minimum expenditure of A$640,000 by IGO before the withdrawal from the agreement.

- IGO would receive various option upon making a cash payment of A$500,000 at the end of the first earn-in period, and the options under the agreement are as follows:

- IGO would be eligible to form a joint venture of 51 percent interest.

- IGO can increase its interest to 70 percent, if the company spend a further A$1,000,000 over two years.

- IGO would be granted an option to buy out Classics interest in the joint venture for a consideration of A$2,250,000 along with 1 percent net smelter royalty.

- If Independence Group decides to earn a 70 percent interest, Classic would be carried free to the completion of a pre-feasibility study; or

- If IGO decides to buy-out the remaining 49 percent interest, then Classic would receive an aggregative value of A$4,550,000 in cash along with 1 percent of net smelter royalty.

However, the completion of the agreement remains subjective to the Ministerial approval over the transfer of tenure within the first year of the grant.

The stock of the company, was at A$4.550 (as on 18 June 2019), up by 1.111% from its prior close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.